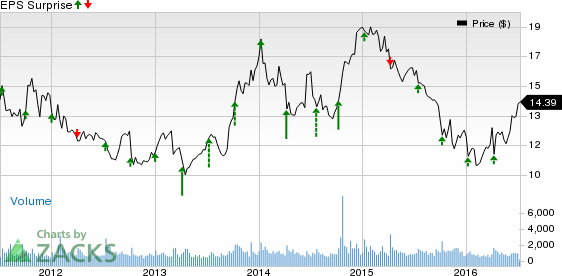

AngioDynamics Inc (NASDAQ:ANGO) is set to report fourth-quarter fiscal 2016 results on Jul 13. Last quarter, the company reported earnings of 15 cents per share, which exceeded the Zacks Consensus Estimate by a couple of cents.

We note that on an average, AngioDynamics has posted a positive earnings surprise of 3.85% over the last four quarters.

Let’s see how things are shaping up prior to this announcement.

Factors at Play

AngioDynamics’ broad array of products like AngioVac, BioFlo and NanoKnife significantly enhances market opportunities. Notably, the PV business (peripheral vascular sales) has also built a strong momentum for the company.

Sales for the fourth quarter of fiscal 2016 are expected in the range of $87–$90 million, while adjusted earnings are likely to be between 14 cents and 18 cents.

The earnings growth rate is expected to be higher than growth in sales, primarily because of cost curtailment initiatives.

Management believes that the company’s gross margin will improve by roughly 100–200 bps in the fourth quarter of the current fiscal, owing to increased sales of higher margin products.

However, declining sales in at the Oncology, Vascular Access, Non-BioFlo products and NanoKnife businesses may hurt quarterly sales.

Earnings Whispers

Our proven model does not conclusively show that AngioDynamics is likely to beat earnings this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: AngioDynamics currently has an Earnings ESP of 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate stand at 16 cents.

Zacks Rank: AngioDynamics carries a Zacks Rank #3 which increases the predictive power of ESP. However, an ESP of 0.00% makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 and 5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revision momentum.

Stocks to Consider

Here are some companies you may want to consider as our model shows they have the right combination of elements to post an earnings beat this quarter:

PharMerica Corporation (NYSE:PMC) with an Earnings ESP of +2.13% and a Zacks Rank #1.

The Cooper Companies Inc. (NYSE:COO) with an Earnings ESP of +2.64% and a Zacks Rank #2.

Laboratory Corp. of America Holdings (NYSE:LH) with an Earnings ESP of +0.87% and a Zacks Rank #2.

ANGIODYNAMICS (ANGO): Free Stock Analysis Report

LABORATORY CP (LH): Free Stock Analysis Report

COOPER COS (COO): Free Stock Analysis Report

PHARMERICA CORP (PMC): Free Stock Analysis Report

Original post