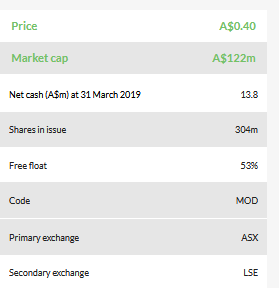

The board of MOD Resources (ASX:MOD), which holds a 7% interest in the company, has unanimously recommended that shareholders accept the offer by Sandfire Resources (ASX:SFR) to acquire 100% of the company through a scheme of arrangement. The deal is also supported by Metal Tiger (MTR.LON), which will hold up to 20% of MOD Resources.

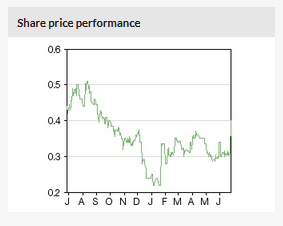

The offer from Sandfire is at a 45% premium to the closing price of A$0.31 on 24 June, and values MOD at A$167m on a fully diluted basis. MOD’s shareholders can elect to receive the consideration as cash up to A$0.45/share, subject to a cap of A$41.6m, or alternatively as scrip of 0.0664 Sandfire shares for one MOD share. Sandfire shares will be issued at a price of A$6.78/share. Sandfire has also agreed to extend its dividend record date to no later than 15 November 2019, so that MOD shareholders can participate if the scheme has completed by this date.

As part of the deal, MOD will acquire from Metal Tiger the outstanding 30% interest in its several exploration licences located in the Kalahari Copper Belt. The consideration for this will be 22,322,222 shares in MOD, which will then be exchanged for shares in Sandfire Resources.

The scheme is subject to approval by MOD shareholders, as well as regulatory and court approvals, independent expert sign-off and other standard conditions. An explanatory booklet that will include an independent expert’s report and further details on the transaction will be sent to MOD shareholders in late August 2019. This will be followed by a meeting of MOD shareholders, expected to be held in October 2019, to approve the scheme.

Business description

MOD Resources is an ASX-listed exploration and development company focused on the Kalahari Copper Belt of Botswana. The flagship T3 deposit has a JORC 2012 compliant mineral resource estimate of 60Mt at a grade of 0.98% copper.