Cable closed the week slightly higher as global sentiment improved somewhat. Domestic activity was a non event as the Bank of England refrained from adding additional stimulus as previous efforts looks have filtered through to the economy. Rates and Asset Purchases were all held at current levels, inline with expectations. The Bank of England is in ‘wait and see’ mode. A deterioration in the U.K economy will trigger another round of easing, but until we see that the BoE will more than likely sit tight.

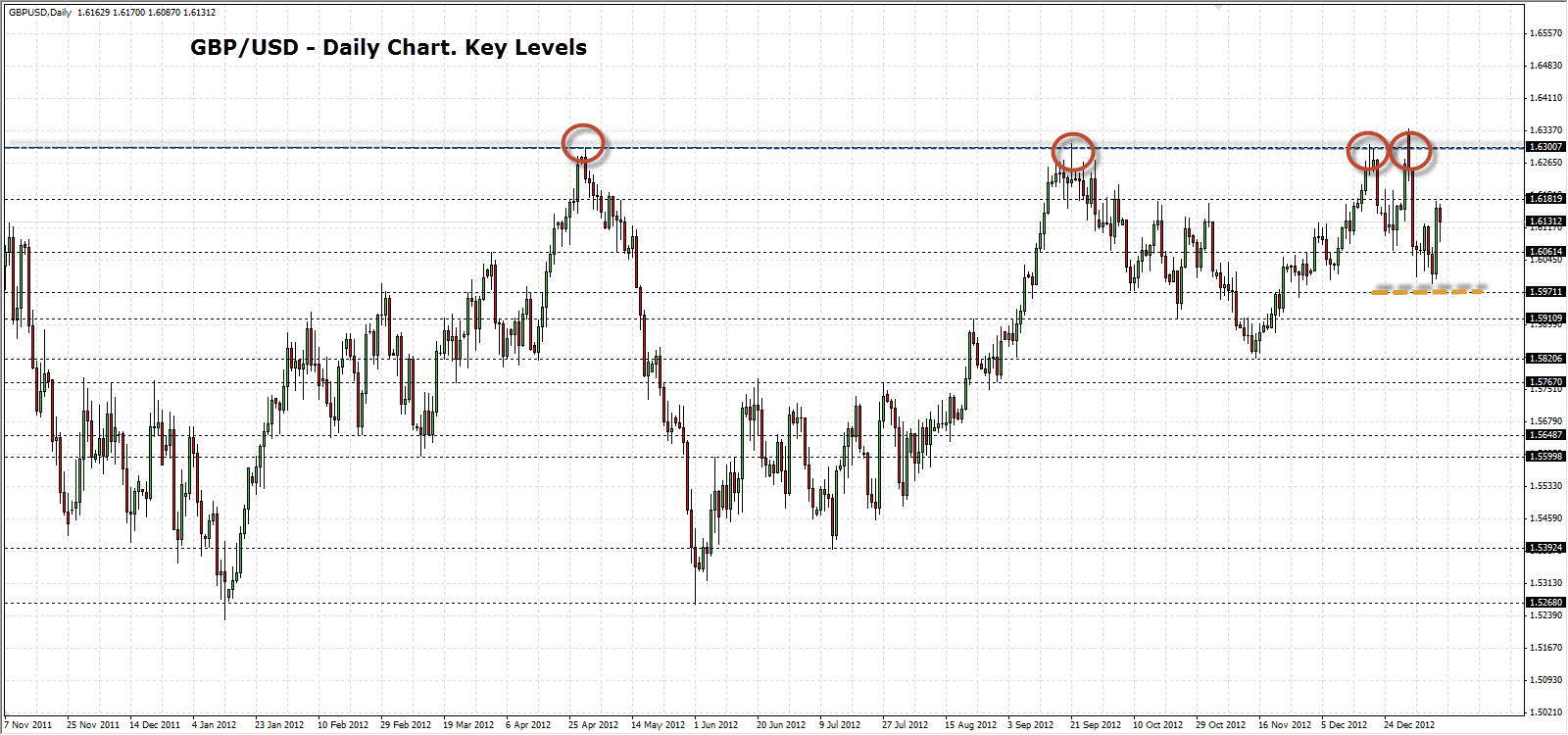

As a result GBP/USD remains in a long-term horizontal range with support at 1.5820 and resistance at 1.6300. In the near-term, a move below short-term support at 1.5971 key level will bring some near term selling.

This week is relatively light in terms of top tier economic data. The highlights will be the CPI and PPI releases on Tuesday along with the potential BoE Inflation Letter should the CPI come in above 3.0%, which is not expected. CPI is forecast to remain at 2.7%.

On Friday Retail Sales are expected to show an increase of 0.2% after last month’s disappointing flat number.

- GBP/USD has been unable to break above the key 1.6300 level since August 2011. Remains a major resistance level.

- Last week’s rally was capped at 1.6181 key level.

- Price looks to be range bound, but favours a bearish move below support at 1.5971.

- Previous support now becomes resistance.

Neutral Bias