A. O. Smith Corporation (NYSE:AOS) is scheduled to report second-quarter 2017 results before the opening bell on Jul 26.

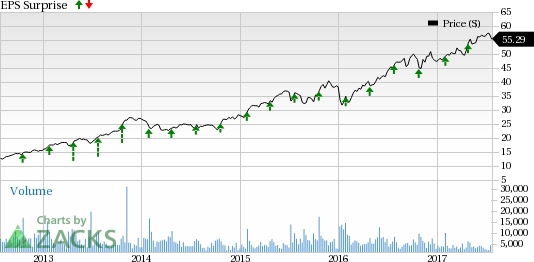

With a string of earnings beats over the past 22 quarters, the company’s surprise history is quite spectacular. Last quarter, it posted a positive earnings surprise of 6.4%. The stock boasts an average positive surprise of 4.9% over the past four quarters.

Let's see how things are shaping up for this announcement and whether A. O. Smith is set to add yet another earnings beat to its winning streak.

Factors to Consider

A.O. Smith’s thriving residential and commercial boiler businesses have consistently raised the top and bottom line over the past several quarters. We believe the stellar demand for its products in China and boilers and commercial water heaters in the U.S. will prove conducive to its sales performance. Factors, including an increasing number of households, thriving replacement market, geographic expansion and improved product mix are likely to act as tailwinds for China.

A.O. Smith’s sales of residential and commercial boilers are largely driven by innovation by Lochinvar. Lochinvar-branded products have benefited from the transition from lower-efficiency to higher-efficiency boilers, new product introduction and market share gain. During first-quarter 2017, Lochinvar-branded products grew 5%, led by strong demand for water heater and modest growth in boilers. This trend is likely to continue for the second quarter as well.

This apart, we believe the Aquasana buyout, which was completed last year, has helped A.O. Smith to cross-sell water treatment products in China. As a matter of fact, for full-year 2017, the company anticipates Aquasana sales to lie within the band of $55–60 million, proving accretive to earnings growth.

Despite these positives, the company has been witnessing a rise in overall operating expenses over the past few quarters. High selling and administrative expenses to support the development of innovative products and quality improvement are expected to hurt second-quarter margins.

Moreover, escalating capital expenditures, in relation to capacity expansion in China and ERP implementation initiatives, are likely to remain an overhang. Also, currency headwinds that have been eroding A.O. Smith’s sales of late, are a concern.

Earnings Whispers

Our proven model does not conclusively show that A. O. Smith will beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here as you will see below:

Zacks ESP: Earnings ESP for the company is 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 53 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: A. O. Smith has a Zacks Rank #2. Though Zacks Rank #1, 2 and 3 increase the predictive power of the ESP, the company’s ESP of 0.00% makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are some companies that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter.

AGCO Corporation (NYSE:AGCO) has an Earnings ESP of +2.89% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Deere & Company (NYSE:DE) has an Earnings ESP of +5.32% and a Zacks Rank #1.

Eaton Corporation plc (NYSE:ETN) has an Earnings ESP of +1.72% and a Zacks Rank #2.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Smith (A.O.) Corporation (AOS): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Eaton Corporation, PLC (ETN): Free Stock Analysis Report

Original post