Cabral (CBS:ASX) has pegged an area of 931km2, in close proximity to its existing landholding near the town of Brumado in Bahia, Brazil, containing ground prospective for high-grade DSO hematite. Initial surface samples indicate hematite iron ore mineralisation grades of >65% Fe with very low contaminants. The existing FCA rail line passes inside the tenement holding and provides potential transport to the Port of Aratu.

Strategic, low-cost acquisition adds 931km2

At a cost of US$55k, the area referred to as Sincora Area more than doubles Cabral’s existing landholding in Brazil, which now totals 1,416km2, with ground prospective for high-grade DSO hematite iron ore mineralisation.

High-grade DSO hematite confirmed in assays

Chemical assays of initial surface samples, now from two sites, are very promising and indicate the presence of high-grade (up to 69.7% Fe) hematite iron with very low levels of contaminants. This raises the potential for near-term production and prospects for cash flow given relatively low capital costs associated with sales of DSO hematite.

New dual infrastructure solution

Cabral’s Sincora Area is well situated with regard to the existing and currently operating FCA rail line, which passes directly within the tenement holding en route to Port of Aratu on the coast near Salvador. Sincora is also in close proximity to the FIOL rail development, 30km away, which is scheduled for completion in 2015/16.

Valuation: Focusing on DSO hematite

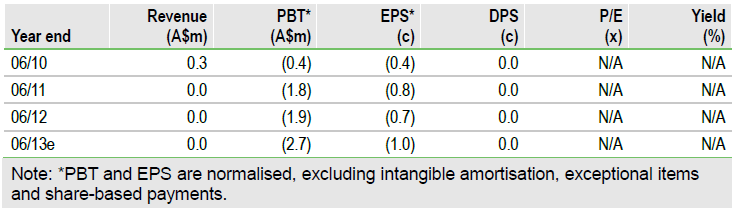

Cabral’s shares are currently trading at a level (A$0.033) that gives the company an enterprise value of A$1.6m, based on cash of c A$7m as at 30 December 2012. This compares with cash per share of A$0.027 and a net asset value (NAV) per share of A$0.079, based on financials reported for the interim period end December 2012.

Although a JORC-compliant resource has yet to be reported, Cabral is well positioned in terms of proximity to existing and planned infrastructure. Initial surface samples now from two sites on the newly pegged Sincora Area augur well for the potential delineation of a high-grade DSO hematite resource. Using a subgroup of peers focused on DSO hematite generates an average EV/t multiple approaching A$0.20/t, which when applied to our three hypothetical resource scenarios generates an implied share price for Cabral of between A$0.07 and A$0.11.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Cabral Resources: New Dual Infrastructure Solution

Published 04/05/2013, 07:39 AM

Updated 07/09/2023, 06:31 AM

Cabral Resources: New Dual Infrastructure Solution

New high-grade DSO hematite prospect

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.