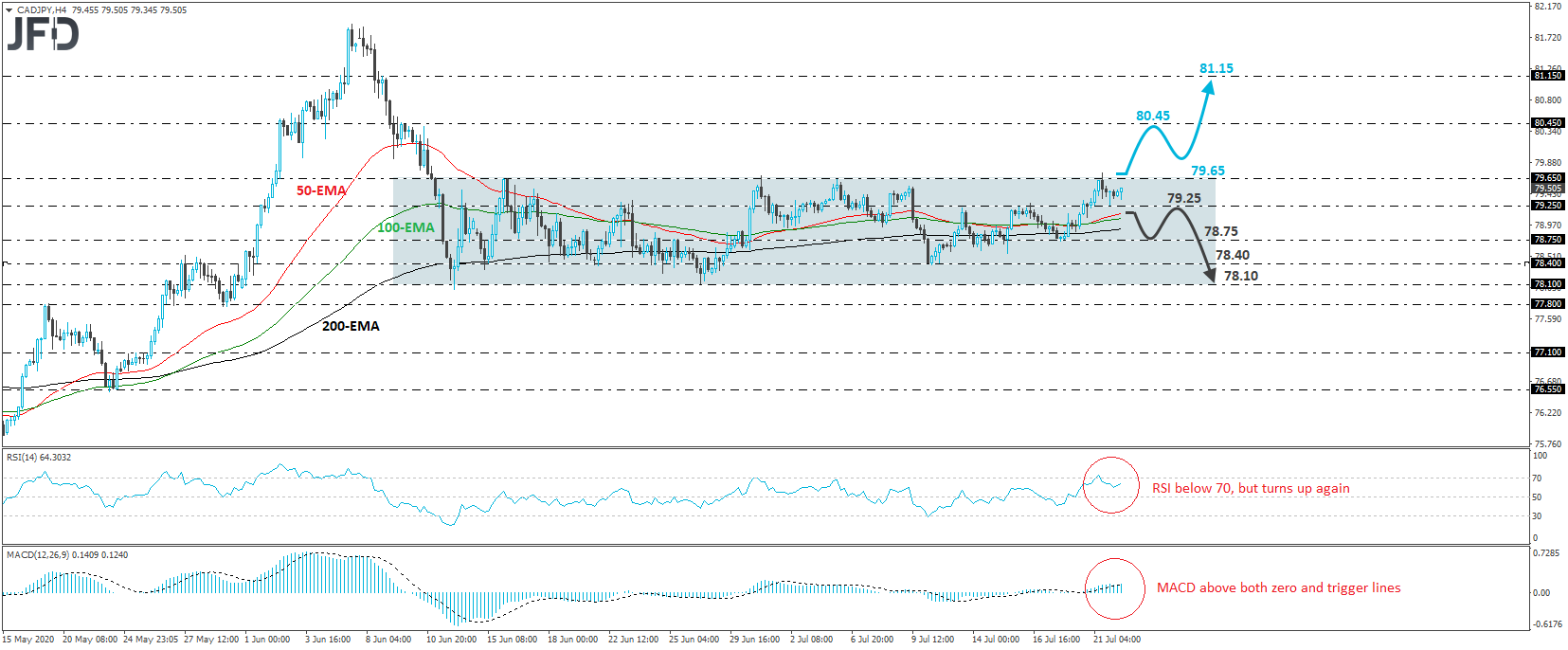

CAD/JPY traded slightly higher on Wednesday, after it hit support at 79.25 on Tuesday. The pair is now trading close to the 79.65 resistance barrier, but remains within the sideways range that’s been containing the price action since June 11th, between that barrier and the 78.10 support. As long as the pair is trading between these two hurdles, we would consider the short-term outlook to be neutral, despite the rate’s proximity to the upper end.

In order to start examining the bullish case, we would like to see a decisive break above 79.65. Such a move would confirm a forthcoming higher high and may pave the way towards the 80.45 zone, marked as resistance by the high of June 10th. If the bulls are not willing to stop there, then a break higher may allow extensions towards the peak of the day before, at around 81.15.

Taking a look at our short-term oscillators, we see that the RSI has recently exited its above-70 zone, but it turned up again, while the MACD, although somewhat flat, lies above both its zero and trigger lines. Both indicators suggest that the rate may have started gaining upside speed again, which increases the possibilities for a break above the upper end of the aforementioned range.

On the downside, a dip back below 79.25 could signal that traders want to keep this pair range-bound for a while more. We may then experience declines within the range, towards Monday’s low of 78.75, the break of which may open the path towards the low of July 10th, or the lower boundary of the range, at around 78.10.