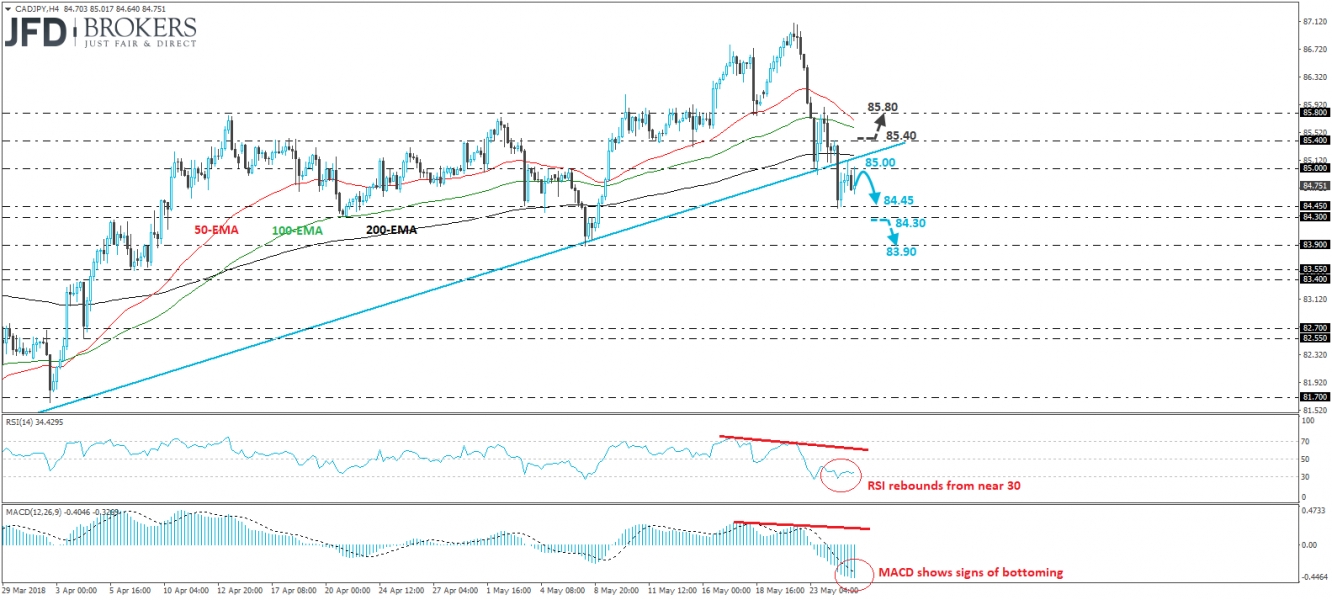

CAD/JPY tumbled yesterday, falling below a short-term uptrend line, drawn from the low of the 19th of March. Then, the pair hit support near 84.45 and rebounded to test that line as a resistance before retreating again. In our view, the break below the uptrend line has confirmed the negative divergence between our momentum studies and the price action, and perhaps turned the short-term picture to negative.

Thus, we would expect the bears to take charge again soon and aim for another test near 84.45. However, we would like to see a clear dip below 84.30 before we get more confident on further declines. Such a break may pave the way towards our next support barrier of 83.90, defined by the low of the 8th of May.

Looking at our oscillators, we see that the RSI has rebounded from near its 30 line, while the MACD, although below both its zero and trigger lines, shows signs of bottoming. These indicators suggest that another corrective bounce may be on the cards before the bears decide to take the reins again, perhaps for another test near the 85.00 zone.

In order to abandon the bearish case, we would like to see a clear break above 85.40. Such a break would bring the pair back above the aforementioned uptrend line and is possible to initially pave the way towards our next resistance barrier of 85.80, slightly below the peak of the 23rd of May, and also marked by the inside swing low of the 18th of the month.