Key Points:

- Cable retains a bearish directional bias

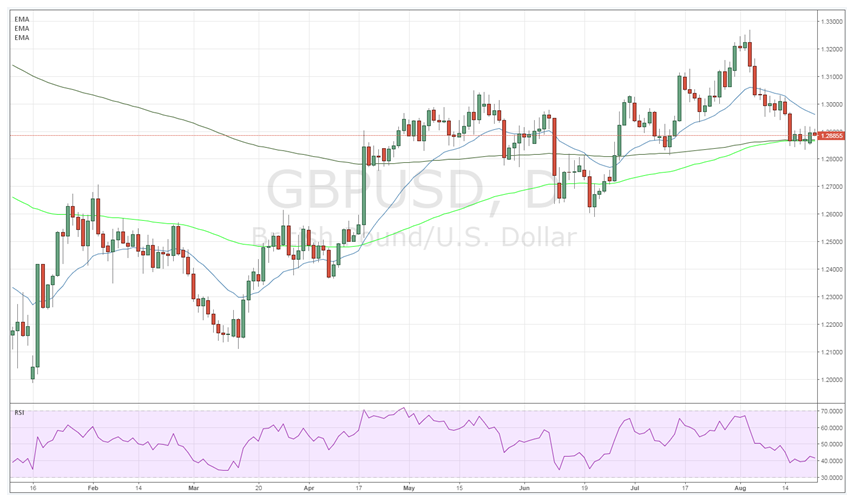

- Price action remains trapped below 50 and 100 Day EMA’s

- Pair likely to remain under pressure in the week ahead

The cable continued to move lower last week as the pair was caught on the wrong side of the wave of sentiment swinging towards the greenback. Subsequently, early in the week saw a relatively rapid fall for the cable, as the pair was dealt a blow from a -0.1% UK CPI result, and this commenced a slide which saw it close the week around 130 pips lower at 1.2870. Subsequently, there is plenty of evidence that the cable could be in for a further fall ahead in the coming week.

The cable never really had a chance to pick itself up last week and trading started off with some sharp declines following a stark miss in the UK CPI results. The key metric was forecast to come in flat at 0% but instead slipped to -0.1% m/m which kicked off some sharp selling.

This was compounded when the U.S. Retail Sales data climbed strongly to 0.6% which set off a sentiment swing which the pair never recovered from. In addition, the U.S. Initial Jobless Claims, and U.S. Philly Fed Business Outlook Index also proved relatively robust at 232k, and 18.9, respectively. Subsequently, the cable fell around 130 pips, over the course of the week, to close trading out at 1.2870.

Looking ahead, the pending week should be relatively interesting for the cable given the large slew of economic data due for release. In particular, the UK GDP numbers are likely to be closely watched by the market given their relative importance and forecast of 0.3% q/q. The much awaited U.S. Core Durable Goods Order figures are also due to print and, given the recent U.S. economic strength, could provide a surprise to the upside.

Finally, we could see plenty of volatility as the Jackson Hole Summit fires up late in the week and many of the major actors in fiscal and monetary policy get together to mull over the economy. Typically, there is always some interesting comments emanating from the forum which means it is often worthwhile monitoring.

From a technical perspective, the cable’s recent decline from 1.3267 appears to have extended over the past week. Price action remains below the critical 100 Day MA whilst the RSI Oscillator is presently within neutral territory. Subsequently, our initial bias remains on the downside for the week ahead with a further breakdown highly likely. Support is currently in place for the pair at 1.2862, 1.2810, and 1.2774. Resistance exists on the upside at 1.2918, 1.3029, and 1.3267, and 1.3480.

Ultimately, the cable is likely to have a relatively rough week ahead as long as price action remains trapped under the 50 and 100 Day MA. At this stage, an upside breakout looks unlikely unless both the fundamental and technical trends change in the week ahead. Regardless, keep a watch on the key 1.30 handle because if a breakout does occur this could be the critical inflection point.