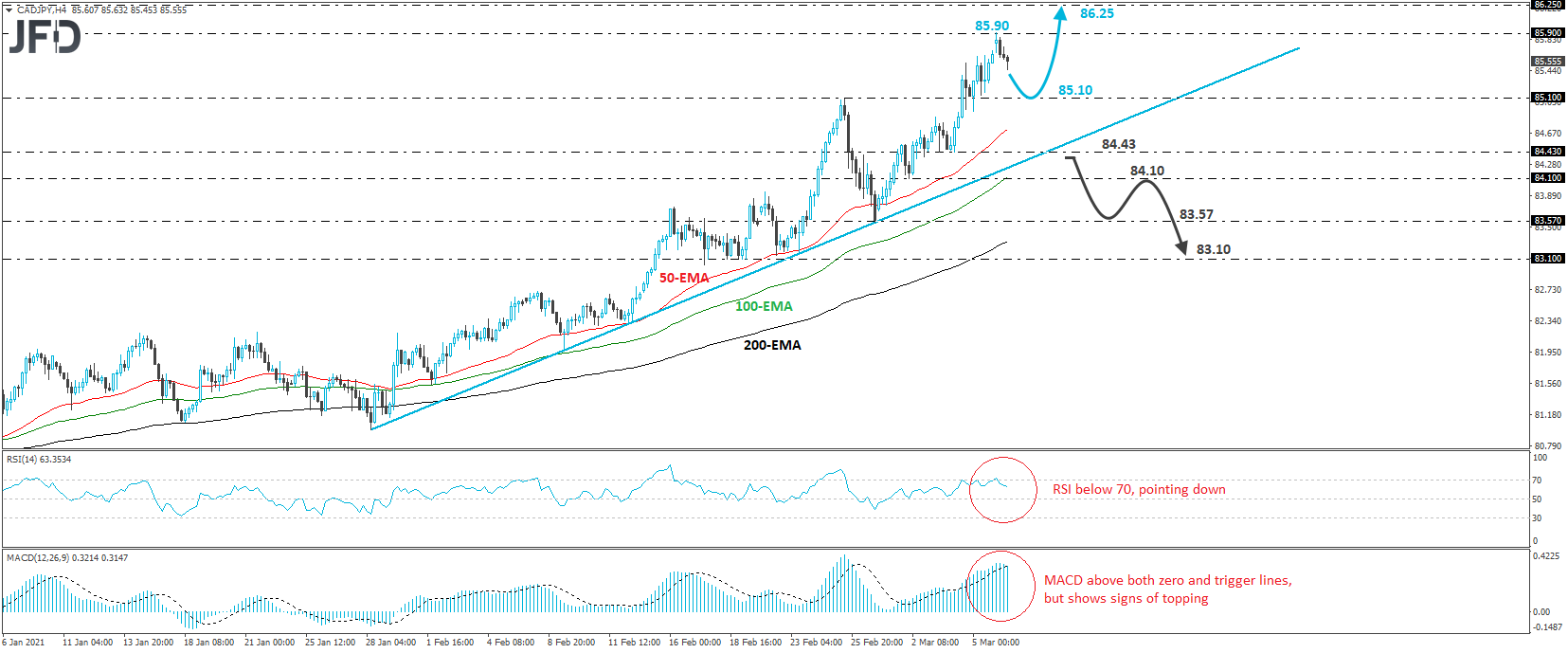

CAD/JPY traded lower today, after hitting resistance near 85.90 during the Asian session. Overall, the pair continues to print higher highs and higher lows above the upside support line drawn from the low of Jan. 28, and thus, we would consider the near-term outlook to be positive.

Today’s slide may continue for a while more, perhaps for a test near the 85.10 barrier, marked by the inside swing high of Feb. 25. However, given that the rate would still be above the aforementioned upside line, we would see decent chances for the bulls to jump back into the action and perhaps aim for another test near 85.90. If they manage to overcome that barrier, a forthcoming higher high would be confirmed and the rate may target the 86.25 hurdle, defined as a resistance by the peak of Dec. 3, 2018.

Taking a look at our short-term oscillators, we see that the RSI hit resistance slightly above 70 and then, it turned down, while the MACD, although above both its zero and trigger lines, shows signs of topping and that it could fall back below its trigger soon. Both indicators detect slowing upside speed, which supports the case for some further retreat before the next leg north.

That said, in order to start examining a bearish reversal, we would like to see a strong dip below last Thursday’s low, at 8443. The pair will already be below the upside support line and the bears may initially aim for last Tuesday’s low of 84.10, the break of which may see scope for declines towards the low of Feb. 26, at 83.57. Another dip, below 83.57, may set the stage for declines towards the 83.10 barrier, marked by the lows of Feb. 18 and 19.