The price of gold could be affected by next weeks Fed meeting as they decide whether or not to taper the Quantitative Easing purchases they have been making in their attempt to buy up the toxic assets of the banks and the treasuries that no one else will buy. Ever since the talk of tapering by Bernanke in June of this year (even though he never used the word “taper,” which became a favorite media term to use), interest rates have pushed toward the 3% mark on the 10 year, and today sit right at 2.90%.

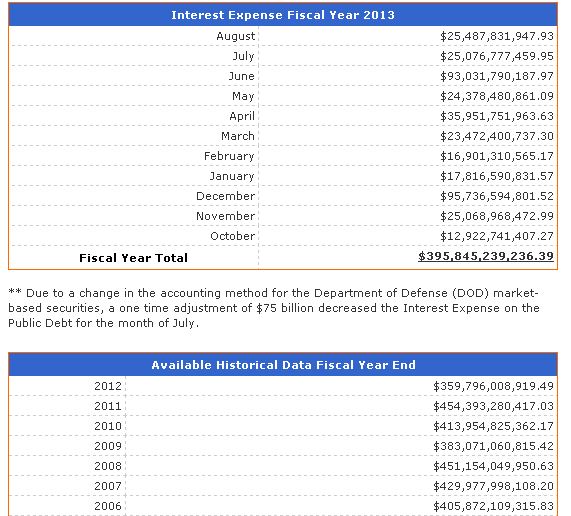

Why are interest rates important to the Fed decision? Because every 1% the rates move higher, it equates to billions more our government has to come up with to pay their bills. First, let’s look at what our government has been paying in interest on the debt the past few years. If you go to the Treasury Direct website, you’ll see the following table of interest paid each month for the past fiscal year.

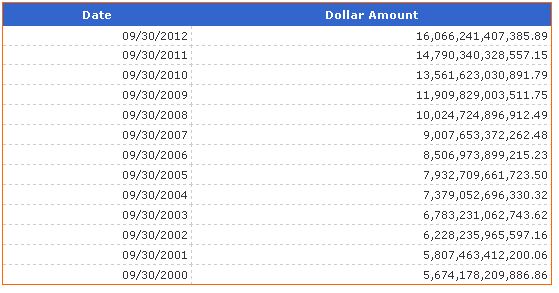

Anyone notice anything peculiar about the table above? The folks over at Treasury Direct seem to have forgotten the entire month of September in their calculation of interest! They didn’t even include it in their total calculation for 2012 as $359 billion was the amount they used for the interest expense. Technically, today, we are at the 2008 interest expense payment of around $450 billion annually. Unfortunately, that payment was on just over $10 trillion of national debt. Today we stand at close to $17 trillion (figures below as of 9/30/2012). In the last year, we have added about $1 trillion to the National Debt alone. Not as high as the previous 4 years, but still a staggering sum.

The interest on each additional trillion of debt is 170 billion more that has to be paid by the taxpayers. If the Fed tapers, interest rates will shoot higher. Can the Fed possibly do this? I don’t think so. I believe they will actually do what Bernanke did in June, “talk the talk.” The stock market at that time was pushing all-time highs. Today, we are close to that level again. I believe the Fed will come out Sept. 17th and 18th next week and say the economy is doing well, but we still need to keep an eye on things. They can’t possibly rattle the markets with any tapering action. The “talking” worked last time, enough to curtail a stock market living and breathing on what the Fed does rather than the underlying data (well, at least any stock not government or financial related) and I believe this is the tactic the Fed will use this time as well. Besides, they have two more Fed meetings; Oct. 29th and 30th, and Dec. 17th and 18th to make any of the moves Bernanke commented about in June.

2010 CBO Projections for the Future a Wee Bit off Target

For further proof of what the Fed may do, they need look no further than to the December 2010 projections of the Congressional Budget Office (CBO) to see how far off target they are today. In December of 2010, the CBO said the following;

The Congressional Budget Office (CBO) projects that, under current law, debt held by the public will exceed $16 trillion by 2020, reaching nearly 70 percent of GDP. CBO also projects that interest rates will go up. The combination of rising debt and rising interest rates is projected to cause net interest payments to balloon to nearly $800 billion, or 3.4 percent of GDP, by 2020.

Here we are in September of 2013 and the debt is approaching 17 trillion (only missed it by a trillion CBO) and interest rates are already pushing 3%. They were predicting $800 billion of payments for interest in 2020 on $16 trillion of debt. That’s 7 years from now! This prediction was AFTER the financial crisis! They assumed a 5% interest rate to come up with the $800 billion payment of interest on the $16 trillion of debt. It is quite possible that by the time 2020 does come, 7 years from now, that the debt might be more like $20 to $25 trillion or even higher, which at 5% (a reasonable assumption) the interest payments would be $1 trillion to $1.25 trillion a year.

