Street Calls of the Week

Although the stock market is closed today, things will pick back up tomorrow. Kicking things off bright and early will be Kroger Co (NYSE:KR), set to release its third-quarter report before the market opens Thursday, Dec. 6. Ahead of the event, options traders have been targeting calls, and anticipating another big post-earnings move.

Looking at Kroger's earnings history, the stock has closed lower following five of its last eight quarterly reports, including a 9.9% drop back in September. Overall, the equity has averaged a historical earnings move of 9% within this two-year time frame, regardless of direction. This time around, the options market is pricing in a 9.3% single-session post-earnings move for the security, according to implied earnings deviation data.

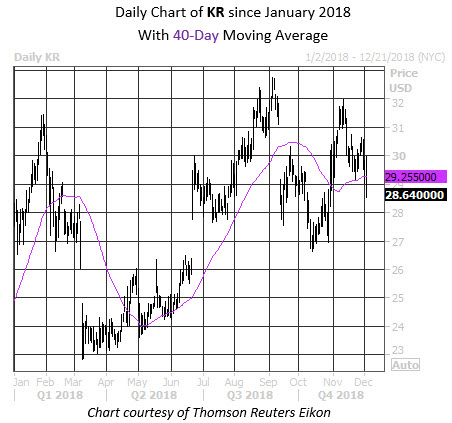

On the charts, Kroger stock has been choppy, with its 40-day moving average alternating between support and resistance all year. The shares have currently racked up three straight weekly losses, but still remain 4% above their year-to-date breakeven point -- closing Tuesday at $28.64.

In the options pits, calls have been popular leading up to earnings. Yesterday, more than 27,000 calls changed hands, 18times the average daily volume and in the 96th percentile of its annual range. Leading the charge was the December 32 call, where new positions were purchased for a volume-weighted average price of $0.38. In this case, breakeven for the call buyers at the close Friday, Dec. 21, is $31.62 (strike less premium paid).