American Airlines Group (NASDAQ:AAL) is scheduled to report second-quarter 2017 results on Jul 28, before the market opens.

Last quarter, the company delivered a positive earnings surprise of 7.02%. It also has an impressive earnings history, beating the Zacks Consensus Estimate in three of the last four quarters with an average beat of 20.24%.

Let’s see how things shape up for this announcement.

Factors Likely at Play

High costs are likely to hurt bottom-line growth in the second quarter. Consolidated CASM (excluding special items and fuel) is projected to increase 7% in the quarter. In addition, average fuel cost per gallon (mainline) is projected in the band of $1.6-$1.65 per gallon.

The wage hike announcement for pilots and flight attendants in April is also likely to pressurize the bottom line. The fact that American Airlines is a highly leveraged company might further hurt results in the second quarter.

However, the carrier issued a bullish view on unit revenues and adjusted pre-tax margin for the second quarter of 2017 while releasing June traffic results. The carrier now expects total revenue per available seat mile (TRASM) for the second quarter to grow in the band of 5–6% (old guidance had hinted at growth in the range of 3.5–5.5%). Pre-tax margin excluding special items for the quarter is expected in the range of 13–14% (previous guidance: 12-14%).

Earnings Whispers

Our proven model does not conclusively show that American Airlines is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. But that is not the case here as elaborated below.

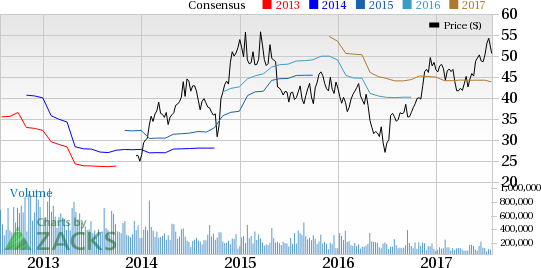

Zacks ESP: American Airlines has an Earnings ESP of 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at $1.87 per share. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: American Airlines has a Zacks Rank #1.

We caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Investors interested in the airline space may consider the following stocks, since our model shows that these companies possess the right combination of elements to come up with an earnings beat this time.

Copa Holdings, S.A. (NYSE:CPA) has an Earnings ESP of +4.29% and a Zacks Rank #2. The company will release second-quarter results on Aug 9.

LATAM Airlines Group S.A. (NYSE:LTM) has an Earnings ESP of +200.00% and a Zacks Rank #2. The company will report second-quarter results on Aug 18.

SkyWest, Inc. (NASDAQ:SKYW) has an Earnings ESP of +3.45% and a Zacks Rank #1. The company will report second-quarter results on Jul 27. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Copa Holdings, S.A. (CPA): Free Stock Analysis Report

SkyWest, Inc. (SKYW): Free Stock Analysis Report

American Airlines Group, Inc. (AAL): Free Stock Analysis Report

LATAM Airlines Group S.A. (LTM): Free Stock Analysis Report

Original post

Zacks Investment Research