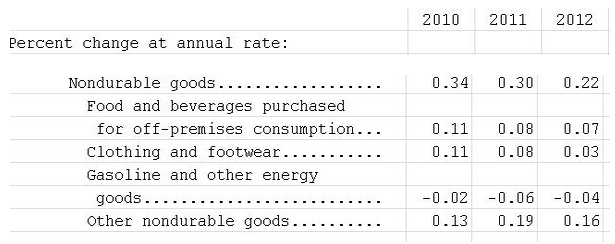

While the debt burden will increase either by interest or government spending, the consumer is supposed to be a big part of any growth that may be forthcoming in the economy. But from the non-durable aspect to consumer spending (what matters most to them), we have done nothing but sink since 2010.

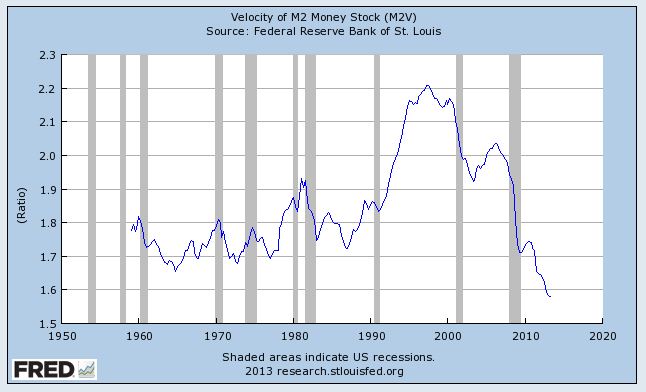

What will the Baby Boomers do moving forward? Are they going to keep buying cars or are they paying off their debt as much as possible? From the chart below, it clearly shows they are not spending but rather, saving. The government then, according to the flawed philosophy of most in government who dictate economic policy, otherwise known as Keynesian economics, has to make up for this lack of consumer spending to keep the economy rolling.

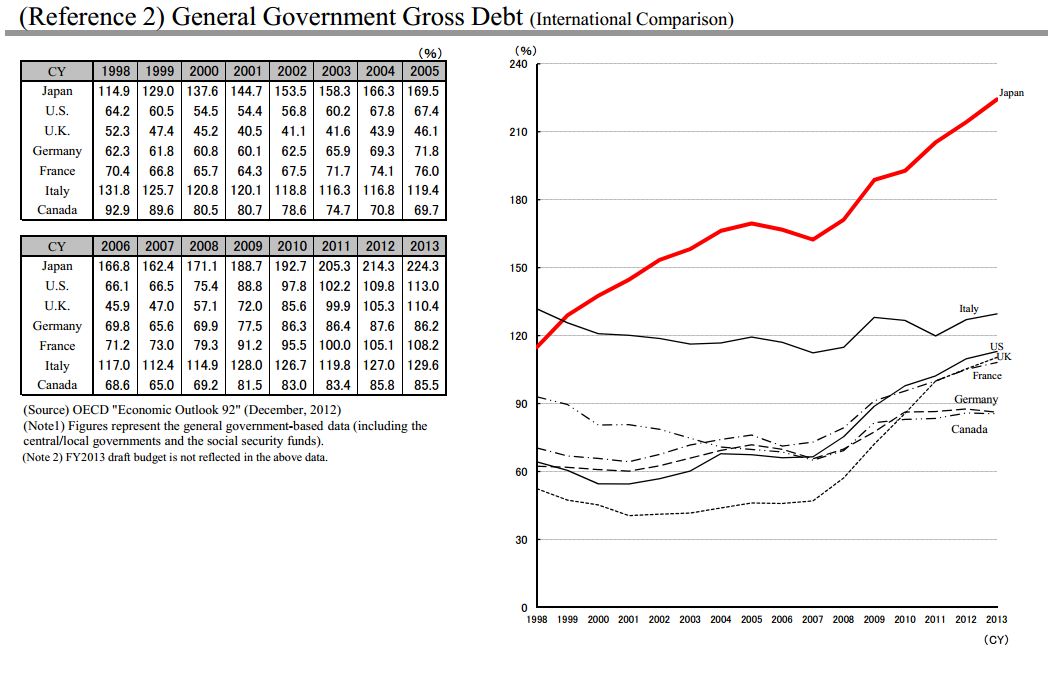

But how did this work for Japan? How did Government Spending help stimulate Japan’s economy? The answer is, it didn’t. It has simply kept the game alive, but at the expense of their Debt to GDP, which sits at the highest in the civilized world.

