- Amazon has made a significant investment in Anthropic, a major player in the AI sector

- The company's core business, retail, remains its strongest pillar, supported by its thriving e-commerce segment

- Will the recent investment in AI add another strong pillar and help spark growth?

Amazon (NASDAQ:AMZN) has been making a remarkable comeback in 2023, with its stock surging by more than 55% since the start of the year, bouncing back from a nearly 50% retreat in 2022.

But as the horizon begins to turn cloudy for US retail and the company's sales growth appears to hit a near-term peak, investors begin to wonder whether the Seattle, Washington-based behemoth will be able to diversify its operations beyond the cloud computing and e-commerce spaces.

To address this question, Amazon is embarking on a strategic foray into the highly competitive field of artificial intelligence (AI) by making a substantial $4 billion investment in Anthropic, one of OpenAI's primary rivals (OpenAI is the developer behind ChatGPT).

This bold step positions Amazon strategically for fierce competition with tech titans like Microsoft Corporation (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOG), both of whom are vigorously advancing their presence in the AI sector.

Amazon's investment in Anthropic not only solidifies its standing in cloud computing services but also leverages its stronghold in e-commerce and robust cash flow, further establishing its foothold among top-performing growth stocks.

To delve into Amazon's diverse range of activities, its core business remains strong, supported by its thriving e-commerce segment. In the second quarter, Amazon reported a substantial $53 billion in revenue from online stores and $32.3 billion from third-party sales out of the total $134.4 billion in revenue.

Additionally, Amazon Prime, its globally popular video streaming and loyalty program with over 200 million subscribers, along with Whole Foods, a retail chain acquired in 2017, and Amazon Web Services (AWS), commanding 40% of the cloud computing market, contribute significantly to its growth potential.

Considering Amazon's presence across these diverse sectors, its current P/E ratio of 103.6X, which surpasses the sector average, doesn't necessarily classify it as an overvalued stock.

Several factors point to Amazon's high future expectations. Foremost among these is AWS, a major revenue driver for the company, surpassing competitors like Alphabet (NASDAQ:GOOGL) and Microsoft's Azure service. Amazon is proactively strengthening its cloud service position with artificial intelligence support.

Amazon CEO Andy Jassy highlights that 90% of global information technology spending still remains on-premises and has not yet transitioned to the cloud, underscoring the immense potential in this sector.

In the brick-and-mortar arena, Whole Foods, while ranking among the top 10 store chains, has a relatively modest market share compared to its rivals, indicating significant room for growth.

Furthermore, Amazon reported strong earnings for the current quarter, pleasing investors after last year's downward trend. Q2 results exceeded expectations, with earnings per share (EPS) at $0.65, a staggering 90% above InvestingPro's predictions. Q2 revenue of $134.4 billion also surpassed expectations by 2.3%.

Looking ahead to Q3, expected to be announced on October 26, Amazon's performance continues to gain favor among analysts, with 24 revising their forecasts upward. EPS forecasts are at $0.58 and quarterly revenue at $141.6 billion, showcasing a positive outlook for the company's future.

