Key Points:

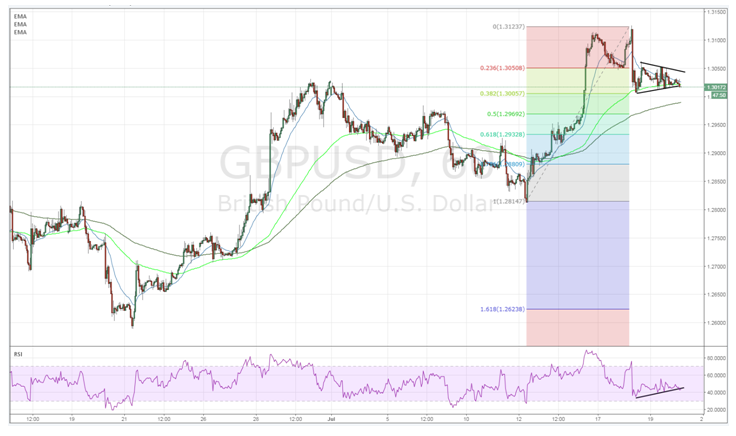

- Price action continues to trend within a tightening wedge pattern

- RSI Oscillator is diverging higher and away from price action

- Watch for aupward breakout in the coming week as momentum builds

The past few days have been relatively volatile for the cable as the pair has been beset by the softer than expected UK inflation figures. This has caused a relatively rapid depreciation from the recent highs that saw price action collapse from its recent high of 1.3125 all the way back to the 1.30 handle. However, some interesting technical factors are now suggesting that the pair is likely to see an upward trajectory in the coming few days.

In particular, price action has entered a liquidity zone around the 1.30 handle and is presently taking a decidedly sideways direction which happens to also coincide with the 38.2% Fibonacci retracement level. In addition, it has also formed a relatively clear wedge pattern and the pressure is currently building towards a breakout.

Given that price action is currently within the liquidity zone, an upside move appears to be the most likely directional bias. In fact, the RSI Oscillator is already cautiously demonstrating some buoyancy and has been trending slowly higher over the past few days which curiously is divergent from price action’s current direction.

However, the fundamental factors that sent the pair reeling, namely a relatively softer than expected CPI result of 2.6% y/y, still exists and are still impacting sentiment. Indeed, the broader economic trend within the UK of late has been slightly flat and this is largely unsurprising given the rising risks around the lack of a Brexit deal.

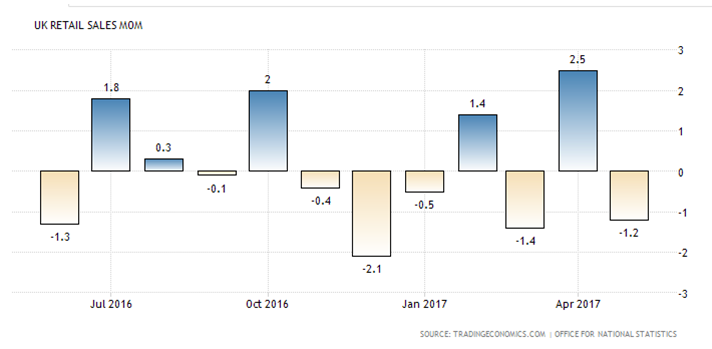

The full impact of a hard separation is still to be quantified but the short term impacts might finally become apparent as the political situation appears to have stabilised. Regardless, as the UK Retail Sales results loom, the market will be watching closely for a fundamental near term trend change.

Ultimately, the coming week is likely to see some significant gains for the pair as pressure builds and the wedge formation subsequently fails. In addition, the RSI Oscillator might already be signalling price action’s forward direction given that the indicator is presently showing some divergence.

At this point, the most likely scenario is a relatively rapid rally back towards the recent highs formed around the 1.3100 handle and then a probable period of moderation. However, as mentioned, monitor the UK Retail Sales results closely as they could cause volatility for the pair.