Key Points:

- UK GDP likely to return a 0.3% q/q print

- U.S. FOMC decision could provide some volatility

- Watch for a challenge to the 1.31 handle in the week ahead

The cable had a relatively poor week after the UK Inflation figures surprised the market, coming in well below estimates at 0%, and sending the cable in to selloff mode. Subsequently, the bears piled into short positions and the pair declined to close the week sharply lower at 1.2992. However, as we enter the new week it appears as if there might be some support for the cable and a retest of the 1.31 handle is likely in the next few days.

Last week proved highly negative for the cable as the pair reacted to a sharp slip in the UK CPI figures to 0% (0.2% prev). Subsequently, there was plenty of negative sentiment for the cable and the pair fell sharply throughout most of the week to close at around the 1.2992 mark. Further supporting the short side push was the U.S. Initial Jobless Claims figures which came in below estimates at 233k. However, there was a bright spot for the cable with the UK Retail Sales rising sharply to 0.9% m/m which was promptly ignored by the market.

Looking ahead, it could be a relatively volatile week for the cable with the UK GDP and U.S. Core Durable Goods Orders due for release. In particular, the UK GDP figures could prove relatively critical with the key indicator set to return a slight uptick to 0.3% q/q. Subsequently, any surprises could bring with it some sharp volatility.

In addition, the U.S. Core Durable Goods Order figures are due to hit the wires and most economists have the indicator returning a 0.4% m/m print. This represents a slight uptick and could prove bullish for the greenback as long as the FOMC doesn’t spoil the party.

Speaking of the FOMC, the central bank is likely to keep rates on hold at 1.25% in the pending meeting. However, keep a close watch on the content of Yellen’s speech following the event because it is highly likely that she may attempt to slowly play down the forward guidance around rates. The reality is that the central bank has largely been boxed into a corner and will now likely look towards QE taper as their next form of tightening.

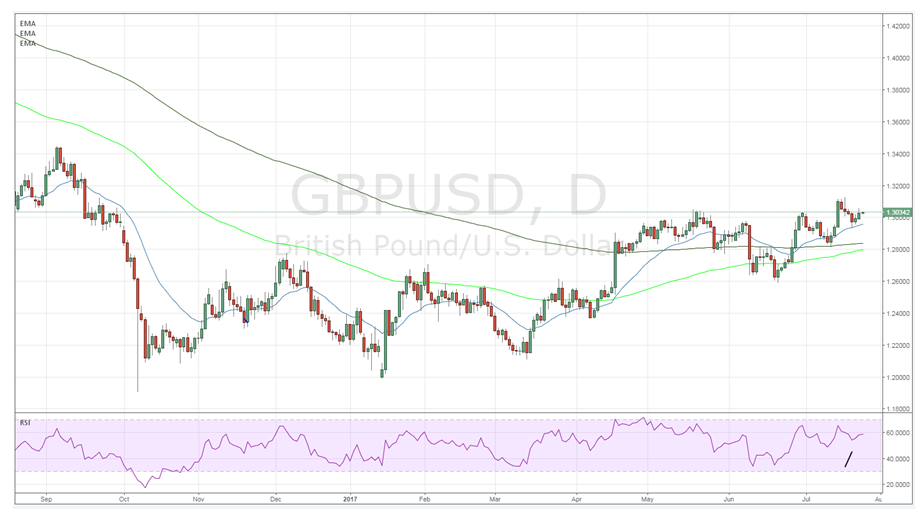

From a technical perspective, the cable’s recent fall has taken it back below the 1.30 handle and as long as support at 1.2811 remains intact we could see a resumption of the uptrend soon. However, our initial bias is neutral for the week ahead given that the RSI Oscillator is still relatively close to overbought levels and price still has some distance to fall. Support is currently in place for the pair at 1.2810, 1.2713, and 1.2636. Resistance exists on the upside at 1.3112, 1.3168, and 1.3377.

Ultimately, the cable could be in for a relatively volatile week as the pair faces down with the looming spectre of the U.S. FOMC meeting and the UK GDP results. However, the short term fundamental trend is one of strength for the cable so we should see the needed gains in the coming week but watch for potential jawboning from the Fed.