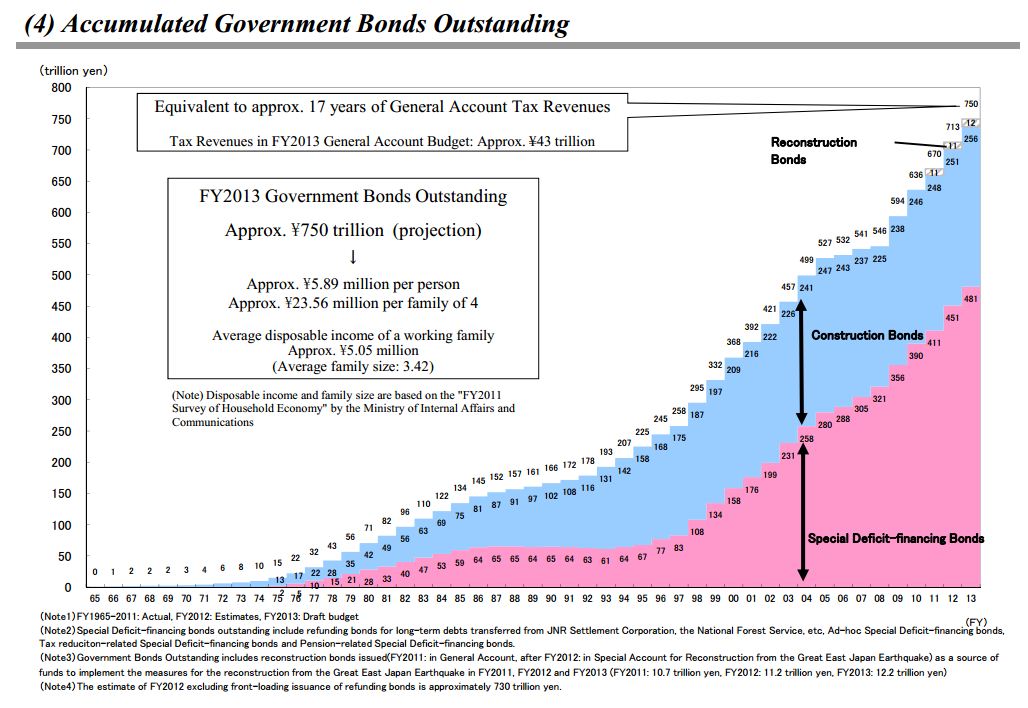

In fact, Japan needs growth that just won’t come with an aging population. They need the equivalent of 17 years of tax revenues to get out from under their debt burden. Is this possible?

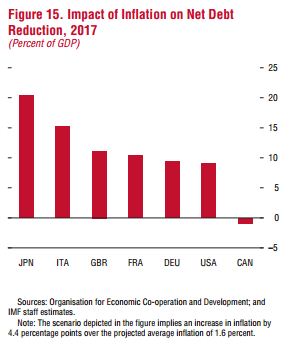

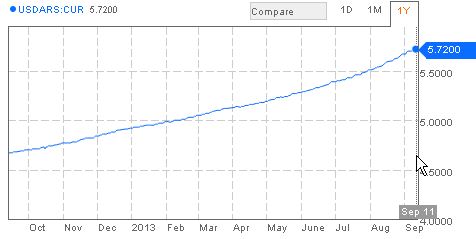

So Japan’s only way out of their ticking debt bomb is to inflate their way out – AKA, Abenomics, (which by default is dollar bullish). This is why over the last year, since Japanese Prime Minister Shinzō Abe in 2012, we have seen, with the approval of the G20, the Yen get hammered versus the dollar. While inflating debt problems away can be very problematic, it is a reason everyone needs to keep an eye on Japan.

USD/JPY" width="802" height="493">

USD/JPY" width="802" height="493">

All countries could eventually be taking the Japanese currency path, including the U.S. They may have no other choice. But in Europe, the Southern Countries as well as Ireland are all struggling as they can’t, like Japan or the U.S., print their way out of their mess. They are stuck with whatever the European Central Bank, (ECB) dictates. Because of this slow to action scenario, I am still negative on the Euro, which again, can be dollar bullish. We’ll find out soon enough in Europe with the election of possibly a new leader in German, who may dictate the Euro’s future.

Some leaders in the weakening currency race are Brazil, Argentina and India. Again, all of this is dollar bullish overall, and of course gold bullish in those countries whose currencies are falling the last year, along with the Yen.

