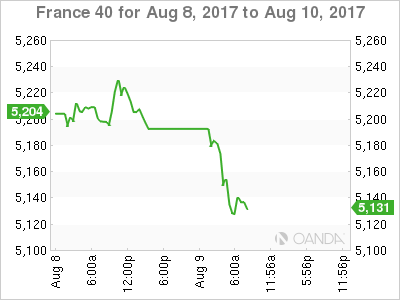

The CAC is down sharply in the Wednesday session. Currently, the index is at 5,134.50, down 1.62% on the day. On the release front, there are no Eurozone or French events on the calendar. On Thursday, France releases Industrial Production, with the markets braced for a decline of 0.6%.

Geo-political tensions are again weighing on European stock markets, as the war of words between North Korea and Washington has escalated. Pyongyang has reacted furiously to new sanctions imposed by Washington, and has threatened to attack Guam, which is a major US military base.

President Donald Trump is taking a tough line on North Korea, and has promised that any aggression from North Korea will be met with “fire and fury.” With Trump and North Korean President Kim Jong-un on a possible collision course, risk appetite has decreased, as nervous investors have snapped up gold, a traditional safe-haven asset. There was more bad news for French stock markets on Wednesday, as a car-ramming in Paris injured several soldiers, with the incident being treated as a possible terrorist attack.

With the eurozone economy looking solid in 2017, the markets are keeping a close eye on the ECB, particularly its quantitative easing program (QE) a key part of the bank’s ultra-accommodative monetary policy. The ECB will hold its next policy meeting on September 7, and there is a strong likelihood that policymakers will make an announcement in regard to QE, which is scheduled to terminate in December. However, the ECB has taken pains to remind the markets that this December is not fixed in stone, stating repeatedly that QE could be extended “if necessary”.

The problem facing policymakers is that despite a stronger labor market and improved growth, inflation levels remain stubbornly low, as the ECB’s inflation target of 2% has proven overly optimistic. The ECB is well aware that any talk of tighter policy could send the euro higher, as was the case in June, when investors snapped up euros after Mario Draghi made some hawkish comments at a meeting of central bankers. As far as interest rate moves, the ECB is unlikely to raise rates until its tapering process is well under way, meaning we’re unlikely to see any rate moves before the second half of 2018.

Economic Calendar

Wednesday (August 9)

- There are no French or Eurozone events

Thursday (August 10)

- 2:45 French Industrial Production. Estimate -0.6%

*All release times are EDT

*Key events are in bold

CAC, Wednesday, August 9 at 7:45 EDT

Open: 5178.30 High: 5123.50 Low: 5185.50 Close: 5134.50