With a couple of events likely to impact CAD/JPY this week, we’re closely watching to see how it reacts around the pivotal level it rebounded towards this week.

Whilst this week’s BOC meeting is flagged as a risk-event for CAD crosses in general, ongoing trade talks between the US and China could leave its mark on CAD/JPY. Positive trade headlines have proven supportive for commodity currencies (and sentiment in general), whilst simultaneously reducing demand for safe havens such as the yen. Therefore, a successful meeting could be a net positive for CAD/JPY or simply weigh on the cross if a deal is not struck. It’s then interesting to note the cross is hovering just beneath a pivotal zone at 82.07 – 82.17 around these events.

We can see on the daily chart that the 20-day average and June ’18 low marks resistance at 82.17, and today’s intraday breach of the 82.07 high shows the bearish structure is being tested. A clear break above 82.17 could see the cross aim for the August ’18 low around 83.63, whereas a move lower from here takes it back in line with the dominant trend. Either way, we’d prefer to see compression before its next directional move given the volatile rebound after last week’s flash crash.

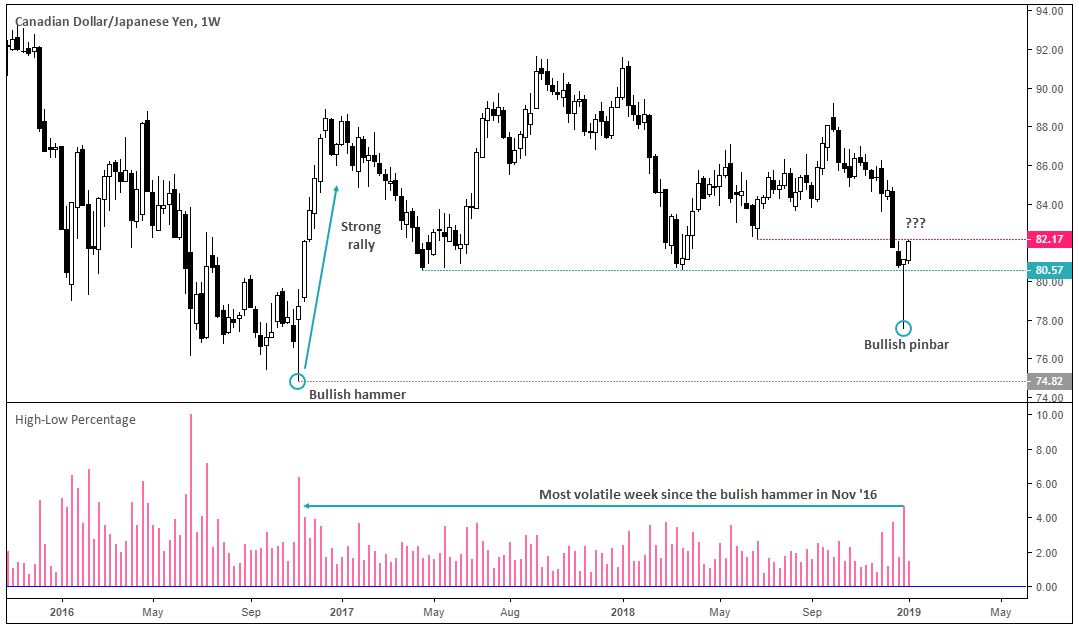

We can see a prominent bullish pinbar on the weekly chart which had a high-low range of 4.7%. The last time we saw a reversal candle of this magnitude was the bullish hammer in November 2016, which marked the beginning of a rally spanning over 19%. That’s not to say that the cross is poised for a double-digit return from here, but the bull-camp will likely take comfort knowing that last week’s flash crash failed to close beneath 80.57 support and invalidated a 2-year head and shoulders pattern. And with near-term momentum favouring the bull-camp, the upside break appears the more likely outcome at the moment.