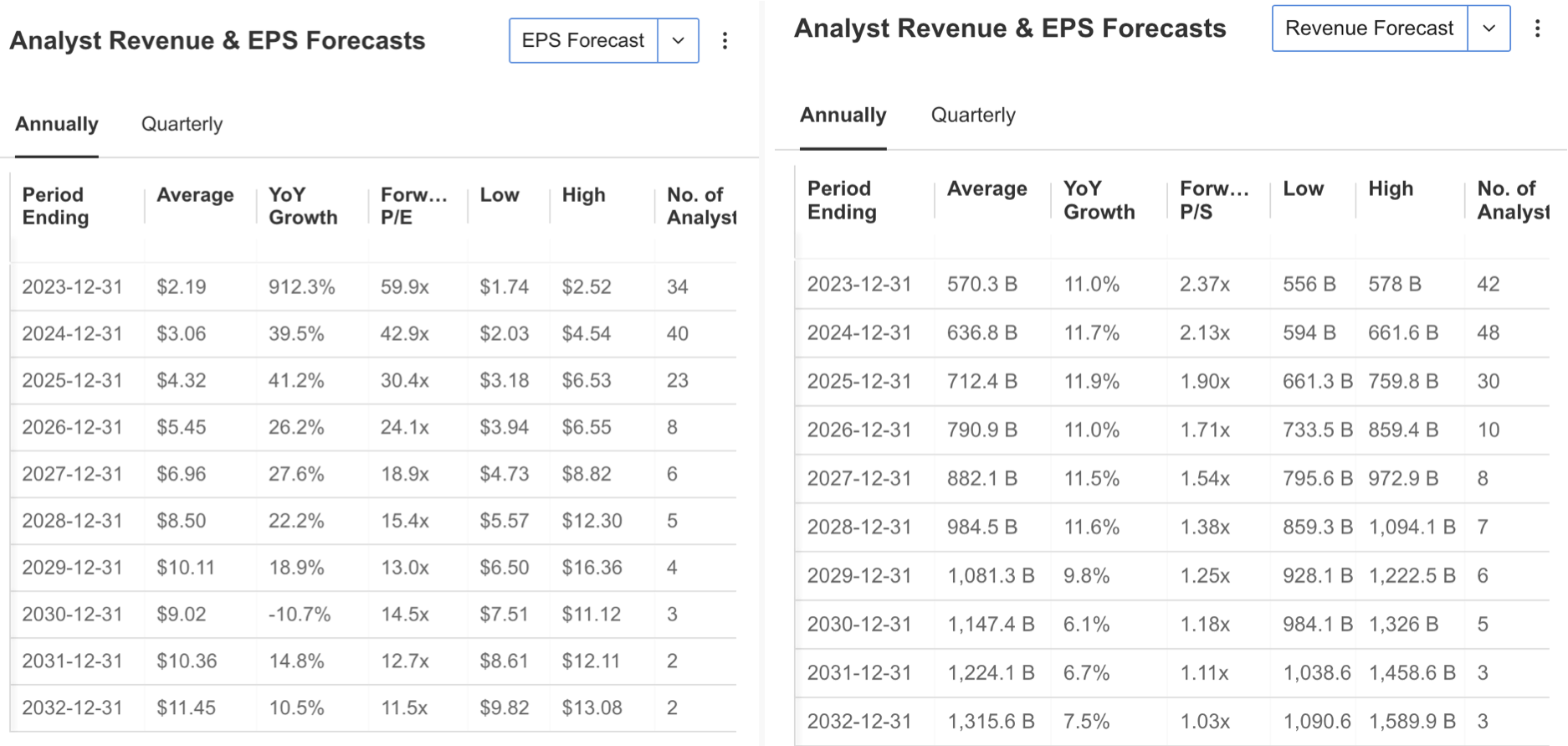

Source: InvestingPro

Accordingly, an EPS of $2.19 is expected for AMZN by the end of the year, with a massive 912% annual growth forecast, while revenue is estimated to rise 11% to $570.3 billion annually. Analysts continue to forecast average revenue growth of 11% in the following years, while EPS is expected to grow at a high but more moderate rate.

