The British pound came under pressure during the week thanks to a disappointing fall in UK GDP figures. Strength was found in the pair towards the end of the week but it has now run out of steam as it hits the bearish trend line at the 100 day MA.

UK GDP fell from 0.7% to 0.5% q/q which was a big disappointment for the market which had been expecting 0.6%. That led to heavy selling in the pound which was compounded by bullishness in the US dollar. The US Federal reserve ensured the pair extended to a two week low as it looks like they may target a rate rise at the December meeting. The Fed surprised the market as they turned relatively hawkish despite holding rates steady once again.

The end of the week saw confidence return to the cable as month end flows were certainly GBP bullish. Disappointing US data was never too far away as US GDP fell to 1.5% q/q (annualised) from the previous result at 3.9% q/q. Market sentiment on optimism that the Bank of England will follow closely behind any US rate rise saw what could have been a week to forget, end as a solid one for the pound.

This week will be telling as the Bank of England is due to set monetary policy. We are unlikely to see any change in policy, but the press conference will be closely watched for any signal of a rate rise sooner rather than later. The consensus had been for the Bank of England to begin normalising rates in mid-2016, but we could see that brought forward if the BoE follows the Fed’s lead by turning hawkish.

There is plenty more in the calendar to keep the market occupied from both sides of the Atlantic. From the UK, keep an eye on the services PMI as it represents 80% of the UK economy. Manufacturing production is also an important indicator for the UK and one worth watching. From the US, it is of course Nonfarm week. Last month’s results were abysmal, so the market will be desperate for any sign of improvement. Keep an eye on the manufacturing PMI and a speech by Fed Chair Janet Yellen.

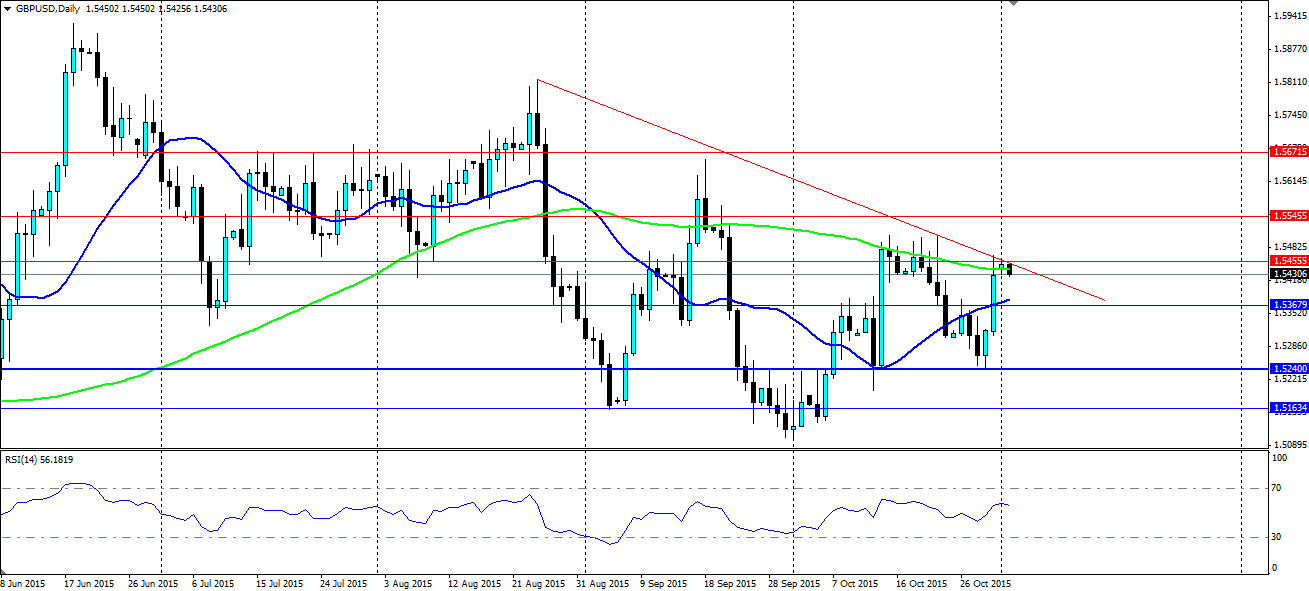

Technical analysis shows the pair charging up the chart but running out of steam as the bearish trend line comes back into play. It is providing dynamic resistance for the pair, along with the 100 day MA, and the firm resistance at 1.5455. The RSI, although in neutral territory, is beginning to trend back down indicating a pull back from the trend line is the likely outcome.

We are already seeing a rejection forming off the trend line and the 100 day MA. A move lower is likely, especially with the bullish USD sentiment in the market at the moment. Look for support at 1.5367, 1.52400 and 1.5163 while resistance is found at 1.5455, 1.5545 and 1.5671.