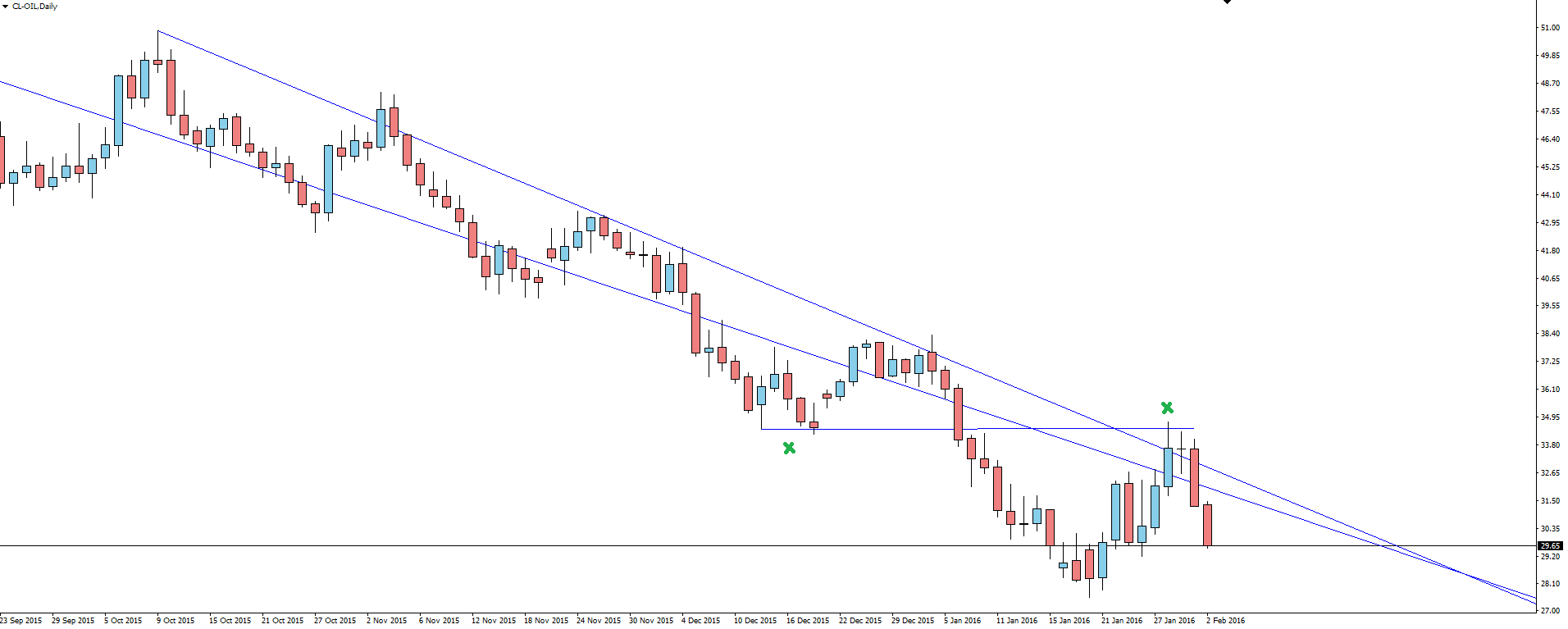

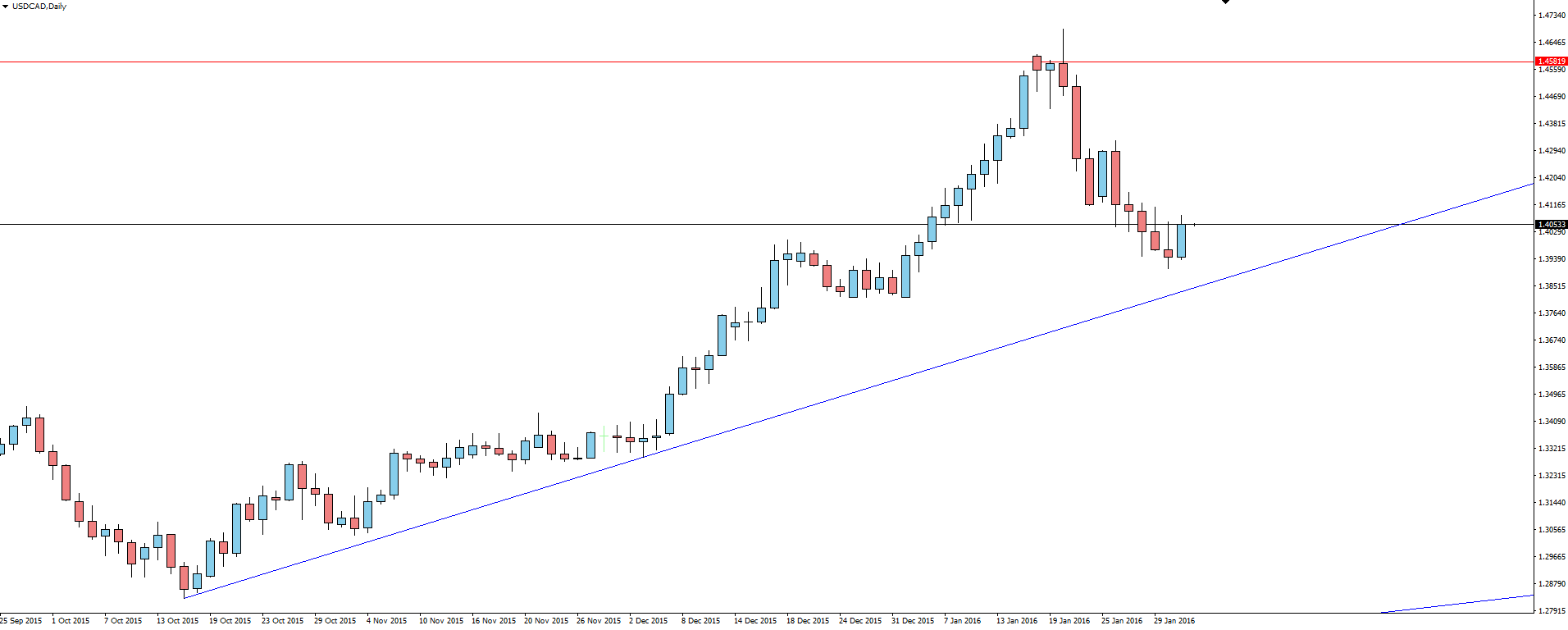

CAD’s Slow Reaction to Oil Weakness:

Something slightly different this morning, with a look at a comparison between oil and USD/CAD.

The last two oil daily candles have been big, red, bearish candles. Price once again couldn’t crack long term trend line resistance which just happened to line up with a short term swing low that was previous support and now acting as resistance, meaning that the positive oil headlines talking about buying have been yet more hot air.

What caught my attention was that over these last two days, the normally highly correlated Canadian dollar hasn’t exactly followed suit.

Price didn’t quite reach trend line support, but did come into the previous area of consolidation just before it and buyers entered the market.

How much more this correlated move has to run is the question. You have your major levels.