Source: InvestingPro

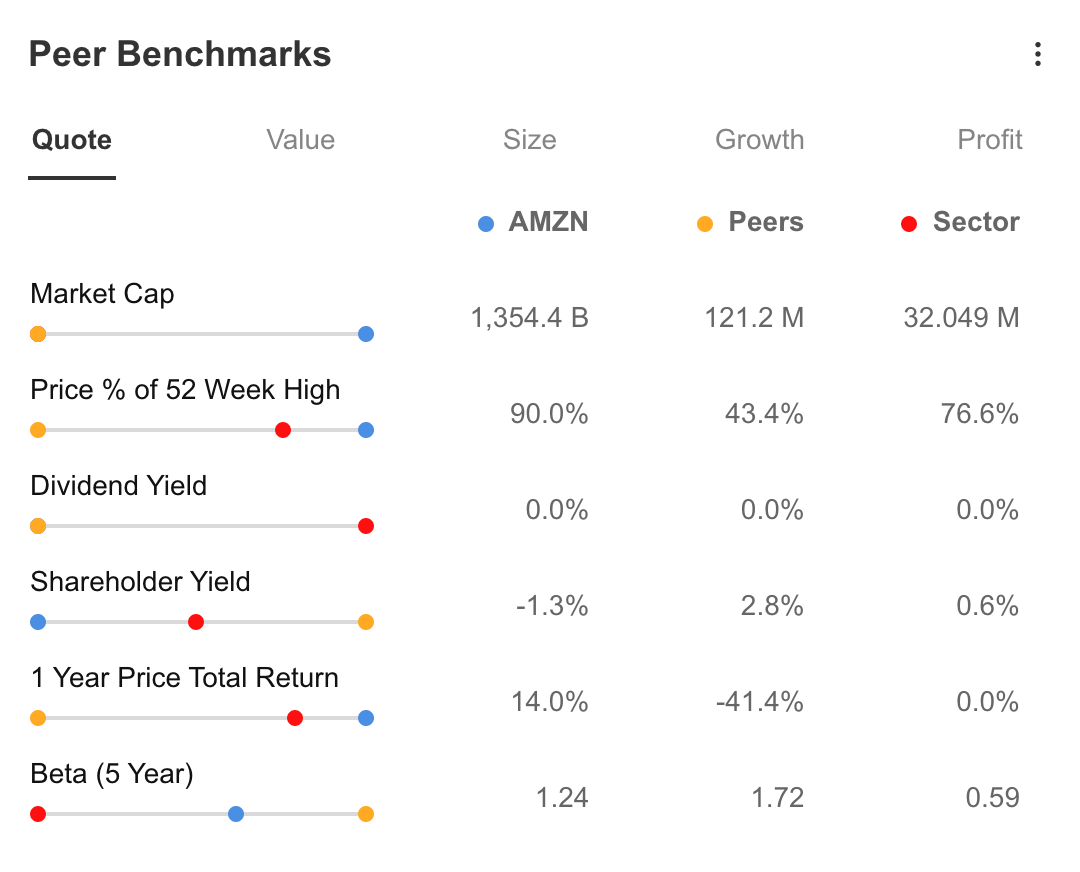

When we compare Amazon, a giant company with a market capitalization of $1.3 trillion, to its peers, we can see that its share price is close to 90%, while its peers are 40% close to the peak of the last 1 year. Although the company's lack of dividend payments seems to be a handicap for long-term investors, its average annual return compensates for this by remaining positive while its peers move in the negative.

While Amazon maintains a beta value of 1.24, which is still below that of its peers, it possesses the capacity to respond swiftly to shifts in the market.

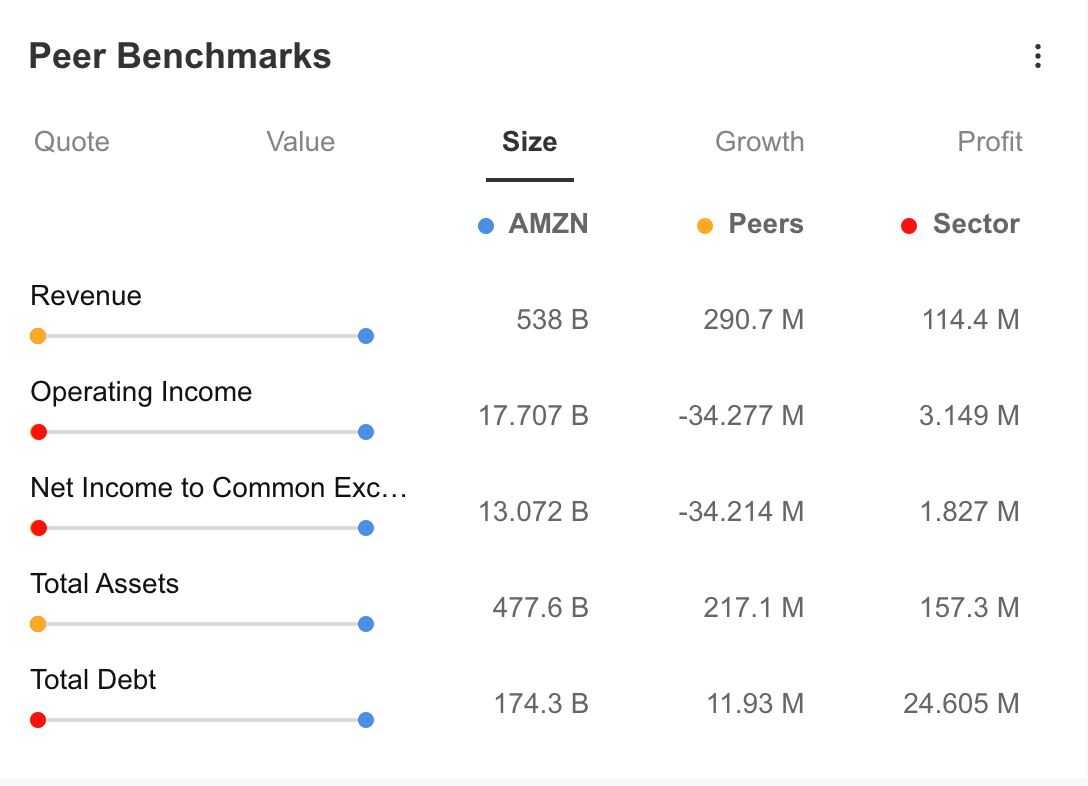

Source: InvestingPro

However, Amazon has an advantage over its peers in terms of revenue, total assets to total liabilities.

