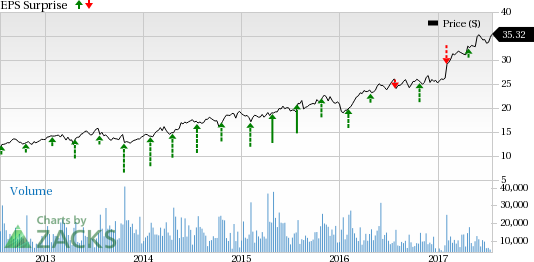

Cadence Design Systems Inc. (NASDAQ:CDNS) is set to report second-quarter 2017 results on Jul 24. Notably, the company has a mixed record of earnings surprises in the trailing four quarters, with an average surprise of 2.82%.

Last quarter, the company posted a positive earnings surprise of 19.05%. Adjusted earnings (excluding stock-based compensation) increased 14.3% from the year-ago quarter to 32 cents per share. It also came in line with the top end of management’s guided range of 30–32 cents.

Revenues of almost $477 million increased 6.5% year over year and easily surpassed the Zacks Consensus Estimate of $473 million and was within management’s guided range of $470–$480 million.

Cadence’s second-quarter guidance was unimpressive. Management noted increased variability in quarter to quarter results due to growing portion of hardware and IP in the business mix. Moreover, weak U.S. dollar was also expected to hurt profitability as almost 30% of the company’s costs are in foreign currencies.

Let’s see how things are shaping up prior to this announcement.

Factors at Play

We note that Cadence has outperformed the Zacks categorized Computer Software industry on a year-to-date basis. While the stock returned 40.1%, the industry gained 23.4%.

The outperformance can be attributed to improving penetration of its newly launched products like Xcelium and Protium S1 as well as strong adoption of Palladium Z1 and Pegasus Verification solution. During the first quarter, the company won a number of customers including Xilinx (NASDAQ:XLNX), Mellanox and Texas Instruments (NASDAQ:TXN) .

We note that Cadence’s digital, signoff and custom/analog tools are now enabled on Samsung (KS:005930) Electronics’ 7LPP and 8LPP process technologies. Moreover, the company has received certification for its 28nm FDS reference flow by Samsung. We believe that the recognition will aid Cadence to win new customers.

Moreover, the company’s expanding product portfolio boost its competitive position. Management noted that as part of the System Design Enablement (SDE) strategy, Cadence continues to pursue opportunities in higher growth areas like automotive, cloud infrastructure, machine learning, and aerospace & defense, which will eventually drive overall results.

Earnings Whispers

Our proven model does not conclusively show that Cadence will beat earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: Both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 21 cents. Hence, the difference is 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Cadence carries a Zacks Rank #3, which when combined with a 0.00% ESP makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

You can consider the following stocks with a positive Earnings ESP and a favorable Zacks Rank:

Cypress Semiconductor (NASDAQ:CY) with an Earnings ESP of +11.11% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Lam Research (NASDAQ:LRCX) with an Earnings ESP of +1.32% and a Zacks Rank #1.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Cypress Semiconductor Corporation (CY): Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS): Free Stock Analysis Report

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Original post

Zacks Investment Research