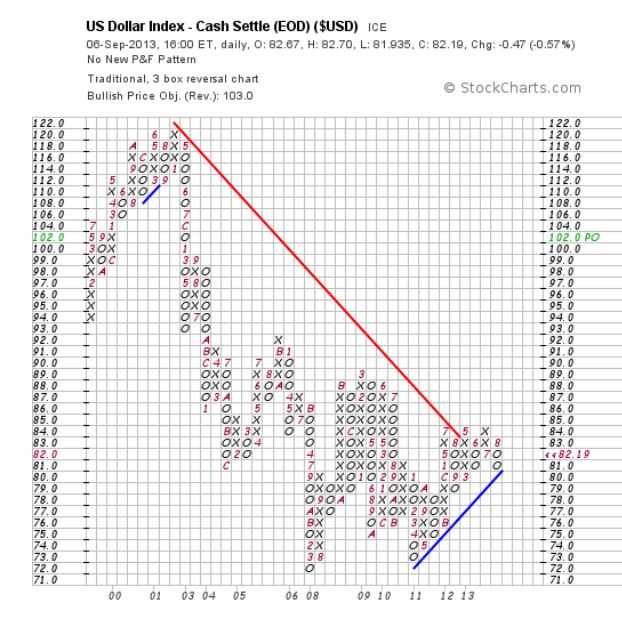

Meanwhile, the dollar is waiting for news in Europe as the Index has held steady between 81 and 82. I keep a close eye on this to possibly change my thinking.

A break below 80 changes things and would be very bullish for gold. I just don’t see it happening anytime soon. A break above 85 on the Index, and even Richard Russell said a few days ago, “For good measure, I’m including a P&F chart of the dollar. The dollar is in an important technical area. At the 80 box, the dollar turns bearish. At the 85 box, we get a triple top breakout, which is very bullish.” I have included his P&F chart below.

What’s Next On the Horizon for Gold and Silver?

While a short term bounce will always come, and it seemed to do just that into the close of business Friday, the three issues that gold and silver have until the end of the year are two that are bullish, and one that can be negative.

First, if the Fed doesn’t do any actual QE tapering, then this could be potentially viewed as bullish for gold. Even though we haven’t had too much of a breakout in gold with all of the QE that has been occurring, it is still bullish for gold in the long run. With all the talk of tapering, a surprise of no tapering could shoot gold up $50 in one day just because it’s a surprise. There is much short action against gold, so any surprises from the Fed can have this bullish affect. But is the Fed really fooled by this economy that is propped up by big government and big financials? Is this the “real” economy? We shall see next week. Probably the hardest for me to call in a long time, but as much as I have been negative on the gold and silver markets the last month, after turning bullish in June, whatever way the metals go, those who are wanting to go long will have an opportunity to do so and still be satisfied with the results down the road.

Second, the date for the national debt ceiling to be breached (where the government runs out of money to pay its bills) is October 18th. Congress will move from Syria to the real issues (we can’t afford to take on Syria’s issues at present no matter how much some of our leaders may want to), the National Debt. If Congress doesn’t act quickly enough on this, as Republicans try and get more seats in the House and Senate come mid-term elections next year and don’t want to say they voted for the increase in debt, it could cause gold and silver to bounce until this is resolved. If S&P comes in and cuts the rating of the U.S. again, this also will help fuel gold and silver higher.

The major negative I see for gold and silver, outside of Market Makers pushing such a small market around to get those who own gold and silver to cry Uncle, is the potential for end of year selling. Since this will more than likely be the first negative year for gold, and because both gold and silver have taken it on the chin this year, the Hedge Funds, Mutual Funds and Professional Traders may just take some year-end tax losses on any of their gold and silver holdings. This selling, if it occurs, can drive the prices of gold and silver down. I wouldn’t expect the selling to occur until after the Thanksgiving holiday and I do expect January to be a great month when the 30 day wash rule expires and the sellers of gold and silver buy the metals back again.

Professional traders can take a dollar for dollar loss as a write-off, unlike most people who are limited to the $3,000 per year limit for losses on investments. If there is some selling that will occur, you can bet the Market Makers will take the selling to an extreme. With this in mind, there is a possibility of lower lows ahead for the metals. Doesn’t mean it will occur, but it is a possibility. The Fed tapering will be interesting to watch. I’m simply calling their bluff.

No matter what happens between now and the end of the year, it will be a good time to dollar cost average into a position to set up for the nice run we will have in the metals in the years ahead. As the CBO projections above show, the so called experts never get anything right and they didn’t even see the last financial crisis coming. You are being given a gift of lower prices to put gold and silver into that portion you wish to allocate for your portfolio. This allocation should be viewed as insurance more than anything else. Just look at what’s going on in the world, from currency devaluation to threats of military action and add to this the banking shenanigans I have written about and view the gold insurance as a higher value than home owners or car insurance where the odds are you will never utilize it. You’ll at least have an insurance that is sure to pay off. I do believe your hardest decision in the years ahead; will be…”when to sell?” It will be a nice position for those that own gold and silver to be in.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Calling The Fed Taper Bluff And What Gold Might Do Next

Published 09/15/2013, 01:49 AM

Updated 07/09/2023, 06:31 AM

Calling The Fed Taper Bluff And What Gold Might Do Next

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.