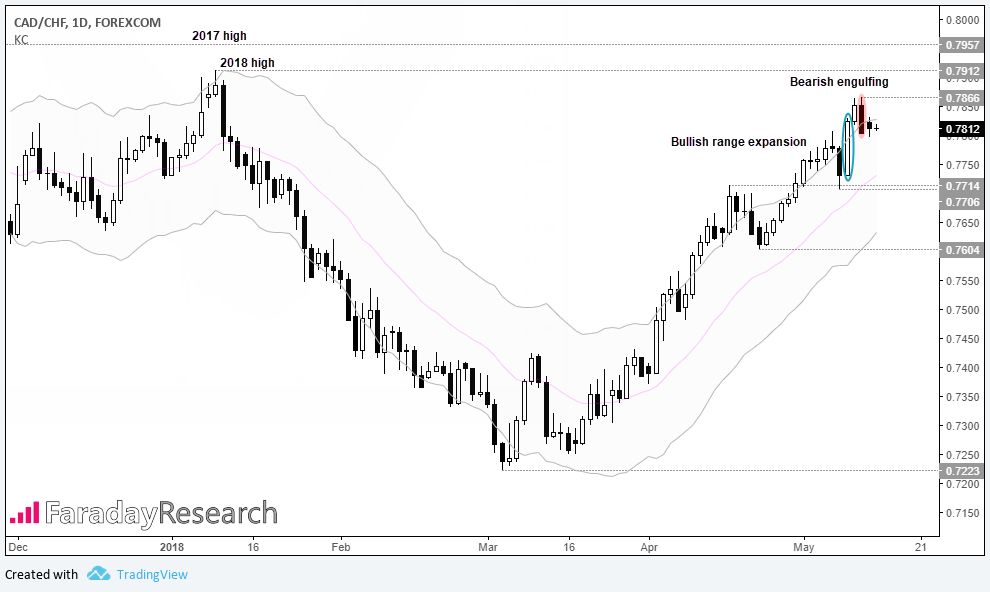

Despite Friday’s wobble, the trend remains predominantly bullish and it could make a run for the 2017 and 2018 highs. But currently amid its second-best weekly run on record, it’s possible these milestone highs could break its streak.

Since the 0.7223 low, CAD/CHF has appreciated nearly 9% in less than three months. The bullish trend structure has provided timely and shallow retracements while bobbing along the upper Keltner band, as if on some sort of jolly. With the 2018 and 2017 highs within such proximity and bullish momentum propping it up, it would almost seem rude for CAD/CHF not to given them a visit.

Still, no trade is without its risk and Friday’s bearish engulfing candle warns of a potential correction. That said, Wednesday’s bullish range expansion candle (in line with the trend) appears far more impressive and, as it was part of a prominent swing low it provides us with greater confidence of the underlying trend.

But if we are to see a decisive break of Friday’s low a deeper correction could be underway, so we’d prefer to wait for volatility to subside before reconsidering a long position. The trend remains intact whilst above 0.7706 and, in an ideal world, any correction from here will not get anywhere near it. A low volatility correction could also be beneficial as it improves the potential reward to risk ratio (assuming a run toward 0.7912 and 0.7957).

On a closing basis, its currently amid its 9th consecutive bullish week, it’s best winning streak since June 2007 and its second-best on record. Whilst such a statistic provides little help in timing the end of its streak, we can at least mark it as an outlier which suggests the odds of a reversal theoretically go higher each week. And from a technical perspective, there’s also the wide bodied Doji to contend with which warns of potential weakness to the otherwise impressive run. Still, the trend points higher and we aim to stick with it, but as we’re approaching milestone highs, it’s something to consider if we hit them.