Ever since Mario Draghi’s announcement of a eurozone wide ABS fashioned QE intentions, the euro saw a massive sell off across the currency pairs. Most noticeably, the euro dropped dramatically against the strong commodity risk currencies such as the Australian and the Canadian dollar. Since yesterday, however, the weak China inflation, spurred by falling Crude Oil prices and a weaker than expected house price index from Canada have managed to weaken the Canadian dollar significantly.

This weakness is however a correction, especially in the EUR/CAD which had enjoyed a strong rally well into early this year. After topping out at 1.5526, the EUR/CAD has declined considerably since March this year. As the Federal Reserve plans to wind up its tapering by October markets would be looking for the Fed to set the path for interest rate hikes. Historically, the Canadian Dollar tends to perform well in conjunction with the US economy, despite the BoC’s lag in monetary policy in relation to the US Federal Reserve.

If the ECB continues on with its QE to ease up liquidity and to lower the currency, further declines can be seen in the EUR/CAD pair.

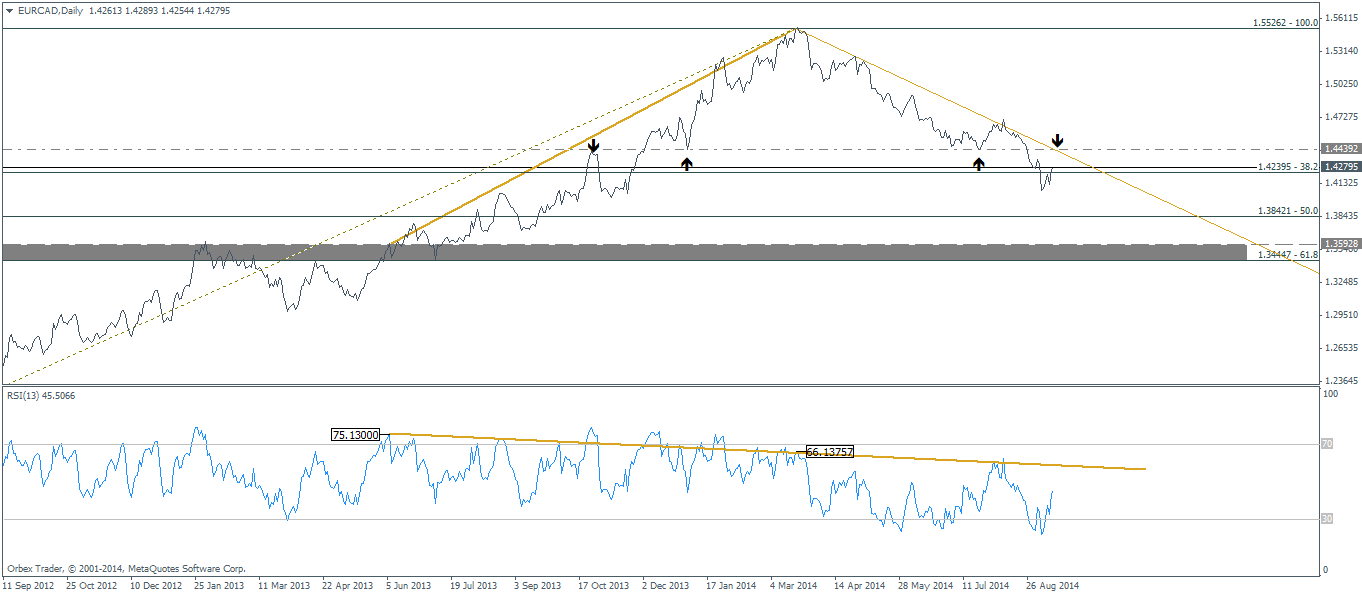

The daily chart of the EUR/CAD below shows a very long term bearish divergence to the rally, giving a corrective target towards 1.36 levels. When measuring the rally with the Fibonacci levels, we also see a confluence to the 61.8% Fib level. An important support/resistance level at 1.44392 has been breached and as past history shows, this level is yet to be retested for resistance. At the time of writing, EUR/CAD is currently gaining ground, trading at 1.428.

