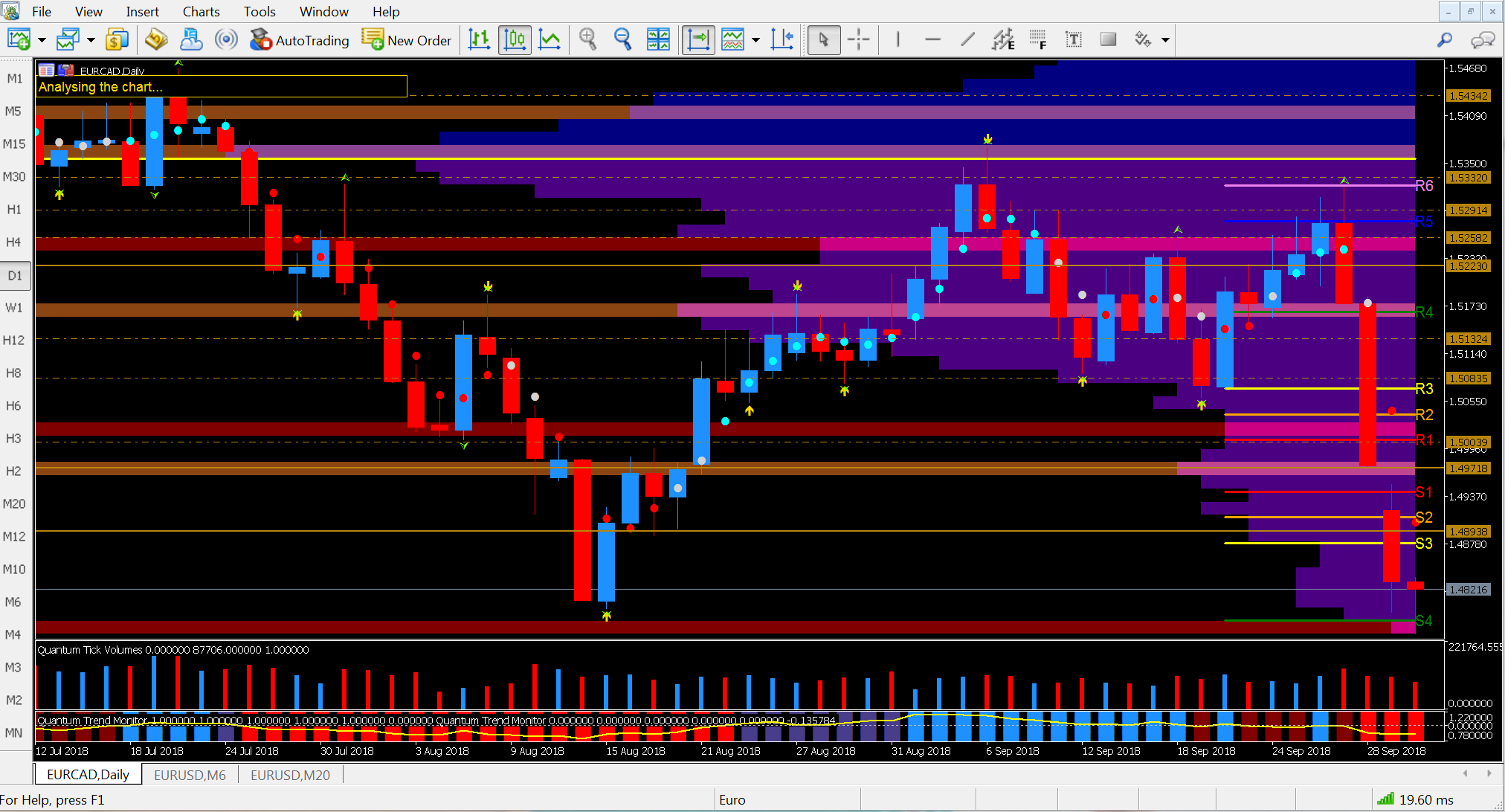

It’s been a very lively start to the new trading week, month and final quarter. On Monday we had all the hoopla over the US/Canadian trade deal, which sent the CAD soaring and at the same time we also had the Italian government threatening to break EU rules over its budget plans, which sent the euro into free-fall. So it was no surprise to see these events reflected in the EUR/CAD cross pair, which posted a strong gap down late on Sunday with further falls on Monday. However, the main move lower for the pair began as far back as last Thursday when we had a bearish engulfing candle followed by a sustained move lower on Friday on a better than expected GDP release, with the political news then giving the move some additional momentum after the weekend. And with CAD, we also always have to factor in the price of oil, which has been rising strongly in recent sessions.

