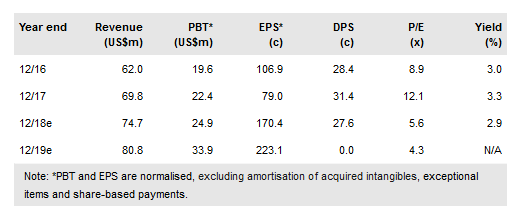

FY17 saw Caledonia Mining Corporation Plc (TO:CAL) marginally beat its 54-56koz gold production guidance, drive down AISC costs, its head grade increase (which had a corresponding positive effect on gold recoveries) and add significantly to its code-compliant resource base. In relation to its investment plan to lift production to 80koz by 2021, we see capex peaking this financial year (FY18), which will then allow significantly improved free cash flow generation. Coupled with an improved political environment and regulatory changes seemingly favouring gold miners (with a key objective of improving Zimbabwe’s domestic US$ currency supply), Caledonia is very well placed to capitalise on the long-overdue opening up of one of Africa’s prime geological and mining gems.

Production and costs beating guidance

Caledonia produced 56,133oz Au in FY17, a y-o-y increase of 11.4%, at all-in sustaining costs (AISC) of US$847/oz, a y-o-y decrease of 7.1%. This resulted from an improving gold grade (a recent concern of investors, and one which should now be readdressed to the upside as the mine delves deeper into higher-grade resources) and higher tonnes processed from improving milling efficiency.

To read the entire report Please click on the pdf File Below: