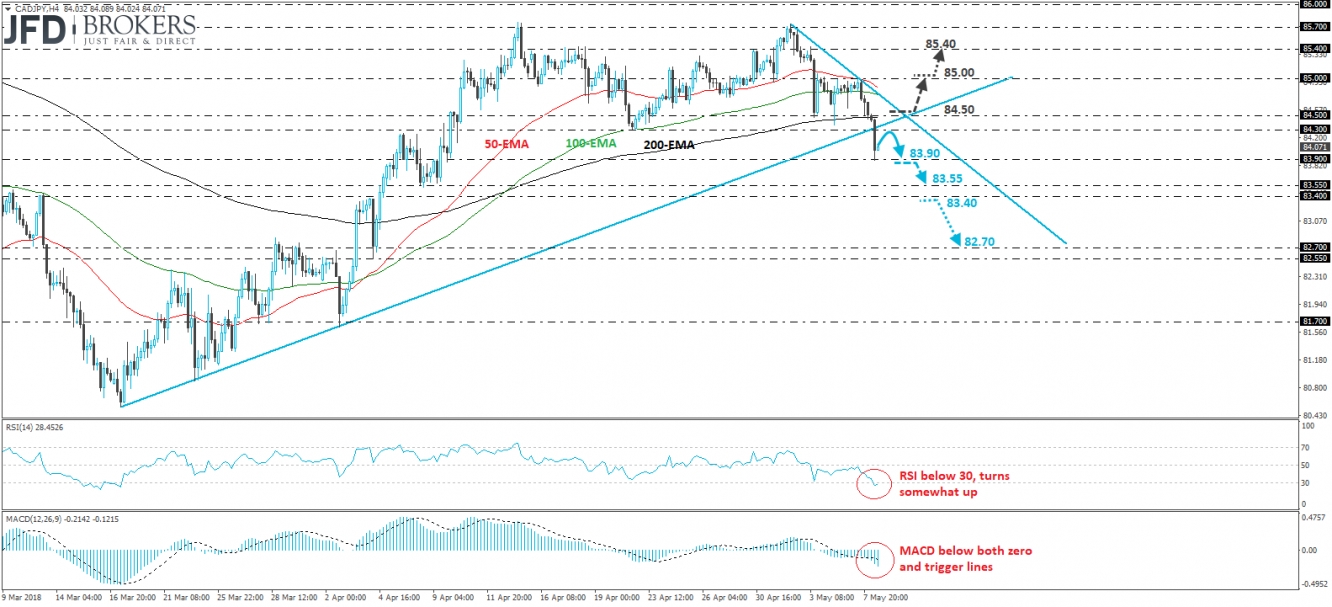

CAD/JPY tumbled during the European morning Tuesday, breaking below the upside support line drawn from the low of the 19th of March. What’s more, the fall brought the rate below the support (now turned into resistance barrier) of 84.30, a move that may have signaled the completion of a double top formation on the daily chart. Having these technical sings in mind, we believe that the short-term outlook may have now turned to the downside.

If the bears manage to stay in charge and push the rate below 83.90, then we may see them targeting our next support territory of 83.55, defined by the lows of the 6th and 9th of April. That said, in order to assume that larger declines may be in the works, we would like to see a decisive dip below 83.40. Such a dip is possible to trigger extensions towards the 82.70 zone.

Turning our gaze to the short-term oscillators, we see that the RSI lies below 30, while the MACD stands below both its zero and trigger lines, pointing south. These indicators detect strong downside momentum and support the case for CAD/JPY to continue drifting lower in the short run. However, given that the RSI has turned somewhat up, we stay cautious of a corrective bounce before the next negative leg, perhaps for a test near the 84.30 level as a resistance this time.

But, even if this is the case, we would still consider the near-term outlook to be negative. The rate would still be trading below the new short-term downtrend line taken from the peak of the 2nd of May. We would like to see a clear break back above that line and the 84.50 barrier before we abandon the bearish case. Such a move could initially aim for our next resistance of 85.00, the break of which may set the stage for the 85.40 hurdle.

Article written by Charalambos Pissouros, Senior Market Analyst at JFD Brokers