Key Points:

- Official Bank Rate decision pending.

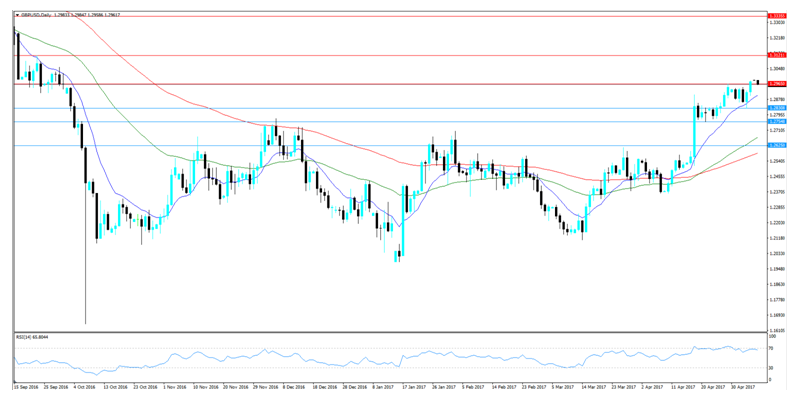

- RSI Oscillator strongly overbought.

- Watch for a pullback towards the 1.29 handle in the coming week.

The Cable had another week in the green as the pair largely followed out forecast from last week and rose to challenge resistance at 1.2965 following some strong gains in the UK Manufacturing and Services PMI figures. In addition, the uncertainty around the U.S. Fed’s path to rate hikes also buoyed the pair and saw it close the week out around the 1.2977 mark. Subsequently, it makes sense to review last week’s events given that there is plenty of question as to whether the pair can retain its current level in the week ahead.

The Cable provided a strong performance last week as the currency reacted to some gains in the UK Manufacturing and Services PMI’s to 57.3, and 55.8, respectively. This saw a fairly constant appreciation for the GBP which was further buoyed by the vacillation from Fed Chair Yellen over future rate hikes. It appears that the lack of forward guidance from the Federal Reserve is impacting the greenback’s strength and, therefore, benefitting the GBP. Subsequently, the pair rallied through most of the week to close right in the middle of a key zone of resistance at 1.2977.

Looking ahead, the Cable is likely facing a frenetic week with the release of the Bank of England’s decision on interest rates, as well as the NIESR GDP Estimate, due for release. The BoE’s monetary policy committee is likely to keep the official bank rate on hold at 0.25% but expect plenty of forward guidance from the bank, especially considering that inflation continues to rise. Additionally, the NIESR GDP Estimate is due out on Friday and is estimate at 0.4% q/q which is likely to be relatively accurate this time around. However, any deviation could cause a spike of volatility for the pair.

From a technical perspective, the pair’s rally has taken it to a key zone of resistance around 1.2965-75 and the RSI and Stochastic Oscillators are now strongly within reversal territory. Subsequently, our initial bias is bearish for a corrective pullback towards support around the 1.29 handle in the coming week. However, keep a close watch on volatility from the BoE and NIESR GDP releases as they may impact the pair’s trend direction. Support is currently in place for the pair at 1.2754, 1.2830 1.2625. Resistance exists on the upside at 1.2965, 1.3121, and 1.3335.

Ultimately, the Cable is in for a volatile ride with plenty of fundamental decisions due out over the next week. In particular, watch the positioning ahead of the Bank of England’s decision on interest rates as the statement following the event will be critical moving forward. I suspect that the likely course of events is a small pop before the Cable declines back towards support around the 1.29 handle.