Technical Sentiment: Bullish

Key Takeaways

- CHF holds on to its bearish bias alongside the troubled Euro currency;

- CHF CPI and Retails sales are due on Tuesday, both with bullish expectations;

- The Canadian Dollar received a small hit on Friday, following a disappointing -0.6B Trade Balance report;

- Canadian Ivey PMI due to be released soon after 10/6 U.S. trading session begins;

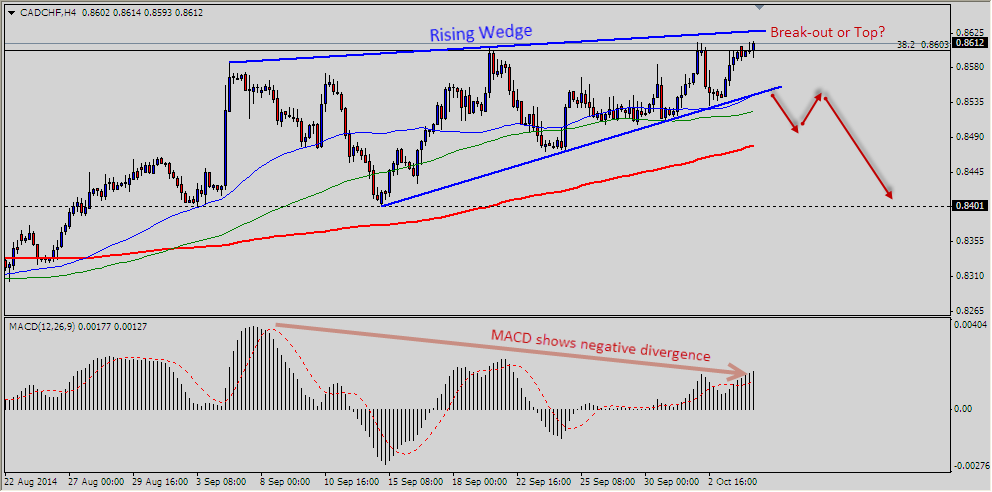

- CAD/CHF is prone to a technical correction if price will break the rising wedge support.

CAD/CHF remains at elevated levels, approaching the tip of a rising wedge as the uptrend shows signs of slowing down amid overbought conditions.

Technical Analysis

CAD/CHF opened above 0.8600 at the start of the trading week, hinting of an overall bullish tendency. Price action remained largely muted throughout the Asian and European trading sessions, while Canadian Dollar buyers are patiently waiting a much needed boost from Ivey PMI.

Throughout September and most notably in the last two weeks, rallies in CAD/CHF have pretty much failed to make a big impression. Several swing highs clustered around 0.8600, tightening trading ranges as a rising wedge took shape. The pair is currently trading around 0.8612, probing 2nd October high. Based on the wedge pattern, today’s resistance is located at approximately 0.8627. It remains to be seen if buyers will be able to rally past this level during U.S. trading hours since it’s the only way to revive the uptrend and open targets toward 0.8843 (cluster formed between a large pivot zone and 50% Fibonacci retracement from 0.99 down to 0.78).

The overall long-term trend remains bullish, as shown by a strong configuration of Higher Lows and Higher Highs. That being said, multiple technical bearish signals are starting to emerge on all timeframes, suggesting a top and a deeper correction might be just around the corner. Stochastic is in overbought territory on 4H, Daily and Weekly. Additionally, 4H MACD is showing an increasing negative divergence with previous tops. The rising wedge chart pattern is actually a bearish reversal pattern. If price rejects off ~0.8627 and continues with a sell-off below 0.8550, CAD/CHF will immediately turn bearish. Initial support targets for this scenario are located around 0.8480, followed by 0.8400.