USD/CAD

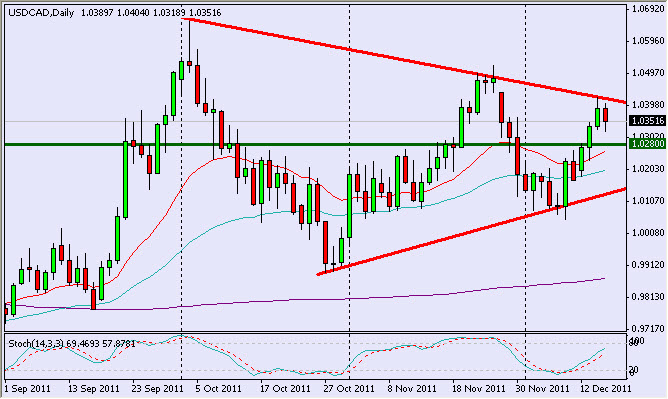

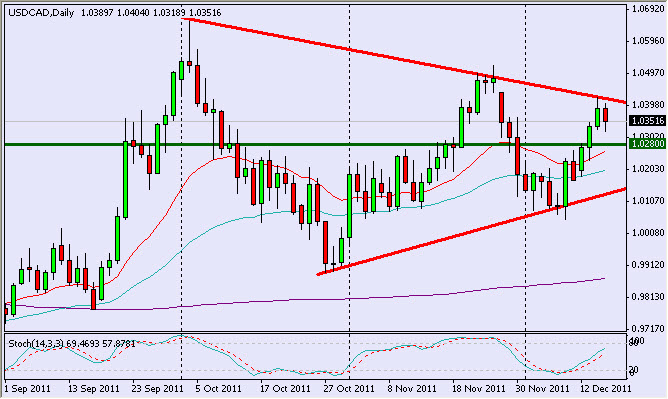

Like many other currencies these days, the momentum of the USD influences the direction of the Canadian dollar. Therefore, if the Wall Street corrects some of the recent declines, the USD can lose its momentum and the CAD will correct against it.

The pair reached the resistance of the downtrend line that shows a "lower-highs" pattern in the pair's daily chart. However, at the same time, there is a "higher-lows" pattern in this chart, and this means that the buyers and the sellers are about to meet, unless the USD breaks through the resistance and continues to 1.05-1.06. However, if the CAD corrects, then the pair might slide to the support of the uptrend line at 1.015, and the meeting point between the buyers and the sellers might occur around 1.025-1.03.

EUR/CAD

The EUR is extremely weak against most of the currencies, and it broke important supports against the USD. The pair EUR/USD is obviously oversold and it might correct up, but the general trend is unquestionably down and it would be gamble to try taking the Euro up against the USD.

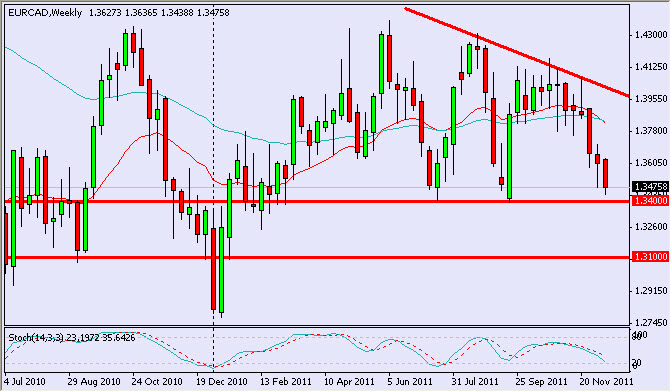

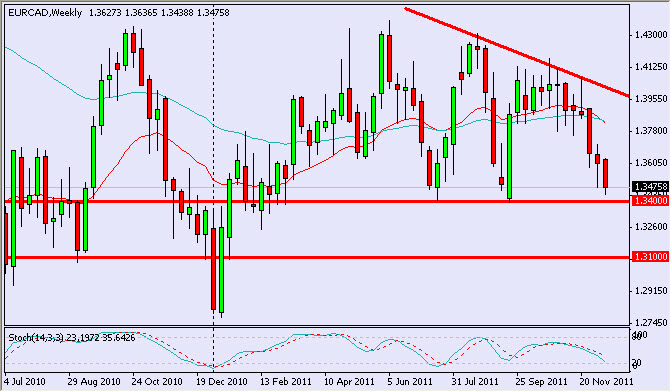

However, the EUR might sharply correct against other currencies, which are losing points these days, such as the CAD. On both daily & weekly charts of the pair EUR/CAD, we can see a stable support at 1.34, but the highs are getting lower. This creates a descending triangle, which indicates for the pressure of the sellers. If the pair breaks under the support of 1.34, it might slide to the next support at 1.31. However, the strength of this support increases the possibility for an up-correction in the sort-term, in which the pair might rise to 1.37.

Like many other currencies these days, the momentum of the USD influences the direction of the Canadian dollar. Therefore, if the Wall Street corrects some of the recent declines, the USD can lose its momentum and the CAD will correct against it.

The pair reached the resistance of the downtrend line that shows a "lower-highs" pattern in the pair's daily chart. However, at the same time, there is a "higher-lows" pattern in this chart, and this means that the buyers and the sellers are about to meet, unless the USD breaks through the resistance and continues to 1.05-1.06. However, if the CAD corrects, then the pair might slide to the support of the uptrend line at 1.015, and the meeting point between the buyers and the sellers might occur around 1.025-1.03.

EUR/CAD

The EUR is extremely weak against most of the currencies, and it broke important supports against the USD. The pair EUR/USD is obviously oversold and it might correct up, but the general trend is unquestionably down and it would be gamble to try taking the Euro up against the USD.

However, the EUR might sharply correct against other currencies, which are losing points these days, such as the CAD. On both daily & weekly charts of the pair EUR/CAD, we can see a stable support at 1.34, but the highs are getting lower. This creates a descending triangle, which indicates for the pressure of the sellers. If the pair breaks under the support of 1.34, it might slide to the next support at 1.31. However, the strength of this support increases the possibility for an up-correction in the sort-term, in which the pair might rise to 1.37.