Dividend policy equates to 7.5% yield for FY14

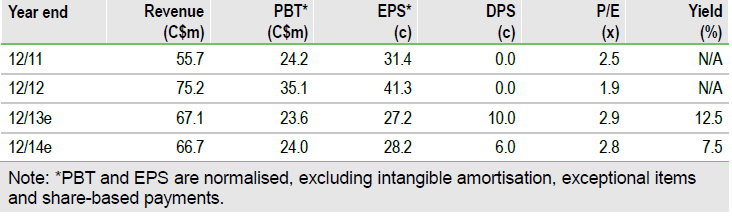

Caledonia Mining Corporation, (CAL) has announced it will pay an aggregate 6c dividend on a quarterly basis through FY14, with the first 1.5c dividend expected to be declared in January 2014. This represents a yield of 7.5% (cf an average of 3.55% yield for the FTSE Mining Index). This dividend policy cements management’s intention to pay out to shareholders on a regular basis. Furthermore, we forecast that Caledonia’s ability to pay out dividends will grow in parallel with its ramp-up to a 76koz production capacity by 2016, with the 52koz production target for FY15 potentially allowing for a 7.6c dividend to be paid (based on our assumption of a 16% payout ratio), representing a yield of c 9.5%.

Q313 costs – all-in cash costs US$999/oz

Caledonia’s Q3 on-mine cash costs were US$554/oz, its all-in sustaining cash costs were US$873/oz and its all-in cash cost came in at US$999/oz (including expenditures on its expansion projects). Caledonia’s year to date on-mine cash cost is US$596/oz (simple average) vs our forecast 2013 value of US$668/oz.

Valuation: Adjusted for dividend and gold prices

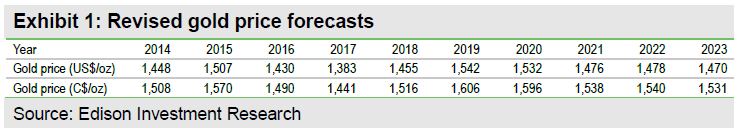

We adjust our financial model for Caledonia’s stated FY14 dividend policy as well as our revised gold price forecasts. The latter have been revised in line with our sector report Gold – US$2070 by 2020, and are given in the following table:

The revised gold prices reduce our dividend discount model from C$2.62 to C$2.15 (at a 10% discount rate to reflect general equity risk), putting Caledonia’s shares at a 62% discount reflecting continued market resistance to it operating in Zimbabwe and not taking into account consistent, at or above budget, production performance or this dividend policy. The gold prices also reduce our FY13 forecast revenue by 4.4% from C$72.6m (which used a gold price of US$1,511/oz) to C$69.6m. The cost of production remains largely unchanged, other than for a slight C$0.2m drop due to the related drop in royalties, which are driven by revenue. Further, we have changed our forecast FY14 dividend of 7.5c (at US$1,511/oz gold), which was based on our assumption of 20% of net attributable revenues driving dividend payments, to the aggregate 6c per share announced by Caledonia. This represents a 21.3% payout ratio (using our FY14 estimate of C$14.7m net attributable profit).

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Caledonia Mining: Adjusted For Dividend And Gold Prices

Published 12/03/2013, 10:07 AM

Updated 07/09/2023, 06:31 AM

Caledonia Mining: Adjusted For Dividend And Gold Prices

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.