Facebook (NASDAQ:FB)

Information Technology - Internet, Software & Services | Reports April 27, After Market Closes

Key Takeaways

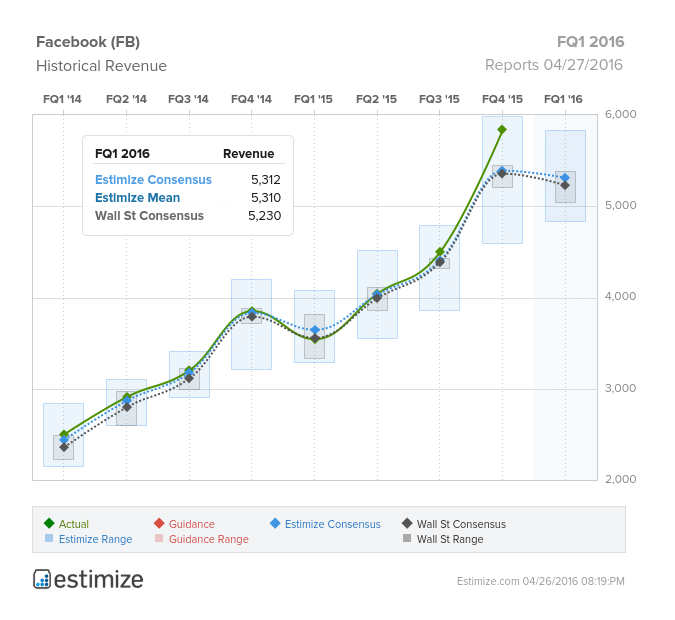

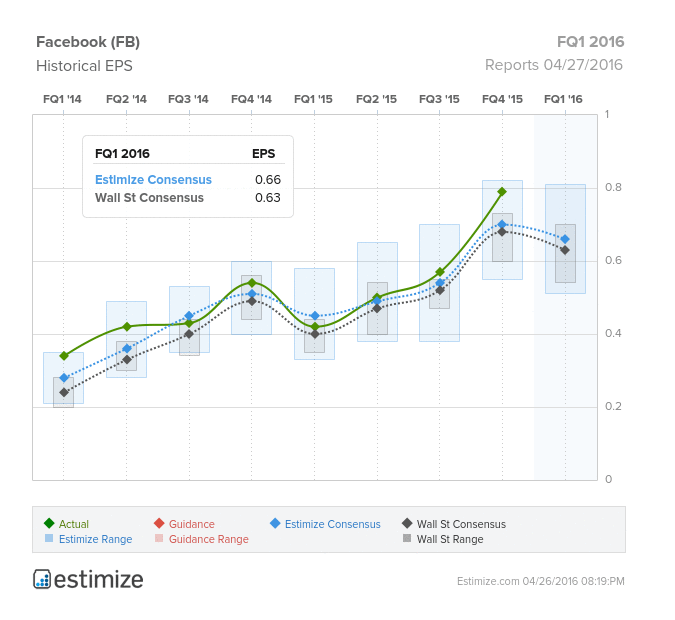

- The Estimize consensus is calling for EPS of $0.66 on 5.31 billion in revenue, 3 cents higher than Wall Street on the bottom and $80 million on top

- Facebook continues to generate robust active user growth and ad revenue from its core social media business

- Facebook is no longer strictly tied to social media but has a presence in a variety of industries across the world

The social media darling, Facebook, is poised to open up 2016 with a bang when they report first quarter earnings later today. Unlike its peers, Twitter (NYSE:TWTR) and LinkedIn (NYSE:LNKD), the Mark Zuckerberg led company has lived up to and even surpassed all of its expectations.

As a result, Facebook earnings have steadily increased, beating in 3 of the 4 quarters in fiscal 2015. The stock has largely tracked earnings and is now up 35.04% on the past 12 months.

Given Facebook’s track record, it’s not surprising that earnings have been on the move. In the past 3 months per estimates have risen 12% on 6% increase in sales. Therefore, the Estimize consensus is calling for EPS of $0.66 on 5.31 billion in revenue, 3 cents higher than Wall Street on the bottom and $80 million on top. This indicates earnings per share growing 57% compared to a year earlier while revenue could grow as much as 50%. Facebook is firing on all cylinders and is anticipated to be one of the bright spots this earnings season.

Last quarter, Facebook reported 1.59B monthly active users (MAU), a resounding 14% YoY increase. This is crucial in the industry because a stronger social network leverages more opportunities for valuable interactions, user growth and revenue. Compared with its peers, Twitter and Linkedin, Facebook is far ahead in both MAUs and DAUs.

Facebook has also developed an interest in growing internationally. Despite lower revenue per user in emerging markets, Mark Zuckerberg has been drawn to expanding in India, home to more than one billion people. By reaching a larger audience, Facebook’s instant ads will create more value for advertisers. However, FB no longer relies solely on ad revenue and has expanded its ecosystem to services and applications.

Notably, Facebook’s past acquisitions of WhatsApp, Oculus Rift, and Instagram have performed remarkably well, with Oculus Rift shipments just beginning last month. Facebook is also looking to take on peers such as LinkedIn with “Facebook at Work” and Yelp's (NYSE:YELP) local business and services platform.