Improving Data Bullish For Canadian Dollar

Recent positive data suggest Canadian economy performs better than expected. Will the USD/CAD continue recent slide?

Recent positive data support the view of further monetary tightening as Canadian economy performs better than expected. Manufacturing sales recorded 1.6% growth in August from a 2.6% decline in July, beating expectations of negative 0.3%. Employment rose in September, the tenth month of job gains in a row. And September inflation report is due today at 14:30 CET: a rise in headline inflation to 1.7% from 1.4% in August is expected. A weaker inflation report may be bullish for USD/CAD.

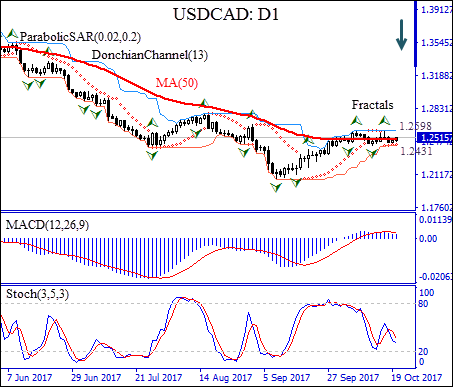

USD/CAD: D1 has been trading with a negative bias on the daily timeframe since it hit a sixteen-month high in the beginning of May. The price is testing the 50-day moving average MA(50).

- The Donchian channel indicates no trend yet: it is flat.

- The Parabolic indicator gives a buy signal.

- The MACD indicator is neutral.

- The stochastic oscillator is falling but has not reached the oversold zone.

We expect the bearish momentum will continue after the price closes below the lower bound of the Donchian channel at 1.2431. A price point below that level can be used as an entry point for a pending order to sell. The stop loss can be placed above the upper Donchian bound at 1.2598. After placing the pending order the stop loss is to be moved to the next fractal high following Parabolic signals. Thus, we are changing the profit/loss ratio to the breakeven point. If the price meets the stop loss level (1.2598) without reaching the order (1.2431), we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

Position - Sell

Sell stop - Below 1.2431

Stop loss - Above 1.2598