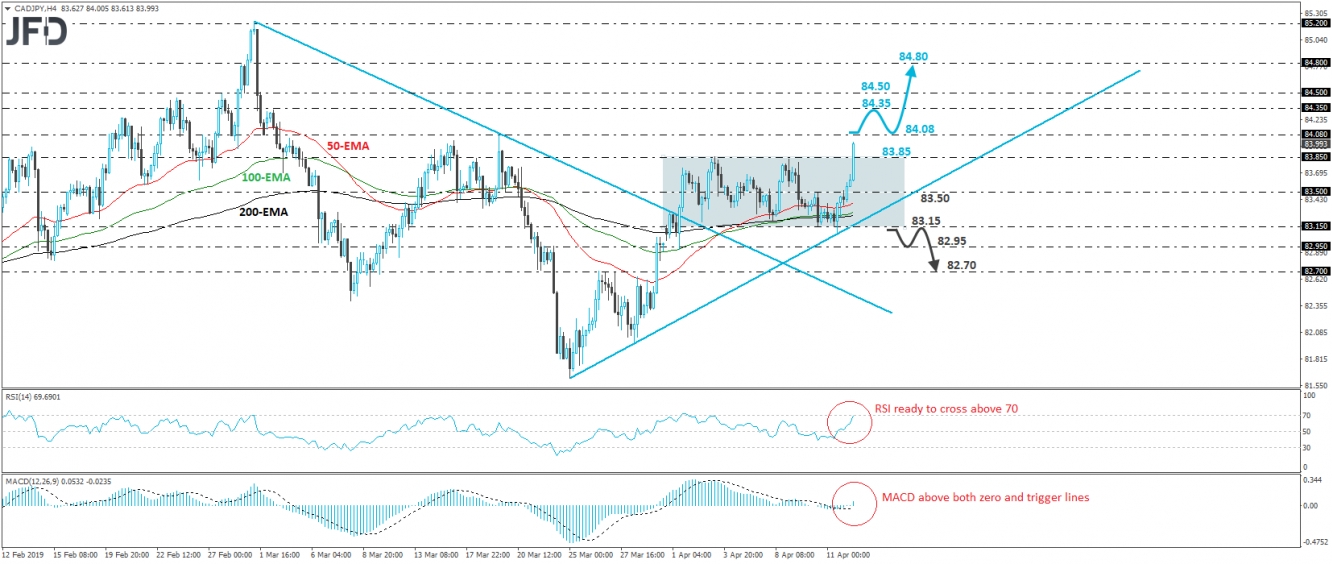

CAD/JPY surged on Friday, breaking above the 83.85 barrier, which acted as the upper bound of the sideways range the pair had been trading within since April 1st. Combined with the fact that the rate is trading above the upside support line drawn from the low of March 25th, the upside exit out of the aforementioned range suggests that the near-term outlook is positive again, in our view.

We would expect the bulls to continue driving CAD/JPY north and perhaps testing the 84.08 level soon, defined by the peak of March 19th. A clear break above that hurdle may allow more upside extensions, perhaps towards the 84.35 area, which is the peak of March 4th. If that level proves to be just a temporary pit-stop for the bulls, then the 84.50 mark may come into play, a zone where the rate formed an intraday swing low on February 28th. Another break, above 84.50, may allow the pair to climb towards the 84.80 territory, defined by the high of February 28th, as well as an intraday swing low on March 1st.

Taking a look at our short-term oscillators, we see that the RSI edged north and now appears ready to move above its 70 line, while the MACD lies above both its zero and trigger lines, pointing up as well. These indicators detect accelerating upside speed and support the notion for some further short-term advances.

On the downside, a dip below 83.65 would bring the rate back within the aforementioned range and turn the picture to flat. The move that would encourage us to start examining the bearish case is a dip below 83.15. Such a dip would confirm the break below the upside support line drawn from the low of March 25th, as well as a forthcoming lower low on the 4-hour chart. The rate could then slide towards the 82.95 level, marked by the low of April 1st, the break of which could extend the slide towards the 82.70 area, near the inside swing highs of March 26th and 27th.