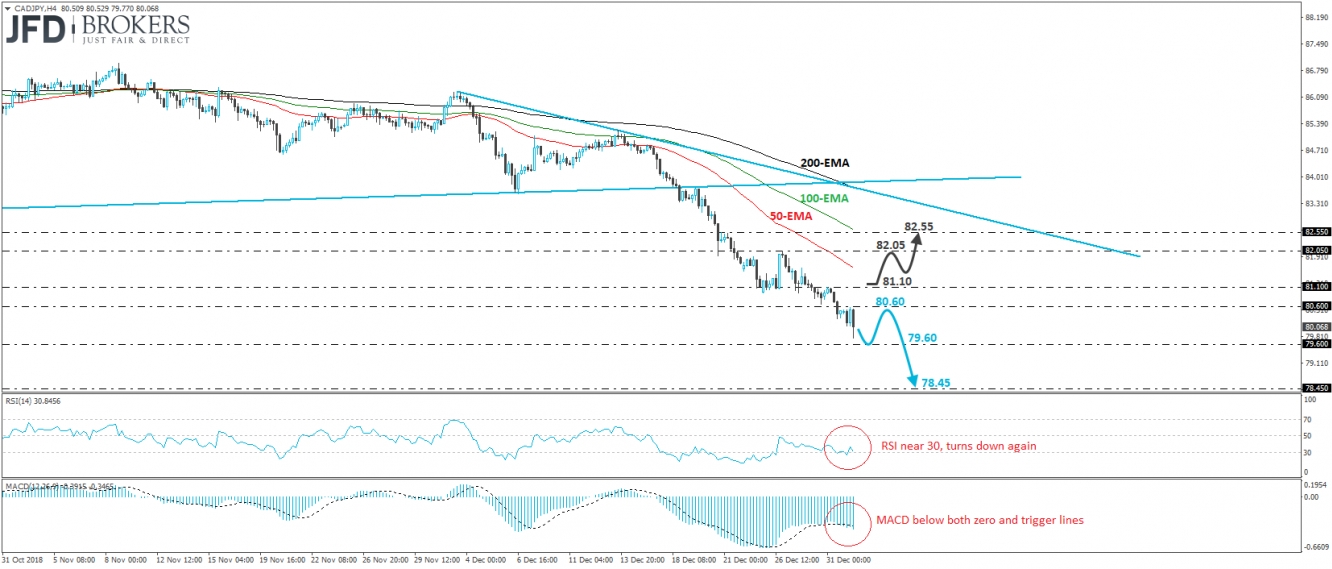

CAD/JPY traded higher during the Asian market morning Wednesday. CAD/JPY hit resistance near the key territory of 80.60, which acted as a strong support back in April and May 2017, as well as in March 2018. Then, the rate slid again to find temporary support slightly above the 79.60 zone. On the December 18th, the pair dipped below the long-term upside support line drawn from the low of the November 9th, 2016, and since then, it has been on a steep downtrend. Having that in mind and given that the pair is trading below all three of our short-term moving averages, we would see a negative near-term outlook.

If the bears are willing to stay in charge, we would expect them to eventually challenge the 79.60 barrier soon, a support marked by the inside swing peak of the November 10th, 2016. A clear break below that hurdle may carry more bearish implications, allowing the sellers to put the 78.45 zone on their radar. That zone is defined by the low of November 11th, 2016.

Taking a look at our short-term oscillators, we see that the RSI turned down again, from slightly above 30. It could fall back below that mark soon. The MACD lies below both its zero and trigger lines, pointing south. These indicators detect strong downside speed and support the case for CAD/JPY to continue its downside trajectory for a while longer.

On the upside, we would like to see a decisive move above Monday’s peak, at around 81.10, before we start examining the case of a decent recovery. Such a break may set the stage for the 82.05 territory, the break of which could open the path for our next resistance, near 82.55. Having said that though, even if this is the case, we would class such a rebound as a corrective phase, given that the rate would still be trading below the aforementioned prior long-term upside support line, as well as below the near-term downside one taken from the high of December 3rd.