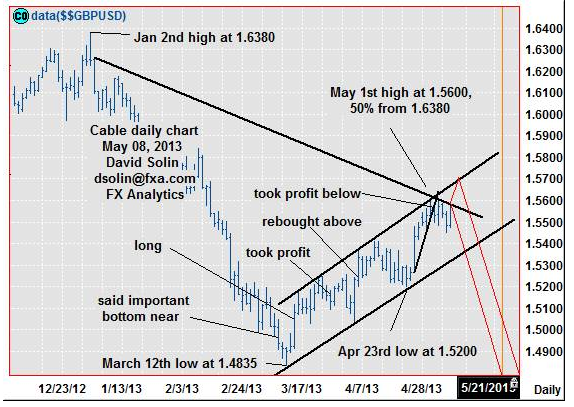

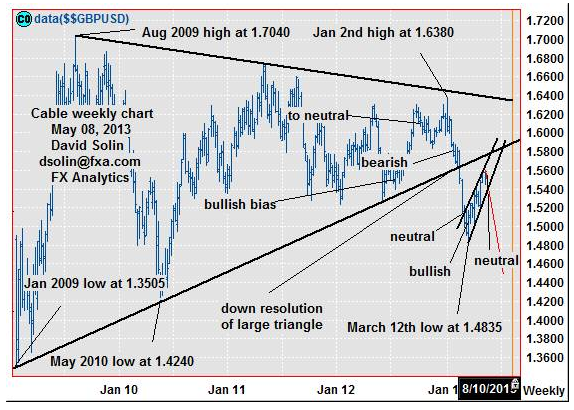

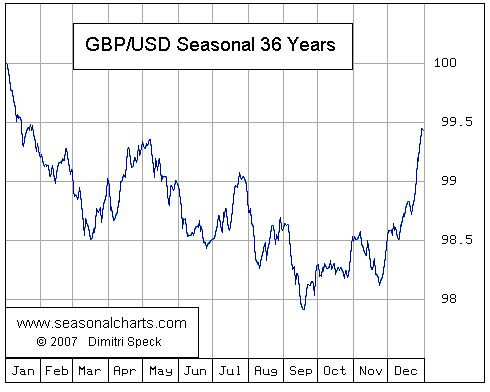

No change, as the view since early March of an extended period of ranging higher, and as the market corrects the tumble from January, continues to unfold. But these gains are seen as a correction, and with an eventual resumption of the longer term declines back to the Mar 12th low at 1.4835 and even below. Currently, the market is chopping from the May 1st high at 1.5600/20 and the long discussed "ideal" area to form such a top (50% retracement from the Jan high at 1.6380 and then the ceiling of the bullish channel since March). At this point, there is still no confirmation of such a top "pattern-wise", but the broader US$ ($ index) is seen completing an important bottom last week and the seasonal chart tops around this time (see 3rd chart below), with both arguing that an important top is in place (or at least very close). Further resistance above 1.5600/25 is seen at the ceiling of the bull channel since March (currently at 1.5665/80). Nearby support is seen at 1.5445/55 (yesterday's low, 38% retracement from the Apr 23rd low at 1.5200), and the base of the channel (currently at 1.5320/35).

Strategy/position:

Took profit on the April 5th buy at 1.5335 on May 2nd below the bull trendline from late April (then at 1.5575, closed at 1.5535 for 200 ticks). At this point with the market seen having completed (or nearly) a potentially major top, would sell here (currently at 1.5580). But with some risk for another few days of a topping, would initially use a wide stop on a close above the ceiling of the bullish channel. Will also switch to a more aggressive, trailing stop on nearby weakness and as the confidence rises that a top is indeed in place (also don't like the idea of a stop that moves away from the market).

Long term outlook:

Long held, long term, very bearish outlook remains in place as the market did indeed finally resolve lower from the large triangle/pennant from Jan 2009 this last Feb, and in turn continues to target eventual declines all the way back to that Jan 2009 low at 1.3505 (start of pattern) and even below. But as been discussing, there will no doubt be good sized, multi-month bounces/periods of correcting on the way lower. Looks like the countertrend bounce since March may indeed be "complete" (see shorter term above), and with a resumption of the long term declines ahead (see in red on weekly chart/2nd chart below).

Strategy/position:

Also switched the longer term bullish bias that was put in place on Mar 8th at 1.5090 to neutral on May 2nd at 1.5535 (for 445 ticks). At this point with a potentially more major top seen in place (or at least very close), would also switch the longer term bias to the bearish side here (currently at 1.5580).

Nearer term : short May 8 at 1.5580, initial wide stop on close above channel from Mar (cur 1.5665/80).

Last : long April 5 at 1.5335, took profit May 2 below t-line from Apr (1.5575, closed 1.5535, 200 ticks).

Longer term : bull bias March 18 at 1.5090, to neutral March 8th at 1.5535, now bearish May 8th at 1.5580.

Last : bear bias January 24th at 1.5785 to neutral February 26th at 1.5160 (625 ticks).  GBP/USD - 1" title="GBP/USD - 1" width="574" height="407">

GBP/USD - 1" title="GBP/USD - 1" width="574" height="407"> GBP/USD - 2" title="GBP/USD - 2" width="574" height="410">

GBP/USD - 2" title="GBP/USD - 2" width="574" height="410">

GBP/USD GBP/USD Seasonal" title="GBP/USD Seasonal" width="490" height="392">

GBP/USD Seasonal" title="GBP/USD Seasonal" width="490" height="392">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Cable: Near Term Outlook

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.