Calgon Carbon Corporation (NYSE:CCC) reported net income of $5.9 million or 12 cents per share in second-quarter 2017, compared with a profit of $7.9 million or 15 cents per share recorded a year ago.

Barring one-time items, adjusted earnings were 14 cents per share that were in line with the Zacks Consensus Estimate.

Calgon Carbon recorded net sales of $153 million in the reported quarter, up around 15.4% year over year. The figure beat the Zacks Consensus Estimate of $150.6 million.

The increase in sales was mainly due to contribution of the New Business (the wood-based activated carbon and filtration media business) which was acquired in Nov 2016.

Segment Performance

Revenues from the company’s core Activated Carbon segment increased 9.8% year over year to $135.7 million in the reported quarter. The increase was mainly due to higher net sales of environmental air (which includes mercury removal products), potable water, industrial and specialty processes market in the Americas, which more than offset the estimated lower anticipated activated carbon pellet sales in Japan for treating nitrogen oxide and sulfur emissions, lower sales of potable water market in Europe and lower environmental water market sales in the Americas due to the completion of a major remediation project in 2016.

The Alternative Material segment’s revenues increased around five-fold year over year to $12.9 million as the perlite filtration and diatomaceous earth media products of New Business contributed $11 million to reported quarter sales.

Sales from the Advanced Water Purification segment declined 31.2% year over year to $4.4 million in the quarter due to lower traditional ultraviolet water disinfection equipment and ion exchange project sales, partly offset by modestly higher sales of ballast water treatment system.

Financial Position

Calgon Carbon ended the quarter with cash and cash equivalents of roughly $24.1 million, down roughly 52.9% year over year.

Long-term debt was $241.4 million, up roughly 137.6% year over year.

Outlook

According to Calgon Carbon, second-quarter 2017 performance benefited from improved year-over-year demand of activated carbon products and services, steady execution from New Business to achieve robust quarterly sales growth and the company’s diverse end markets. The company is also optimistic about its industrial sector customers.

Moving ahead, Calgon Carbon expects sequential improvement in gross margin and operating expense. The company expects sales and profitability to improve in the second half of 2017. The company also sees growth in its legacy business sales for the full year, which is expected to benefit from improved demand of activated carbon products in North America.

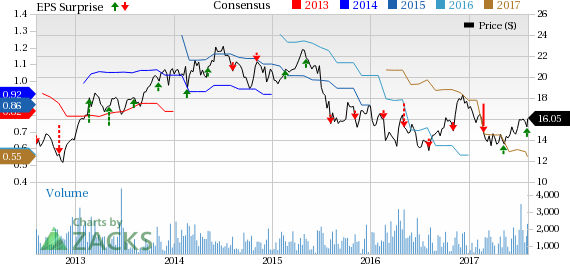

Price Performance

Shares of Calgon Carbon have declined 1.9% in the last six months versus the 5.2% growth of its industry.

Zacks Rank & Key Picks

Calgon Carbon currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are POSCO (NYSE:PKX) , BASF SE (OTC:BASFY) and Kronos Worldwide Inc (NYSE:KRO) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

POSCO has expected long-term earnings growth rate of 5%.

BASF has expected long-term earnings growth rate of 8.6%.

Kronos has expected long-term earnings growth rate of 5%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

BASF SE (BASFY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Calgon Carbon Corporation (CCC): Free Stock Analysis Report

POSCO (PKX): Free Stock Analysis Report

Original post