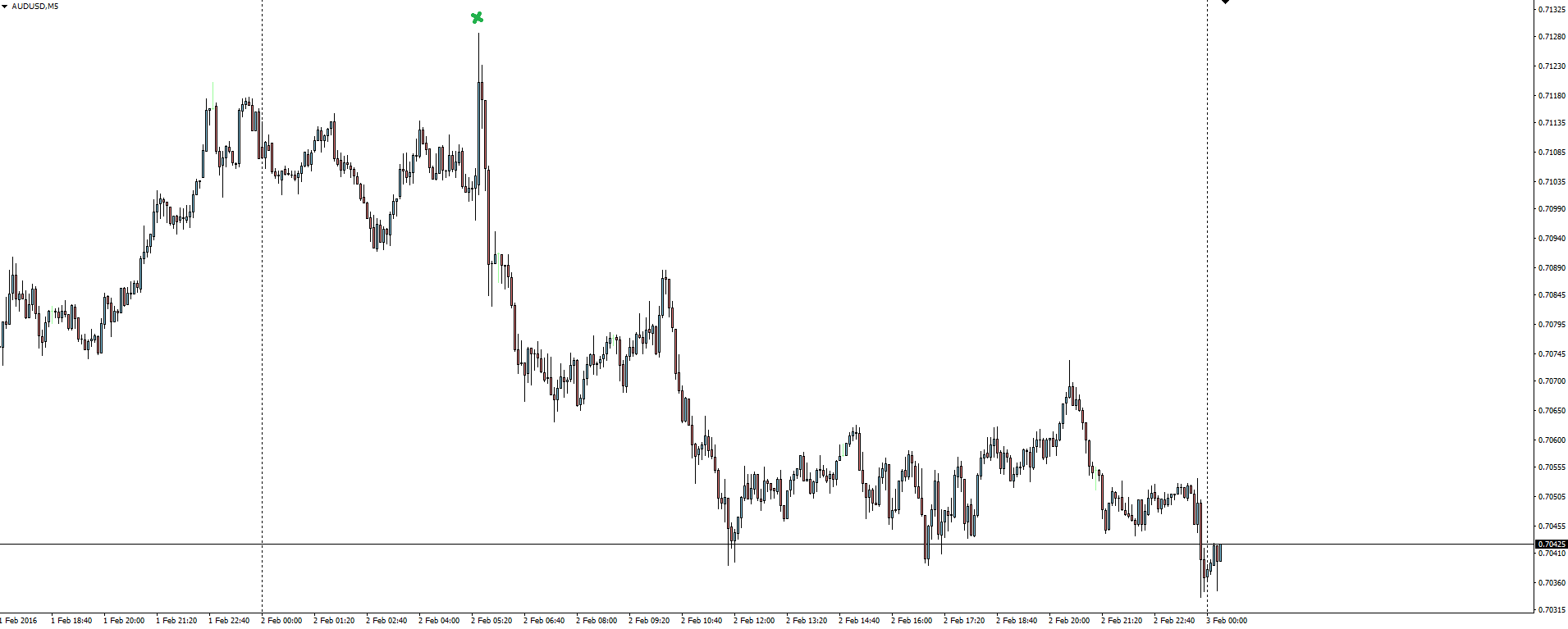

Chart of the Day:

With the RBA keeping interest rates on hold at 2.00% for another month yesterday, Governor Glenn Stevens’ accompanying statement was dovish enough to warn off the traders waiting to pounce on any perceived weakness in the RBA’s guidance.

“At today’s meeting, the Board judged that there were reasonable prospects for continued growth in the economy, with inflation close to target. The Board therefore decided that the current setting of monetary policy remained appropriate.”

“Over the period ahead, new information should allow the Board to judge whether the recent improvement in labour market conditions is continuing and whether the recent financial turbulence portends weaker global and domestic demand. Continued low inflation may provide scope for easier policy, should that be appropriate to lend support to demand.”

These were the all important last two paragraphs from the statement. Read over them, then look at where the AUD/USD market sat beforehand and where it headed throughout yesterday’s entire session.

Try to take something about market positioning and perceptions out of your study. As a trader, it isn’t about what happened and why, it’s about what markets thought would happen and how close they were.

On the Calendar Wednesday:

NZD RBNZ Gov Wheeler Speaks

AUD Building Approvals m/m

AUD Trade Balance

JPY BOJ Gov Kuroda Speaks

GBP Services PMI

USD ADP Non-Farm Employment Change

USD ISM Non-Manufacturing PMI

USD Crude Oil Inventories

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Australian Forex broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.