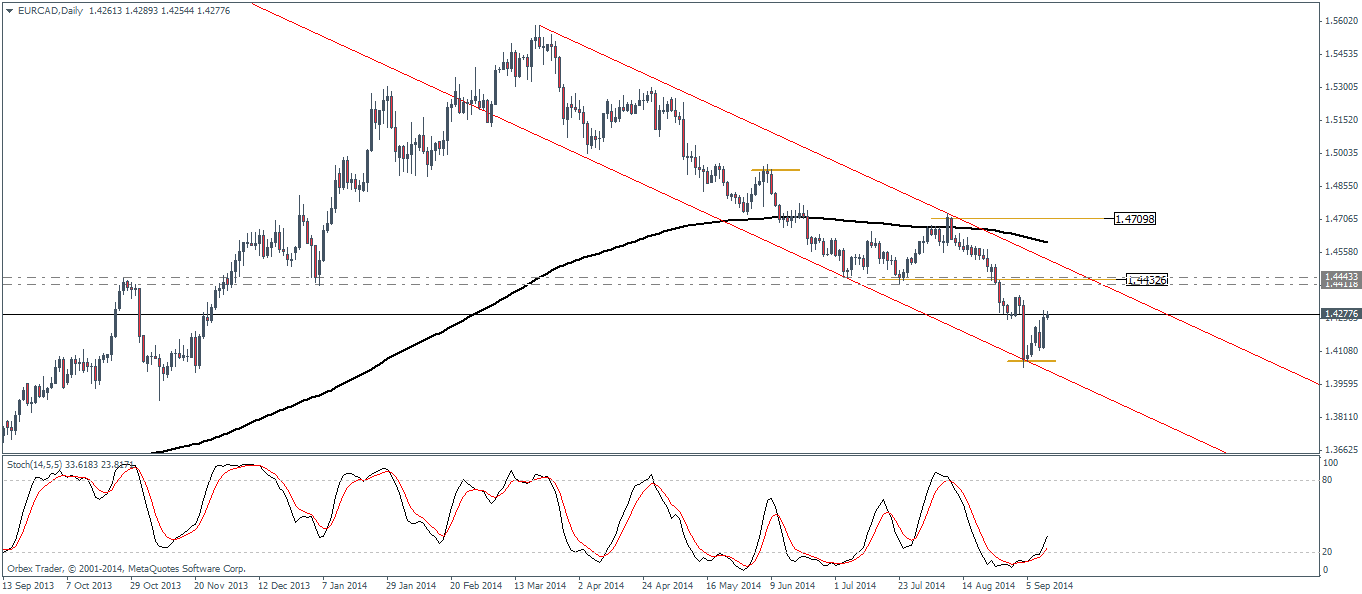

Looking at EUR/CAD in relation to its 200 EMA and Stochastics positioning, we can identify a downtrend, falling channel line. It is interesting to note that the reversal since yesterday came in at the lower end of this channel line, thus confirming the correction to the downtrend. The most recent lower low comes in at a level of 1.44326, which could come in as an interim resistance which also happens to be a long term support/resistance line as shown on the chart below.

Taking the above into consideration, we can look towards shorting EUR/CAD at the region of 1.444 levels, with stops coming in above 1.47098. The EUR/CAD shorts could be moved to break even after a break of support at 1.406. The downside targets for EUR/CAD come in at 1.384, followed by 1.36 a much longer term target giving a Risk/Reward of 1:2 and 1:3 respectively.

In terms of carry trade, EUR/CAD shorts attract a small but decent negative overnight swaps, which also blends well into this long term trade.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

CAD’s Weakness Presents A Selling Opportunity In EUR/CAD

Published 09/12/2014, 06:51 AM

Updated 08/29/2019, 07:20 AM

CAD’s Weakness Presents A Selling Opportunity In EUR/CAD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.