Key Points:

- UK threatens to introduce tax haven rules on hard exit.

- The chances of a “Hard Brexit” increase.

- Watch for further selling pressure.

The cable continued to march lower throughout most of last week as the Brexit negotiations largely drove the trend. The spectre of an unruly Brexit appears to looming with the UK government suggesting that the time for a deal is quickly slipping away. Subsequently, it makes sense to take a look at what occurred last week and assess the impact that further Brexit negotiations could have on the embattled cable in the coming week.

The cable continued its decline throughout the vast majority of last week as the pair reacted to the string of negative statements regarding the Brexit. The war of words became relatively strong with the UK’s Prime Minister May suggesting that a “Hard Brexit” was highly likely given the European Union’s lack of negotiation. In addition, the threat of Britain becoming a tax haven, in the event of no deal being reached, has also been bandied about. Subsequently, the cable saw some concerted selling which took it back below the 1.22 handle by the end of the week.

Looking ahead, the coming week will be critical for the embattled pair as the various Brexit voices reach fever pitch. In addition, it appears that the pair is preparing to gap lower on opening in response to declining expectations of any Brexit deal being reached. In addition, there are plenty of volatility inducing fundamental events ahead with the UK CPI and Core Retail Sales figures falling due. There is also a bevy of US economic news, with the focus falling on the Core CPI and Philly Fed figures, due out which is likely to be felt. Subsequently, expect a wide range for the cable and plenty of volatility as the market digests the economic data as well as the Brexit war of words.

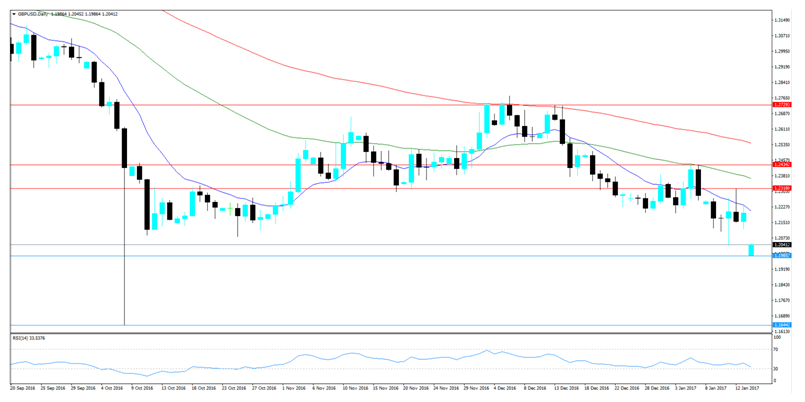

From a technical perspective, the pair looks to remain under pressure in the week ahead with the risk of a significant gap on opening due to the ongoing Brexit talk. In addition, price action appears to have drop below the last significant support level at 1.2081 on opening. In addition, the RSI Oscillator is trending lower but still hasn’t quite reached oversold levels on the daily time frame. Subsequently, there is probably scope for a further fall in the week ahead from both a technical and fundamental perspective. Support is currently in place for the pair at 1.1985, and 1.1644. Resistance exists on the upside at 1.2318, 1.2432, and 1.2729.

Ultimately, the cable is at a precarious position with the volatility inducing Brexit talk likely to take the currency to significantly lower valuations. Regardless of what happens in the next few weeks, the UK’s relationship with the common market is likely to be altered in an irreparable way.