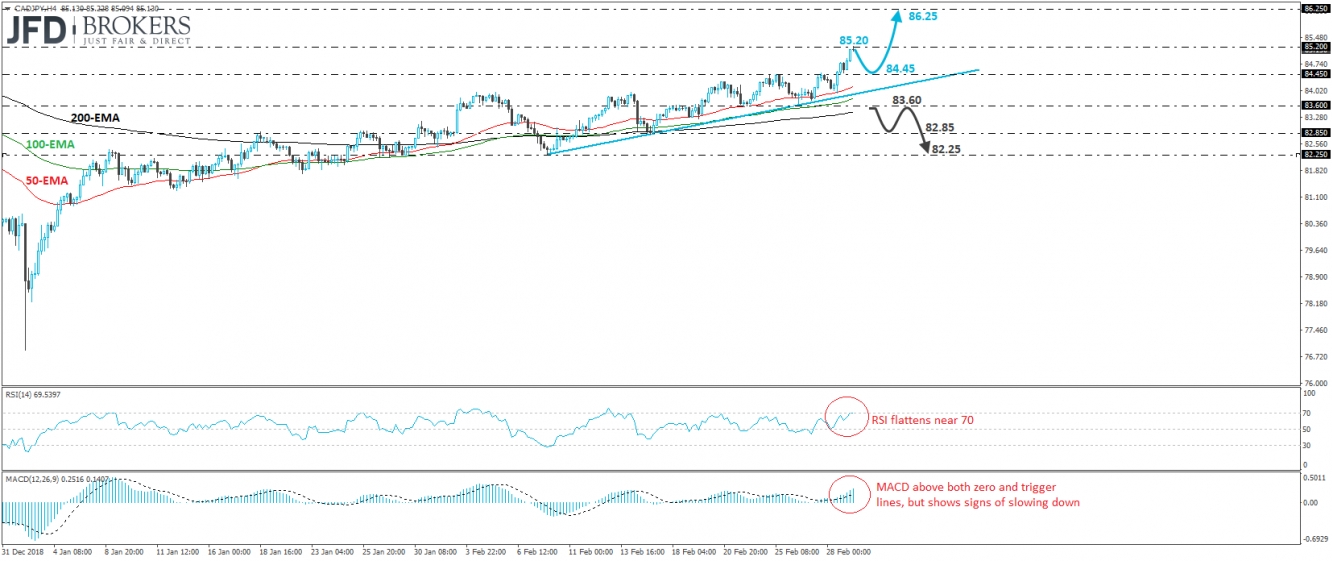

CAD/JPY edged north yesterday, breaking above the key resistance (now turned into support) barrier of 84.45, marked by the highs of February 25th and 27th. The advance continued today as well, with the rate reaching the 85.20 zone, defined by the high of December 13th. Bearing in mind that the latest rally confirmed a forthcoming higher high and that the rate is trading above all three of our moving averages, as well as the upside support line drawn from the low of February 8th, we will consider the short-term outlook to be positive for now.

If the bulls are strong enough to overcome the 85.20 resistance soon, then we may see them driving the action towards the peak of December 3rd, near the 86.25 barrier. If they don’t hit the brakes near that zone, then we may experience extensions towards the 86.90 zone, which proved a strong resistance from October 16th until November 8th. Having said all that though, we will stay careful of a possible setback before the bulls decide to take charge again, perhaps for the rate to test the 84.45 zone as a support this time.

Our view for a corrective retreat before the next positive leg is derived by our short-term momentum studies. The RSI moved higher but has started to flatten near its 70 line, while the MACD, although above both its zero and trigger lines, shows signs of slowing down.

In order to start examining whether the bulls have abandoned the battlefield though, at least in the short run, we would like to see a decisive dip below 83.60. Such a move could confirm the break below the upside support line taken from the low of February 8th and may initially aim for the 82.85 territory, near the lows of February 14th and 15th. Another slide, below 82.85, may allow the bears to put the 82.25 obstacle on their radars, marked by the low of February 8th.