Groupon (NASDAQ:GRPN) stock is up 1.8% to trade at $4.70 today, ahead of the online discounter's second-quarter earnings report, expected before the open tomorrow, Aug. 3. Prior to the event -- and in the wake of recent rumors the company could explore a potential sale -- GRPN calls have become quite popular among options traders.

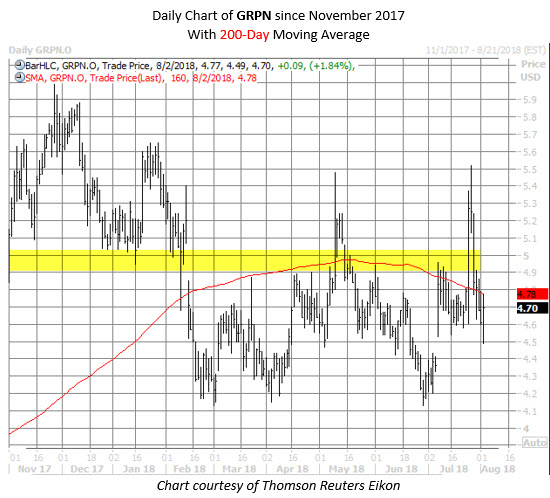

Since the February correction and a negative earnings reaction the same month, Groupon shares have spent most of the past six months struggling to break north of the formerly supportive $4.90-$5 area. The equity briefly popped above this neighborhood in late July, thanks to the aforementioned for-sale rumors, but is now back below this level and staring back up at its 200-day moving average.

The options market is pricing in a much larger-than-usual 23.4% next-day swing for GRPN stock, regardless of direction. This compares to the 14.2% single-session post-earnings move the shares have averaged over the past eight quarters -- where three of the past four have been positive. Last August, GRPN stock added 9.3% the day after reporting.

As alluded to above, calls have been the trend in the options pits. The stock's 10-day call/put volume ratio of 8.74 at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) ranks above two-thirds of all other readings from the past year. This indicates a healthier-than-usual appetite for long calls over puts in the past two weeks.

Echoing that, GRPN stock's Schaeffer's put/call open interest ratio (SOIR) of 0.15 ranks in the lowest annual percentile. This means short-term speculators haven't been more call-heavy in the past year, looking at options expiring in the next three months.

Digging deeper, there are currently 198,079 calls and 44,842 puts open on Groupon -- putting total open interest in the 100th percentile of its annual range. Most of this centers on the October 4.50 call -- home to peak open interest of nearly 50,000 contracts. A healthy portion of the calls were bought to open, per data from the major exchanges.

Some of the recent call buying -- particularly at out-of-the-money strikes -- could be attributable to short sellers seeking an earnings- or M&A-related hedge. While short interest fell 7% in the most recent reporting period, the 38.94 million shares sold short represents nearly 10% of GRPN's total available float.