GBP is the weakest major today, when UK PM Boris Johnson will present his final Brexit offer to the EU. If Brussels do not agree, Britain won’t negotiate further and leave on the 3st October. One unnamed EU member expects it to “go down like a bucket of sik”. No pressure then…

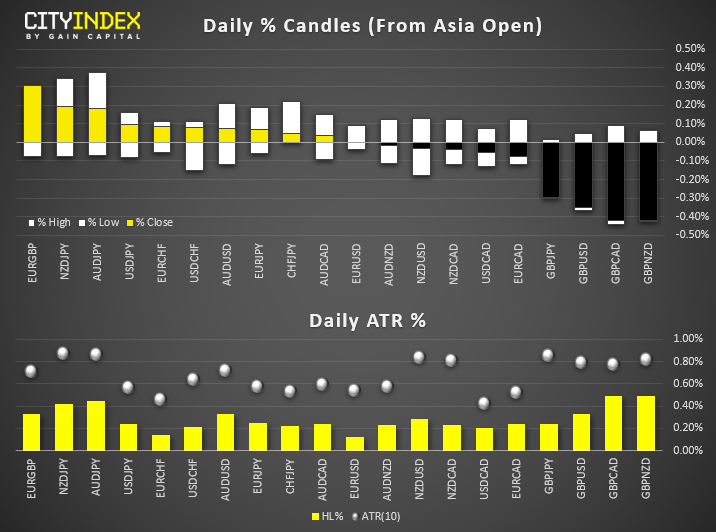

NZD and AUD are the strongest majors, after a weaker USD provided the heavily oversold currencies a reprieve. The dollar was given a setback in the US session with manufacturing PMI data crashing to a 10-year low.

Japan claim that a North Korean missile has landed in their exclusive economic zone. South Korea suggest it was launched from a submarine.

All majors and crosses remain within their typical daily ranges, ahead of what appears to be a quiet day for economic data from Europe and US. DXY and USD/JPY tread water near yesterday’s lows, USD/CAD nudged its way to 12-bar low.

Equity Brief:

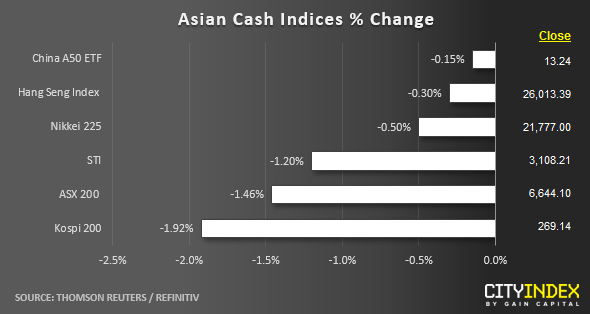

A sea of red today for Asian stock markets that have erased all the gains seen in the past 2 days. Tracking the losses seen overnight in the U.S. stock market that has been triggered by a dismal ISM manufacturing data for Sep that contracted for a 2nd consecutive month to 47.8, the lowest level since Jun 2009.

The Australia’s ASX 200 is one of the worst performers as it tumbled by -1.46% so far that has offset the “optimism” created by RBA’s dovish monetary policy stance. Also, the on-going weakness seen in Australian stocks have been reinforced by a misconduct charge at National Australia Bank, one of Australia’s largest banks. The bank will be slap with a A$1.2 billion charge to compensate customers given poor financial advice or sold junk insurance. The share price of National Australia Bank has declined by -2.49%.

The S&P 500 E-Mini futures has managed to stage a modest bounce of 0.19% in today’s Asian session to print a current intraday high of 2949 after a decline of -1.23% seen in yesterday’s U.S. session at it staged a test on the key support at 2940.

Up Next

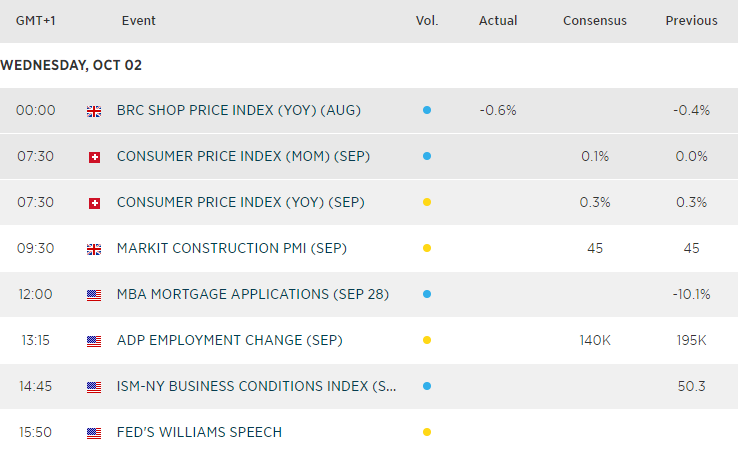

UK manufacturing is the next PMI to step into the limelight, although expectations are low given the sector has contracted for the best part of 5-months.

U.S ADP Employment Change for Sep (a prelude this Fri’s Non-Farm Payrolls) where market participants are expecting an increase of 140K over 195K recorded in Aug. A better than expected print suggests that the U.S. job market is still resilient against a backdrop of deteriorating economic conditions seen in the rest of the world which may offset some of the losses seen in stocks. That said, markets may be more twitchy to a weak print had they otherwise been, following yesterday’s dismal ISM print from US yesterday.

Ultimately, it’s not a set of first-tier data, so traders will probably react more towards Brexit and / or impeachment updates.