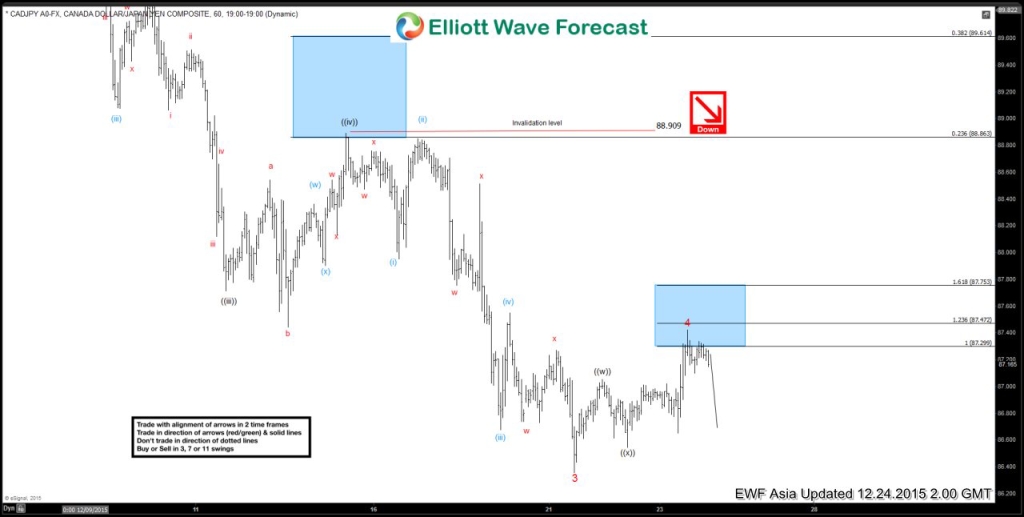

Short term Elliott Wave cycle suggests decline to 86.35 ended wave 3. From this level, wave 4 bounce unfolded as a double three structure where wave ((w)) ended at 87.05, wave ((x)) ended at 86.5, and wave ((y)) of 4 is proposed to be complete at 87.4.

Pair should now try to at least correct the rally from 86.35 in 3 swing, with primary view of extending the decline to a new low. If pair breaks above 87.4 again, it is likely doing a double correction and would open extension higher in 7 swing before the decline resumes. In the event if 87.4 breaks, pair is expected to extend higher in 7 swing from wave 3 low, but as far as wave ((iv)) pivot at 88.9 stays intact in the bounce, pair is still favored to resume the decline to a new low.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.