From a technical perspective, the key level for EUR/CAD is 1.4784, which is where our S4 Camarilla level is currently sitting and has also provided the springboard for some buying. Tuesday's candle looks to be closing as a hammer but we need to wait until the close to see if the current buying is maintained. A failure at the S4, with the price breaking and holding below will open the way for a test of the reasonably strong support at 1.4734.

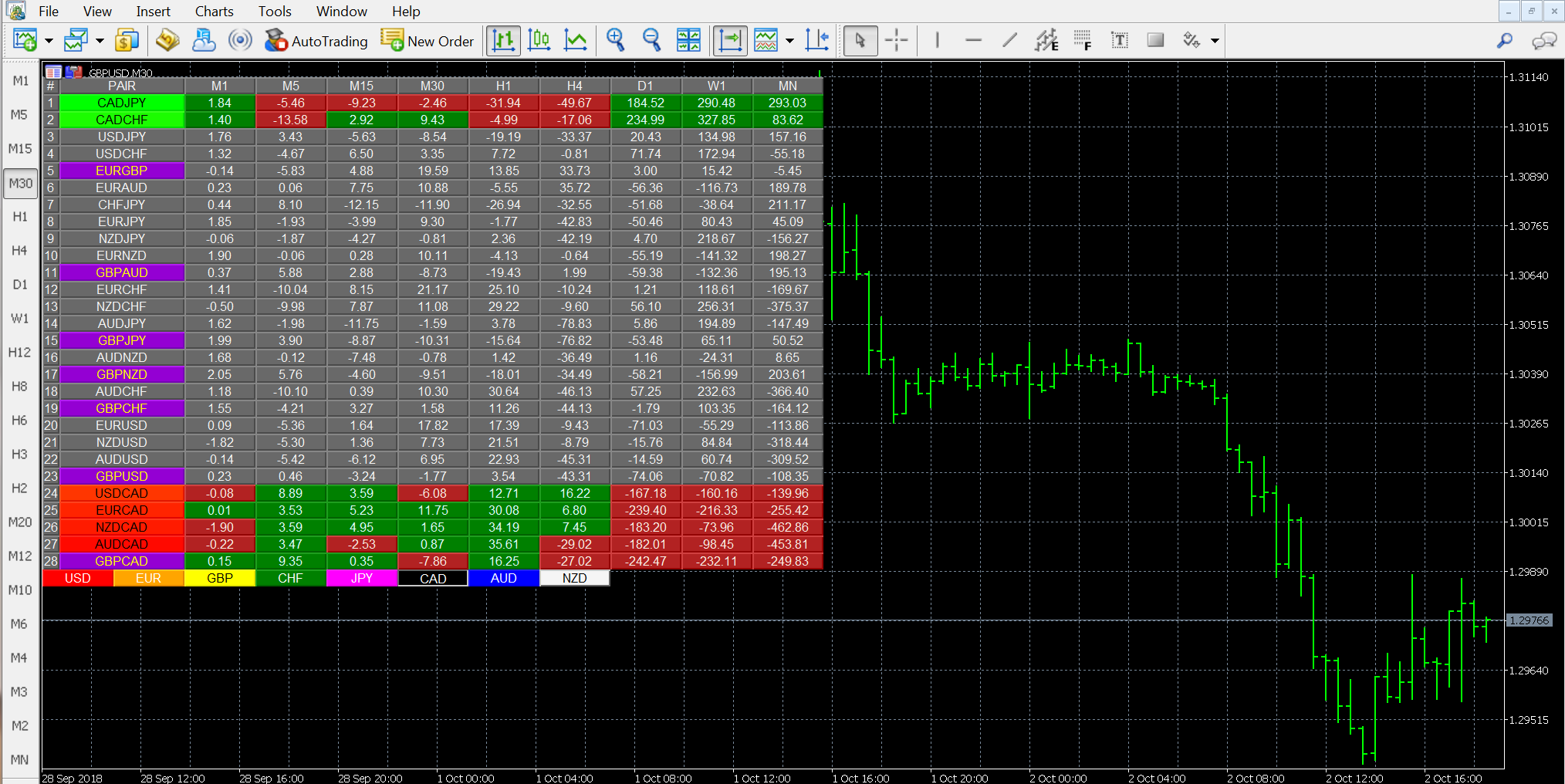

From the perspective of our the heat map, EUR/CAD has tumbled almost to the bottom where it may languish for a time, but at some point we know it will reverse.