- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Cable Patiently Awaits Breakout

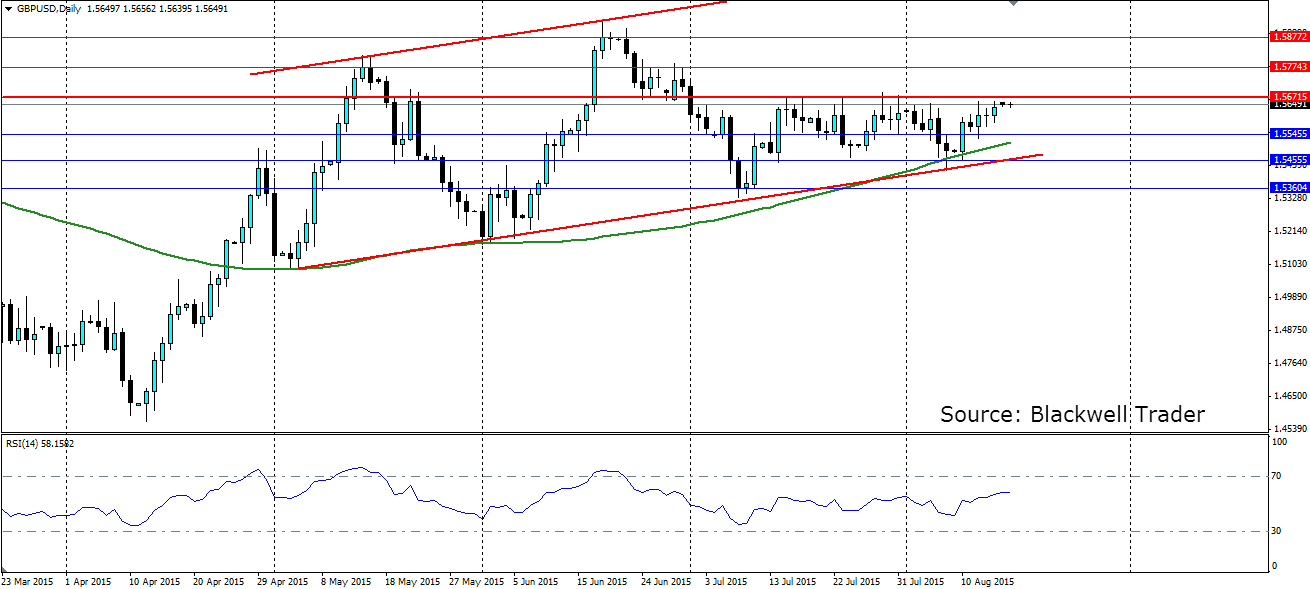

Cable traders will be well aware of the resistance at the 1.5671 mark that has proved tough to break and once again we find ourselves testing it. Will it finally give way this time?

For the last month the Cable has been consolidating between the bottom of a bullish channel, and the resistance at 1.5671 without much action. The level was a point of interest in the previous two top structures so it's no surprise to see it act as resistance now. What is a surprise is the firmness of that resistance.

The lastweek saw a bounce off the bottom of the channel asthe UK employment figures were released. The UK Unemployment rate remained steady at 5.6%, but the claimant count improved by -4.9k (vs +1.3k expected). Further upward momentum was added as the US dollar was being sold off. The devaluation of the Yuan by the PBOC is expected to give the US Federal Reserve headaches as US inflation will likely be impacted. The market is now beginning to question whether or not the Fed will raise rates in September, and if they will continue hiking rates at subsequent meetings.

Inflation figures are due out of the UK this week which will likely have a big impact on the Bank of England's outlook for monetary policy. The market is expecting CPI to remain dead in the water at 0.0%. If we see anything to the upside, this could very well be the catalyst for the much awaited breakout. Also keep an eye on UK retail sales which will tell if consumption is ticking along well.

It has been a nice battle between the bulls and the bears with momentum swinging to favour the bulls at this stage, as the RSI shows. The consolidation is putting further pressure on the 1.5671 level and if the bullish channel is to remain intact, it will be the resistance that must give way. If we do indeed see it fail, the pair will quickly extend higher as the bulls capitalise and stops are triggered. The previous highs will certainly be a target with the top of the channel the ultimate goal.

The obvious trading opportunity here is to set an entry just north of the resistance to catch the momentum of a breakout. Otherwise there is an opportunity to play the range, although that is getting tighter and will offer a lower R/R. Look for support at 1.5545, 1.5455 and 1.5360 while resistance is at 1.5671, 1.5774 and 1.5877.

Related Articles

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

The US stock market stabilized yesterday, but there were no significant moves during the US session as speculators remained neutral ahead of Nvidia (NASDAQ:NVDA) earnings, which...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.