CAD/JPY Weekly Chart" title="CAD/JPY Weekly Chart" height="1021" width="1730">

CAD/JPY Weekly Chart" title="CAD/JPY Weekly Chart" height="1021" width="1730">

Whilst the relationship between the US dollar and oil appears to have broken down, one relationship that continues to remain in place is that between oil and the CAD/JPY pair, which generally correlates in a positive way. As oil prices move lower then so does the pair, and vice versa, and whilst it is far from perfect, nevertheless, it does provide an alternative view of oil in a related market. The reason for the correlation is relatively simple.

On the one hand we have Canada, a major exporter of oil, and a country which ranks third in the world in terms of oil reserves, whilst on the other is Japan, a major importer, with few natural resources of its own. The Canadian dollar is always more responsive to changes in the price of oil and indeed is the currency which responds more directly to weekly oil inventories, despite the fact that the data is released in the US.

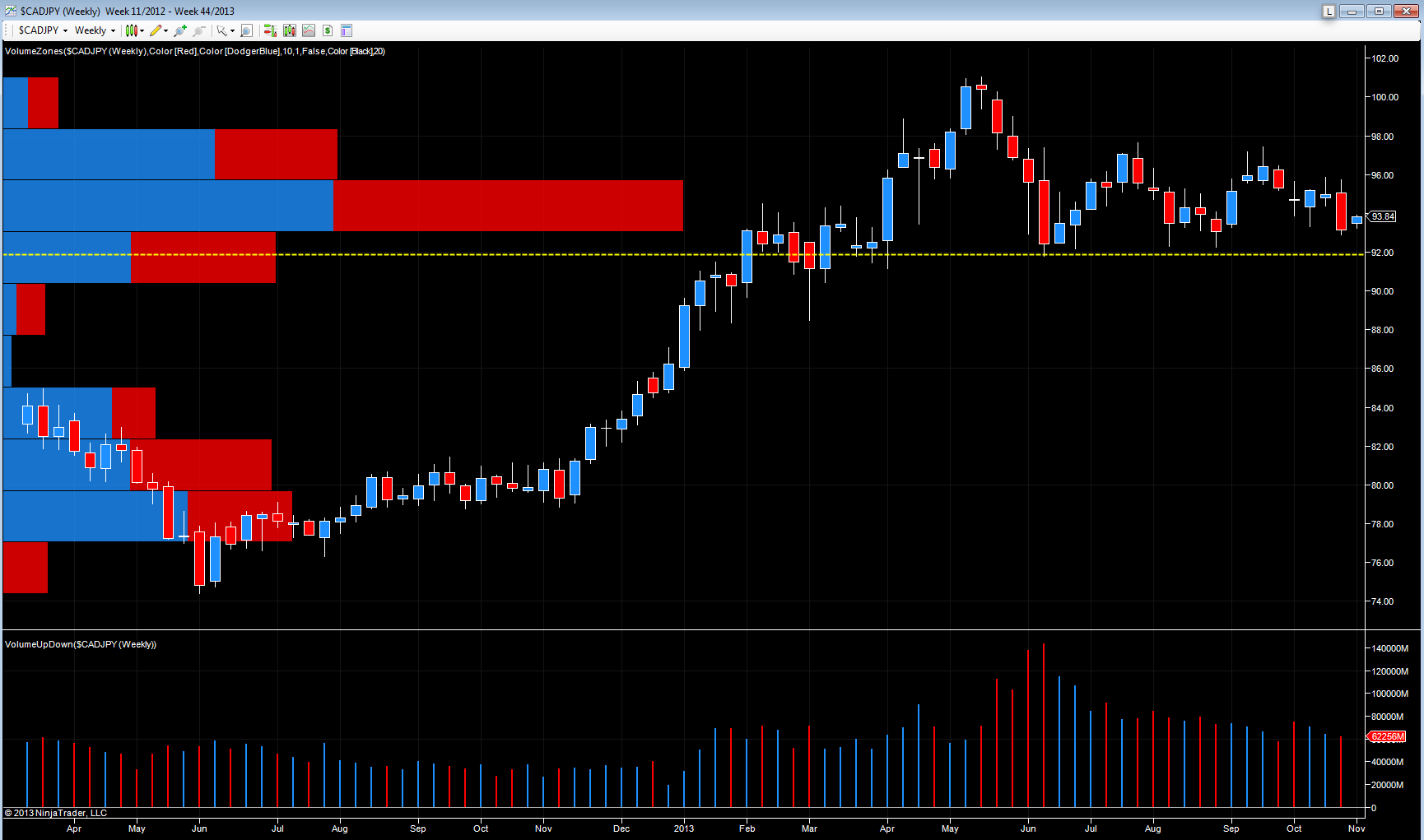

From a technical perspective, the weekly chart is now painting an interesting picture, with the strong and well developed platform of support in the 92.00 region now clearly evident. This is a key level, and one which has provided support in the past, with the pair bouncing higher in both September and July to test the 98 region on the chart. With little in the way of any potential support below this level, any breach of the 92.00 price point, could see a sustained move lower for the pair.

Volumes throughout the summer have remained average and above, but there is little evidence to suggest any sustained buying or selling, but simply a further phase of price congestion between 92 and 98. Any breakout, when it comes, will need to be validated with rising volume, but if the 92.0 support level holds, then we can expect to see a bounce higher once again, with a consequent recovery in oil prices. As always, volume holds the key, and with the depth of price congestion overhead as shown on the volume at price histogram, any move beyond 96 will need to be associated with rising volumes if it is to be sustained in the longer term.