Canadian data could sink CAD

Crude prices continue to recover from the disappointment over the absence of a Russian/Saudi Arabian production deal. WTI front month further rebounded off $43.00, climbing to 4.7% to $47.62 on reports that US crude oil inventories have suffered their largest drawdown since 1999. Volatility in energy prices has dominated the movement of commodity linked currencies such as CAD and NOK.

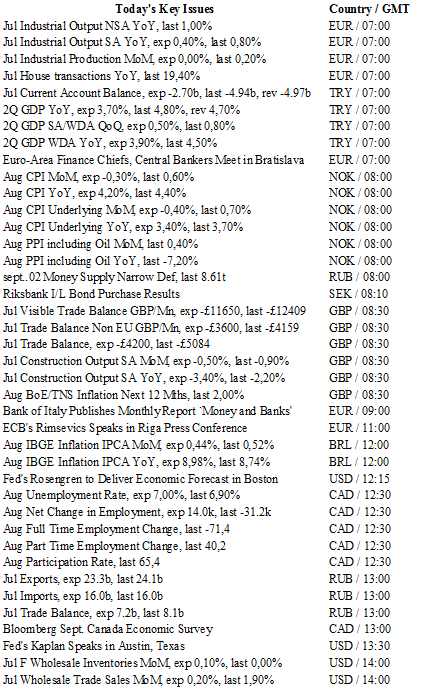

However, on Friday the focus of the CAD shifted back to economic data. Canada released key labor market data this afternoon. The unemployment rate in August should show a rise to 7.0% from 6.9%, while job growth should show an increase by 14k after a collapse of -31.2k in the prior read.

Overall, the soft reads highlights the steady slowdown evident in the deterioration of recent data. Canadian GDP rose by 0.6% m/m in June, however on a quarterly basis dropped by -1.6% in 2Q against -1.5% expected. The focus of CAD traders has been on development in crude prices and dynamic expectations for Fed monetary policy. Yet, with the Bank of Canada signalling its concerns over the rising downside risk to growth and inflation, weak data will only punctuate fears.

Interestingly, the BoC has indicated that global growth was slower than expected including a weaker US economy, potentially reinforcing the view that the US will further cool and delay rate hikes in 2016. We remain constructive on USD/CAD and would target a bullish extension to 1.3005.

Policymakers to speak before Fed meeting

Now that the ECB meeting is over, all eyes are on the next Fed meeting on 21st of September. For the time being, markets are pricing in a small probability (28%) of a Fed rate hike. There is too little time left for policymakers to send hawkish signals that would allow markets to fully reprice a rate hike.

There will be many much-anticipated speeches over the week such as those from Governor Lael Brainard, New York Fed President Dudley or Vice Chair Fischer. In our view, these speeches will, as usual, only provide mixed signals. We do believe that a rate hike will happen - at least not before year-end.

Currency-wise, the demand for the dollar is going to increase as long as the Fed maintains its stance that a rate hike is possible in the near-term. The Fed has been sending hawkish signals for a while, with no real action being taken. Last December’s rate hike was only a move for the credibility. Our research tends to confirm that the state of the US economy is completely overestimated and will stick with this view.

Recent data such as the ISM non-manufacturing and manufacturing report have sharply declined. The manufacturing sector is in contraction, while the non-manufacturing industry should soon contract according to recent data.

When looking at the unemployment rate and wage growth, it is clear that there is something wrong. Unemployment and wages growth cannot be so low at the same time. Full employment should push wage growth higher, which is not the case and is absolutely conflicting. The fact remains that the unemployment rate in the US is largely underestimated.

At the same time, US corporate profits are still subdued or negative. Equities are on the rise, but this is only because of the era of free money.

USD/JPY - Ready For Another Leg Lower

The Risk Today

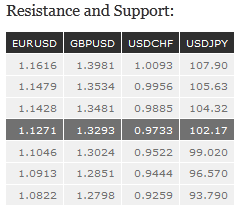

EUR/USD is pushing higher after the recent increase from hourly support given at 1.1123 (31/08/2016 low). It seems that buying pressures are important around this level. Key resistance is given at 1.1352 (23/08/2016 high) then 1.1428 (23/06/2016 high). Strong support can be found at 1.1046 (05/08/2016 low). In the longer term, the technical structure favours a very long-term bearish bias as long as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD is still consolidating lower after breaking resistance implied by the upper bound of the uptrend channel. Key resistance is given at 1.3534 (29/06/2016 high). Last significant low can be found at 1.2866 (15/08/2016 low). Closest hourly support is given at 1.3253 (02/09/2016 low). Expected to show further upside pressures. The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

USD/JPY is edging lower despite ongoing short-term bullish retracement. Strong resistance can be found at 104.32 (02/09/2016 high). Hourly support is given at 101.21 (07/09/2016 low). A key support lies at 99.02 (24/06/2016 low). We favour a further bearish bias. We favour a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF's medium term momentum is clearly mixed. There are periods of strong and low volatility and the pair seems without direction. Support at 0.9739 (02/09/2016 low) has been broken. Hourly resistance is given at 0.9885 (01/09/2016 high). Next resistance lies at 0.9956 (30/05/2016 high). Expected to further weaken. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found at 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.