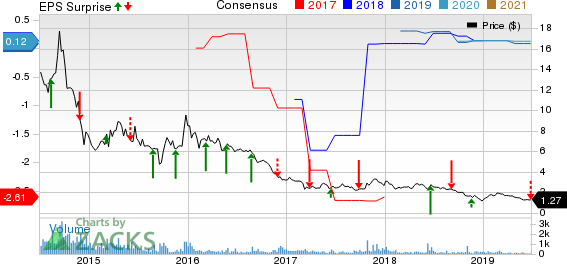

ReneSola Ltd. (NYSE:SOL) incurred a loss of 14 cents per American Depositary Share (ADS) from continuing operations in first-quarter 2019, wider than the Zacks Consensus Estimate of a loss of 11 cents. The reported figure came in line with in the year-ago quarter number.

Notably, the loss incurred in the reported quarter can be attributed to the company’s dismal top-line performance and deteriorating gross margin figure.

Revenues

ReneSola’s first-quarter net revenues of $13.1 million surpassed the Zacks Consensus Estimate of $9 million by 50.1%. The top line, however, declined 71% year over year but 134% sequentially.

Nevertheless, quarterly revenues exceeded the company’s projected range of $8-$10 million. The upside can be contributed to sales of 21.1 MW of project rights in Minnesota and sales of 31.2 million KwH of energy generated by its rooftop DG projects in China.

Projects

As of Mar 31, 2019, ReneSola had over 228 megawatts (MW) of rooftop projects in operation. Of this, the company operates 207.8 MW of rooftop projects in China, 15.4 MW in Romania and 4.3 MW in the United Kingdom. Looking ahead, it has 11.4 MW of rooftop projects under construction in China.

As of Mar 31, 2019, the company had a pipeline of almost 1.4 gigawatts of projects in various stages, of which, 753 MW are late-stage projects. Of these late-stage projects, 49.8 MW are under construction.

Operational Highlights

Gross margin of 2.8% in the first quarter contracted a whopping 1590 basis points (bps) year over year. It also deteriorated immensely when compared with a gross margin of 51.4% in the prior quarter. This downturn can be attributed to revenue decline coupled with unfavorable margin from project sales in the United States.

Operating expenses totaled $2.5 million, flat when compared with the prior-year quarter but down 48% from the previous quarter.

Operating loss in the quarter came in at $2.1 million against the year-ago quarter’s operating income of $5.9 million. The company had incurred an operating loss of $1.9 million in the fourth quarter of 2018.

Financial Condition

As of Mar 31, 2019, ReneSola had cash and cash equivalents of $7 million compared with $6.8 million as of Dec 31, 2018.

Long-term borrowings were $11 million as of Mar 31, 2019, compared with $41.4 million at the end of 2018.

Guidance

ReneSola expects second-quarter 2019 revenues in the band of $10-$12 million, with an overall gross margin of 55-65%. For second-quarter revenues, the Zacks Consensus Estimate is pegged at $36.5 million, much above the company’s anticipated view.

For 2019, the company continues to expect revenues in the $150-$170 million range, with an overall gross margin of 20-25%. The Zacks Consensus Estimate for ReneSola’s 2019 revenues, pegged at $115.6 million, lies much below the company projected guidance.

Business Update

During the first quarter, ReneSola entered into a bridge financing agreement with Eiffel Energy Transition Fund for its solar projects in Hungary and Poland. Under the terms of the agreement, Eiffel Energy Transition Fund will finance ReneSola's 41.3 MW projects in Hungary and 55MW projects in Poland.

Meanwhile, the company made meaningful progress in Vietnam, where it obtained the land rights for a 200 MW ground-mounted project.

Zacks Rank

ReneSola currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Solar Releases

SunPower Corp. (NASDAQ:SPWR) incurred adjusted loss of 41 cents per share in first-quarter 2019, wider than the Zacks Consensus Estimate of a loss of 40 cents. The company had incurred a loss of 20 cents per share a year ago.

First Solar Inc. (NASDAQ:FSLR) incurred a loss of 64 cents per share in first-quarter 2019, wider than the Zacks Consensus Estimate of a loss of 13 cents.

Sunrun Inc. (NASDAQ:RUN) incurred a loss of 12 cents per share in first-quarter 2019 against the Zacks Consensus Estimate of earnings of 32 cents.

Will you retire a millionaire?

One out of every six people retires a multimillionaire. Get smart tips you can do today to become one of them in a new Special Report, “7 Things You Can Do Now to Retire a Multimillionaire.”

Click to get it free >>

Renesola Ltd. (SOL): Free Stock Analysis Report

SunPower Corporation (SPWR): Free Stock Analysis Report

First Solar, Inc. (FSLR): Free Stock Analysis Report

Sunrun Inc. (RUN): Free Stock Analysis Report

Original post

Zacks Investment Research