Source: InvestingPro

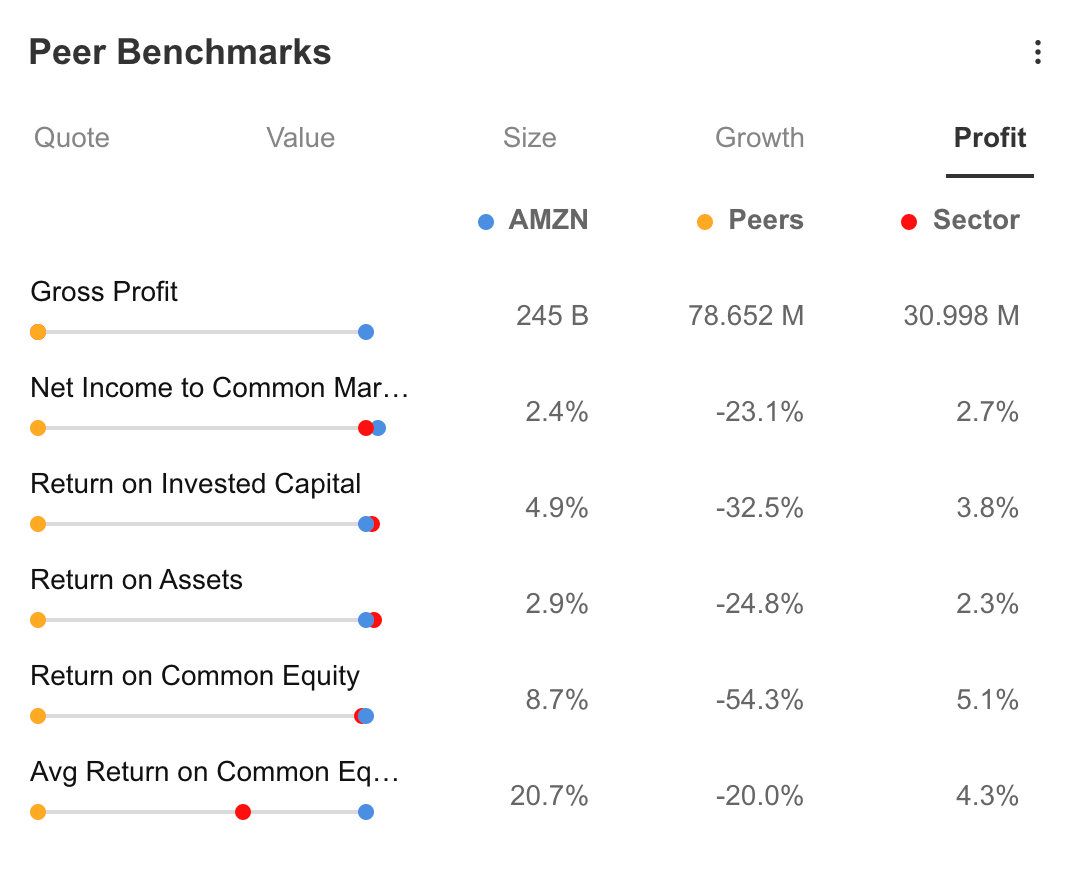

The company stands out with its high growth potential as well as its profitability items.

Source: InvestingPro

Amazon's Strengths and Weaknesses

Amazon's Strengths according to InvestingPro:

- Acceleration in Revenue Growth.

- Expectations for Increased Net Profit.

- Potential for High Long-Term Returns.

- Share Price Growth Over the Last 6 Months.

- High-Margin Activities like Amazon Prime and AWS Support Revenue.

While Amazon's strengths include robust revenue growth, expectations of rising profits, and promising long-term returns, it's also seen positive effects from its investments in high-margin activities and AI. However, its weaknesses encompass the absence of dividend distribution, a high P/E ratio, consistent debt levels, and the substantial costs associated with ongoing investments that may temporarily affect profitability.

Source: InvestingPro

In light of the current data, AMZN's fair value analysis estimates its price at $148 according to 12 financial models and with medium uncertainty. Accordingly, it can be mentioned that AMZN is moving at a discount of 13%. According to 49 analyst opinions, the consensus forecast shows that the stock has the potential to go up to $169.

