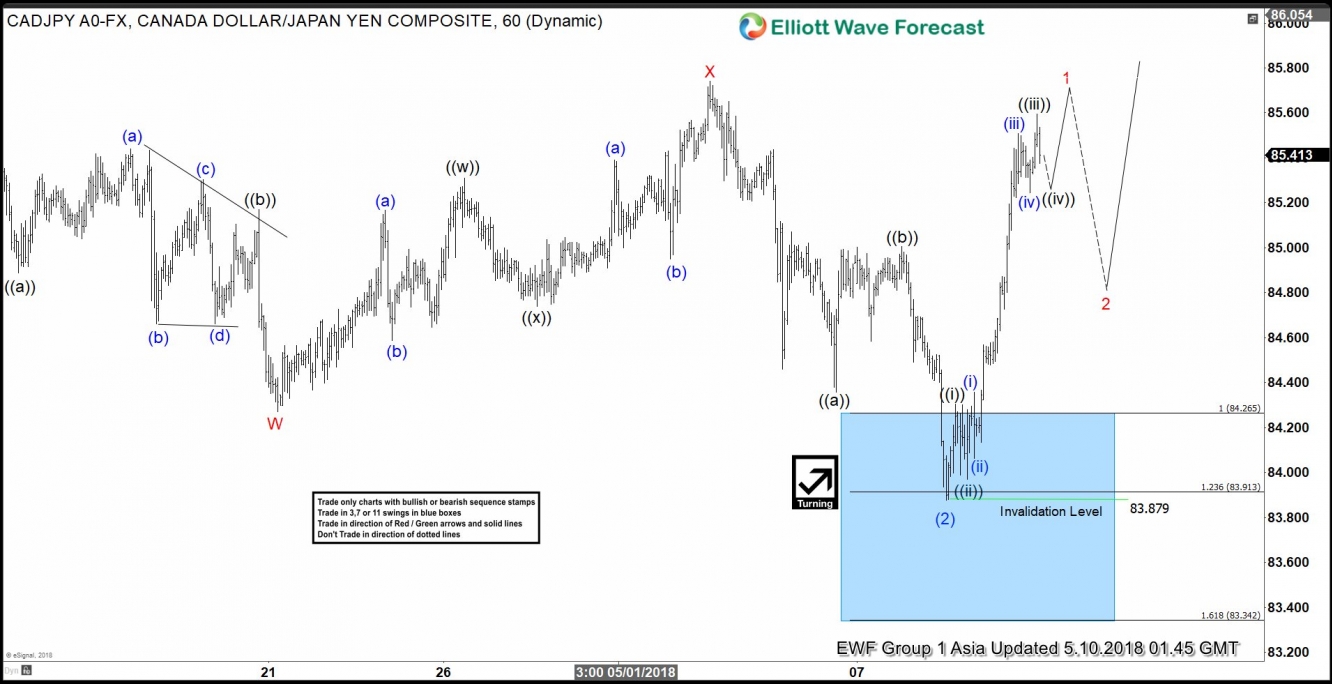

CAD/JPY Short Term Elliott Wave view suggests that the decline from 4/13 peak at 85.76 to 83.87 low ended Intermediate wave (2) as a double three Elliott Wave structure. The internal subdivision of the decline from 85.76 high shows an overlapping structure. This suggests the decline is corrective in nature. We label the correcting as W-X-Y.

Down from 4/13 peak (85.76), Minor wave W unfolded as a Zigzag Elliott wave structure. Minute wave ((a)) of W ended at 84.88, Minute wave ((b)) of W ended at 85.17 high, and Minute wave ((c)) of W ended at 84.27 low. Up from there, Minor wave X bounce also unfolded as a double three Elliott Wave structure. Minute wave ((w)) of X ended at 85.31, Minute wave ((x)) of X ended at 84.74 and Minute wave ((y)) of X ended at 85.74. The internal of Minor wave Y subdivided as a zigzag structure. Minute wave ((a)) of Y ended at 84.36, Minute wave ((b)) of Y ended at 85, and Minute wave ((c)) of Y ended at 83.87 low. The move lower to 83.87 also ended Intermediate wave (2) upon reaching 100%-123.6% Fibonacci extension area of Minor W-X at 83.91 – 84.26.

Above from there, the pair has made a strong rally to the upside in an impulse Elliott Wave structure. Due to the 5 waves impulse, it favors the continuation higher in Intermediate wave (3). However, a break above 4/13 high 85.75 is needed for the final confirmation of the next leg higher. Until then, a double correction lower in intermediate wave (2) still can’t be ruled out. Near-term, as far as dips remain above 83.87 low, expect pair to resume higher. We don’t like selling it.

CADJPY Elliott Wave 1 hour Chart