Putin’s unprovoked aggression against Ukraine prompted the free world to introduce a series of sanctions against Russia. Among many other things, these included an import ban on Russian crude oil by the US and UK.

Meanwhile, Europe is trying to reduce its dependency on Russian natural gas. The trouble is that the world was in an energy crunch even before Feb. 24. Many experts were voicing their concerns that we simply cannot solve climate change without a ramp-up in nuclear power. As a result, the stock of one of the largest uranium producers, Cameco (NYSE:CCJ), was surging.

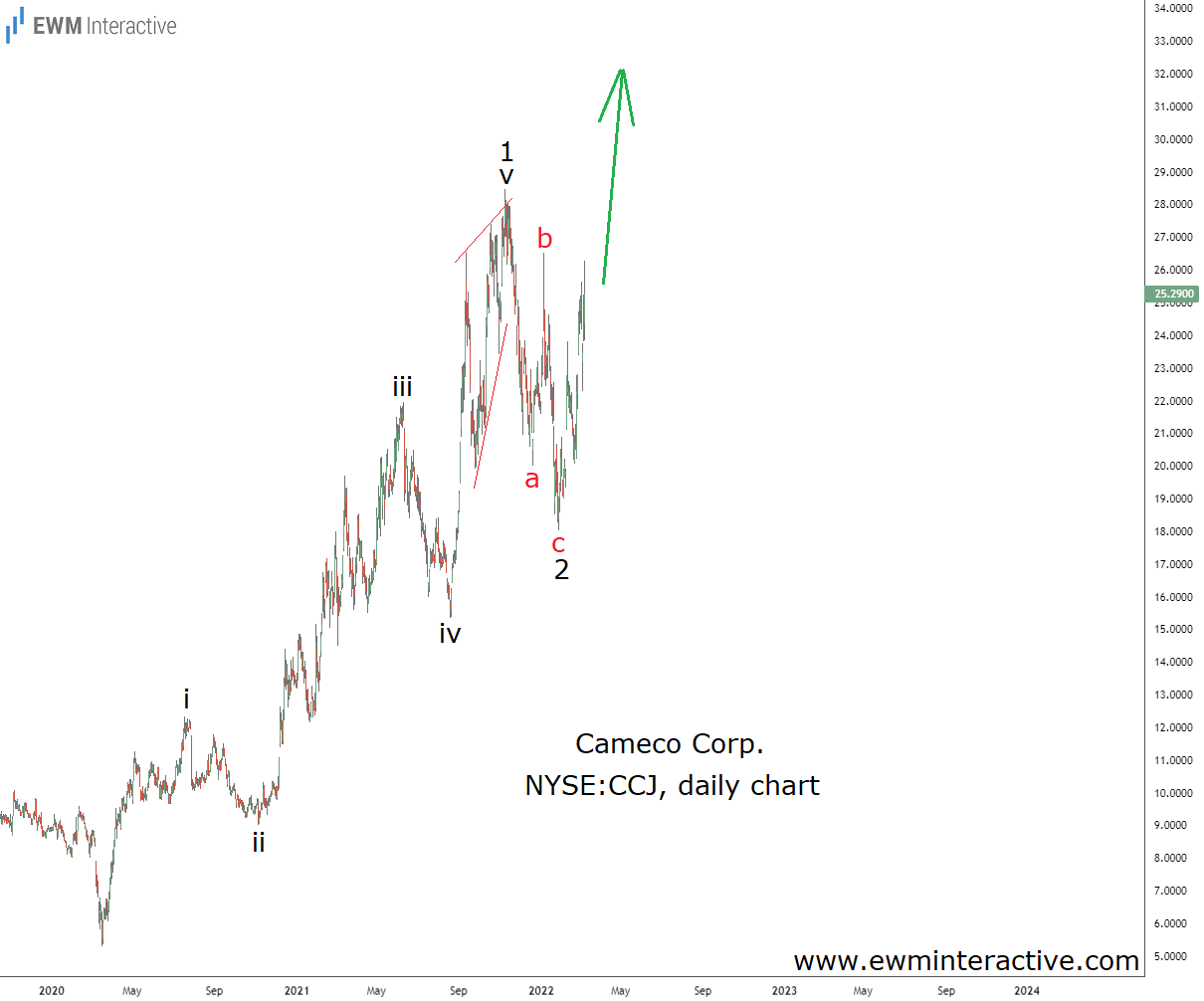

We last wrote about Cameco on Sept. 2, 2021. The stock was hovering slightly over $19 a share on the NYSE when we thought that it “seems to have finally turned a corner.” Of course, our analysis included an Elliott Wave chart with the intention of making things more specific. Take a look at it below.

Cameco ‘s daily chart revealed an almost complete five-wave impulse. The pattern was labeled i-ii-iii-iv-v in wave 1, where wave ‘v’ was still in progress. The theory states that a three-wave correction in the opposite direction follows every impulse. Hence, we thought that once wave 1 is over, we should expect a pullback in wave 2 before the bulls can return in wave 3. Six months later today, here is an updated chart of CCJ stock.

Wave ‘v’ took the shape of an ending diagonal pattern and ended at $28.49 in November, 2021. Then, just as predicted, the bears took the wheel and dragged Cameco stock down to $18.03 by late-January. Wave 2 looks like a simple a-b-c zigzag correction, thus completing the Elliott Wave cycle marked as waves 1-2. If this count is correct, wave 3 up has already begun. Targets near $40 or higher remain plausible as third waves are usually longer than the corresponding first wave.

The Russia-Ukraine war served as the catalyst for the current surge in oil prices. Cameco, and the nuclear energy industry as a whole, might need a catalyst of their own now. It could be Kazakhstan halting uranium exports or Germany deciding to restart its reactors. We’re curious (and a little frightened) to see what is actually going to happen. Aren’t you..?