CAD/JPY pair is in a strong downtrend but it made a deep bullish correction ... It seems like this is part of wave 4 but it remains to be seen whether the bearish correction is completed or not.

We will review different scenarios as the pair can either bounce for an uptrend continuation or expand the bearish correction within wave 4.

This article will discuss the wave perceptive and expected scenarios for the pair during the coming days using wave pattern, support, and resistance and SWAT software.

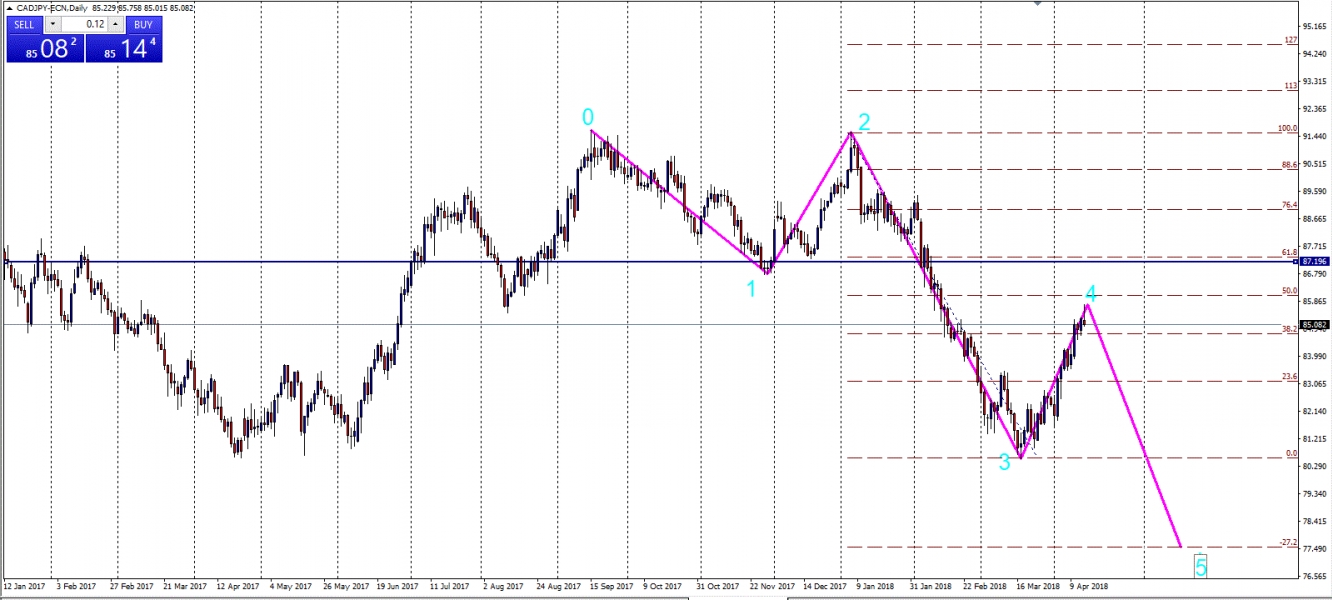

CAD/JPY Wave Patter

As shown in the below chart, the pair is moving in a strong downtrend and has made a correction acctually this correction is part of wave 4... And here are the main conclusions:

- Typical Fib Count of Wave 4 is 38.2 %, 50 % and sometimes can be 61.8% of wave 3.

- The price now at 50 % Fib level, which can be a bouncing spot and also wave 4 can be expanded to 61.8%.

- So the pair now in a critical zone and from my point of view we are looking only for sell opportunities as its matches with the expected wave pattern.

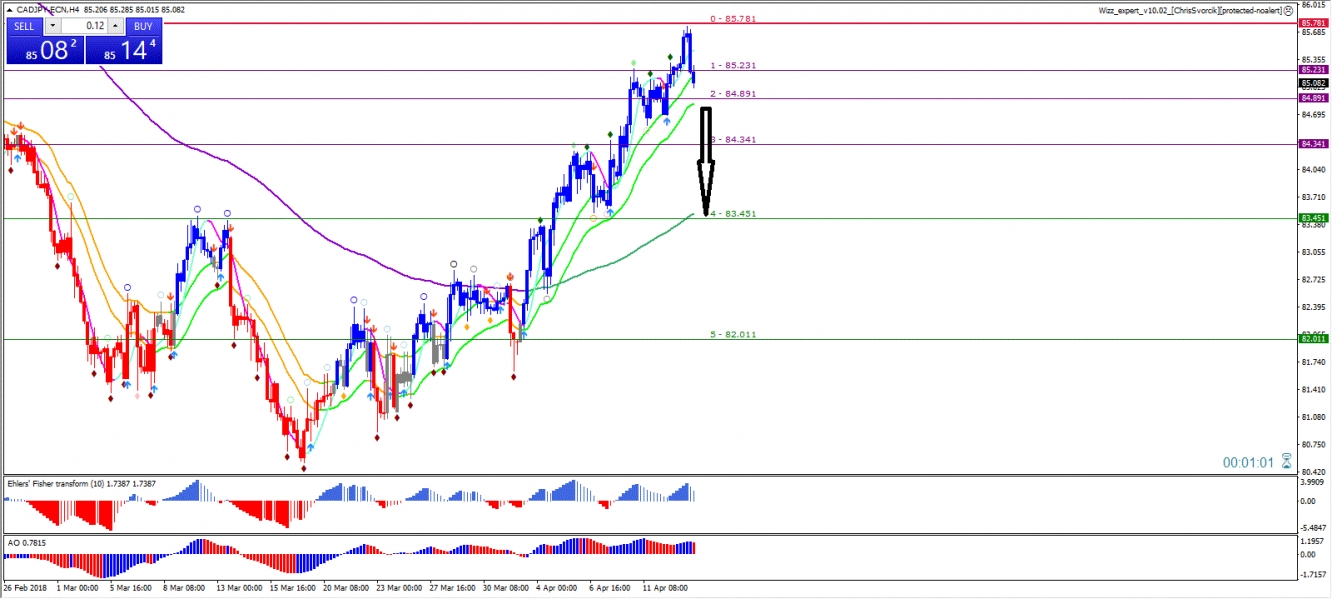

CAD/JPY SWAT CHART

Now its time to use the SWAT 4-hour chart to determine the entry points according to the expected wave patterns... Here are the main conclusions to consider:

- Need the price to break the 21 Ema with a strong bearish candle to test the 144 EMA (first entry and target ).

- Breaking the 144 Ema with a strong candle will be our entry for long setup and our target is the previous low.

- Always advice to trailing stops and protect profits.

So at the moment, I am awaiting confirmation to trade this pair.

Good trading,

Ahmed