Cabot Corporation (NYSE:CBT) incurred net loss of $122 million or $1.98 per share in the first quarter of fiscal 2018 (ended Dec 31, 2017) against a net profit of $55 million or 86 cents a year ago.

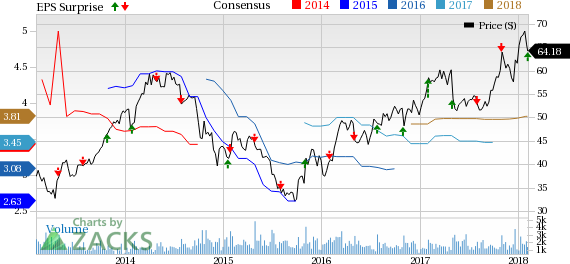

Cabot Corporation Price, Consensus and EPS Surprise

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Methanex Corporation (MEOH): Free Stock Analysis Report

Cabot Corporation (CBT): Free Stock Analysis Report

LyondellBasell Industries NV (LYB): Free Stock Analysis Report

Original post

Zacks Investment Research

Barring one-time items, adjusted earnings for the reported quarter were 93 cents per share (up from 85 cents a year ago), which surpassed the Zacks Consensus Estimate of 78 cents.

Net sales increased around 17.8% year over year to $720 million in the quarter. The figure outpaced the Zacks Consensus Estimate of $644 million.

Cabot Corporation Price, Consensus and EPS Surprise

Segment Highlights

Reinforcement Materials sales increased 31.2% year over year to $387 million in the fiscal first quarter.

Sales for the Performance Chemicals rose almost 11.7% year over year to $229 million in the quarter.

While sales from the Purification Solutions edged up 1.4% year over year to $70 million, the Specialty Fluids segment’s sales decreased 45.5% year over year to $6 million.

Financial Position

Cabot ended the fiscal first quarter with cash and cash equivalents of $189 million, remaining flat year over year.

The company’s long-term debt was down 30.9% year over year to $631 million as of Dec 31, 2017.

Cash provided by operating activities were around $45 million, down about 58% year over year.

Outlook

Going forward, Cabot anticipates the Reinforcement Materials segment to benefit, in the second quarter, from customer agreements along with a firm spot market in Europe and Asia. Also, the Performance Chemicals segment is expected to witness an improvement on a sequential basis owing to higher seasonal volumes and the favorable impact from price increases. However, the segment’s margin is likely to be adversely impacted by higher feedstock costs in specialty carbons and increased costs to support growth investments. Continued momentum in the specialty applications is expected to benefit the Purification Solutions segment while competitive ECS pricing prevails.

Price Performance

Shares of Cabot have gained 22.8% in the last six months, outperforming the industry’s rally of 8.9%.

Zacks Rank & Other Stocks to Consider

Cabot carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the chemical space are Methanex Corporation (NASDAQ:MEOH) , LyondellBasell Industries NV (NYSE:LYB) and Air Products and Chemicals Inc. (NYSE:APD) . All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Methanex has an expected long-term earnings growth of 15%. Its shares have rallied 22.9% over a year.

LyondellBasell has an expected long-term earnings growth of 9%. Its shares have gained 24.2% in a year.

Air Products has an expected long-term earnings growth of 14.1%. Its shares were up 15.6% over a year.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Methanex Corporation (MEOH): Free Stock Analysis Report

Cabot Corporation (CBT): Free Stock Analysis Report

LyondellBasell Industries NV (LYB): Free Stock Analysis Report

Original post

Zacks Investment Research