Weekly chart:

In the week of the 4th November – almost 9 years ago – CAD/CHF reached its last high at 1,304 CHF. Since that fateful week, this pair has only known one direction, namely southwards. Uninterrupted by the occasional larger or smaller correction, it went constantly and symmetrically downhill. The current small trend is also continuing to face downwards, but is, however, in a thoroughly mature stage. The last red box runs between 0.7806 CHF and 0.86578 CHF. The last attempt at a trend continuation failed at the last low, meaning that the current upwards-facing correction can definitely still continue on for quite some time. Nonetheless, it is still a downwards trend.

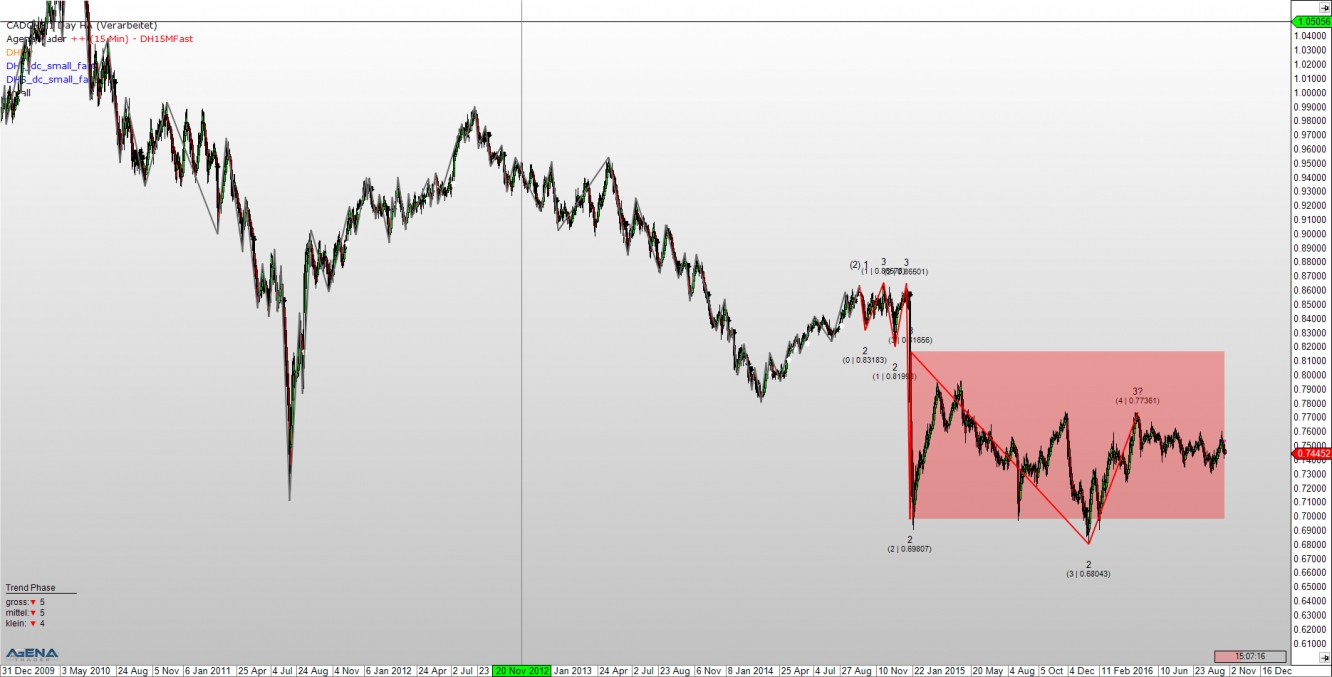

Daily chart:

In the daily chart, we can also very clearly see the active downtrend with a correction zone between 0.69807 CHF and 0.81656 CHF. At the moment, the main event is taking place right in the middle of this red box, and this should continue on as long as the closing price does not break through the red box. The short-term probabilities according to the DowHow approach, therefore, remain on the lower side.

Hourly chart:

Yesterday the DowHow signals were already indicating a continuation of the downward trend. Anyone who reacted to that is – at least at the moment – in the plus. Since we are dealing with a young trend here, the likelihood is very large – but not certain – that we will see further falling prices here. How long it takes is up to the market. And as always, it is simply a game of probabilities.

IMPORTANT NOTE: Exchange transactions are associated with significant risks. Those who trade on the financial and commodity markets must familiarize themselves with these risks. Possible analyses, techniques and methods presented here are not an invitation to trade on the financial and commodity markets. They serve only for illustration, further education, and information purposes, and do not constitute investment advice or personal recommendations in any way. They are intended only to facilitate the customer’s investment decision, and do not replace the advice of an investor or specific investment advice. The customer trades completely at his or her own risk.