The financial sector is seeing strength today after the second-round results of the Fed's stress tests. At last check, the Financial Select Sector SPDR (NYSE:XLF) was up 1% to trade at $26.86. The price action has sparked a flood of options activity, too, and even though the fund is holding below a key technical level, most of the activity appears to have a bullish bias.

Taking a quick step back, roughly 118,000 calls have changed hands on XLF so far -- 1.6 times the expected intraday amount, and more than four times the number of puts traded. The weekly 6/29 27-strike call is most active, and it looks like traders may be liquidating their positions ahead of tonight's expiration.

Elsewhere, Trade-Alert highlights a 10,000-contract September 28-30 call spread that was bought for 41 cents earlier. If this trade is being opened, the speculator expects XLF to rally right up to $30 (sold call strike) by September options expiration, while the maximum potential loss will be realized should the fund settle at or below $28 (bought call strike).

Today's heavy call-skew is nothing new for XLF options traders. The 2.5 million calls currently open on the fund ranks in the 91st annual percentile. By comparison, put open interest sits at a measly 1.6 million contracts -- and ranks in the 7th percentile of its annual range.

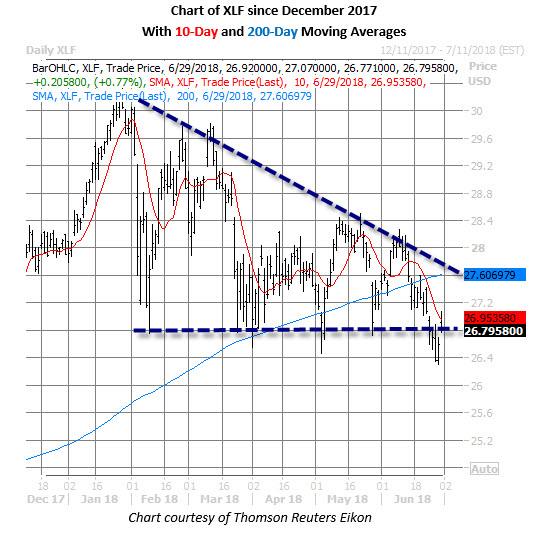

This optimism toward bank stocks is seen elsewhere on the Street, as well. In the most recent edition of Monday Morning Outlook, Schaeffer's Senior V.P. of Research Todd Salamone highlighted the "many talking heads in the media are touting these names as the Fed raises rates and they trade down to their 200-day moving average," -- and the exuberance should spark caution toward the financial sector this summer.

In fact, XLF's upside price action today is running out of steam near $27 -- home to the lower rail of a recent triangle pattern, and its 10-day moving average. According to founder and CEO Bernie Schaeffer, the failure of traders to defend this level "would signal a strong likelihood for greater losses for the bank sector."