Amazon: Technical View

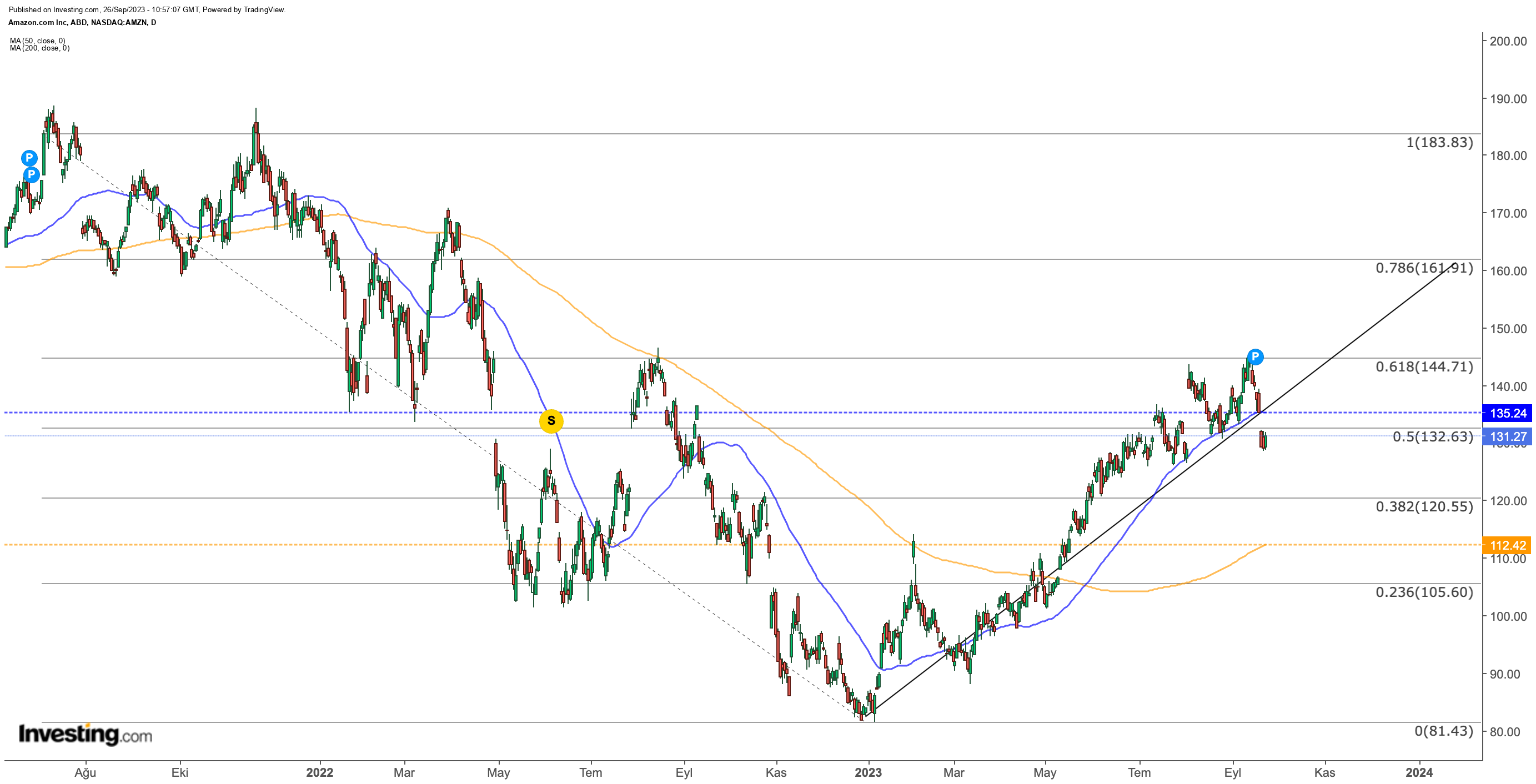

After reaching an average of $140 last month, AMZN stock has lost momentum and moved sideways in the $130-$140 range for about two months.

Amazon's stock underwent a significant correction phase in 2022, coinciding with a rapid increase in interest rates. This downward trend persisted until the end of the year, reaching as low as $81. However, the new year brought increased demand, leading to a rapid recovery.

Examining the price movement from the 2021 peak to the 2022 bottom, it's evident that the share price found resistance at the key correction level of Fib 0.618, which stands at $145. Therefore, $145 is a critical resistance point for AMZN.

In mid-September, the price bounced off this level, and a sharp decline last week pushed it below the rising trend line for 2023 and the 50-day moving average (MA). Notably, Amazon's collaboration with Anthropic had a limited impact on the share price.

From a technical standpoint, if AMZN can surpass the $135 level during the remainder of the week, it might regain upward momentum, contingent on breaking the $145 resistance. This move could potentially trigger a push toward the $160 target in the short term.

Conversely, a retreat to the $120 range is possible in the lower region. Just below this level, the 200-day MA serves as a primary support at $110.

***

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.